XRP NEWS today: XRP shines how Brazil starts the first spot in the world XRP ETF to B3 Exchange

In the historical moment of news about Ripple XRP news, Brazil’s B3 stock exchange officially launched the first SPOT XRP ETF, signaling the main jump towards adoption in the mainstream cripto.

Managed Hashdeks and giving ingenious investments, XRPH11 ETF Offers Investors Regulated, Safe and Efficient Gatevai to Exposure XRP without the need for direct posture or token management.

KSRPH11 Numer Fund on NASDAK XRP Reference price index and is designed to invest at least 95% of assets directly in KSRP or KSRP divers. Samir Kerbage, the main investment officer in Hashdek, commented, “XRPH11 is part of our mono-property line of the Fund, aimed at sophisticated and institutional investors who want to diverse their crypto portfolio to B3.”

This development indicates a a significant milestone Not only for the RIPLJE market, but also for a wider ecosystem for cryptic investment. By providing a regulated access to CRIPTO RIPPLE CRIPTO via B3 Stock Exchange, Brazil has positioned as a progressive player in the global markets of digital funds.

Brazil moves forward, we still wait

While Brazil celebrates this pioneering move, the United States-home for Ripple Laboratory – continues to fight Regulatory delays. In spite of multiple XRP ETF applications From companies like Greiscale and Franklin Templeton, American Securities and Exchange Commission (SEC) have yet to greener all products focused on XRP.

Brazil’s B3 Exchange just made history with XRPH11, the first world XRP ETF launched by Hashdek. Source: Hashdek over x

It is interesting that investment vehicles in the KSRP are gained to the global level. According to coins, the products that focused on the KSRP, which are on the schedule for focused on funds, about $ 950 million in the assets under management from mid-April. Last week alone, the funds of the KSRP in inflows had an impressive 37.7 million dollars, apparatus all other crypto funds.

JPMorgan analysts predicted this Spot XRP ETFS It could attract up to $ 8 billion Net inflow if approved in the main markets – a forecast that could significantly affect the value of XRP and worsen the price of currency. Like Nate Geraci, the President of the ETF store, conveniently put “” XRP ETF approval in the United States feels like inevitability at the moment. “

XRP Outlook

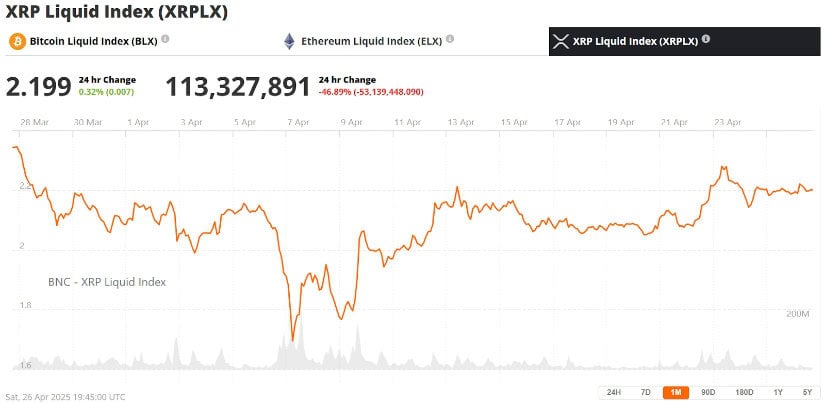

Despite buzzing around the start of XRPH11, the price of XRP remained relatively stable. The last Data XRP is traded around $ 2.20, setting up a modest 0.8% growth in the last 24 hours. However, market feeling suggests that the approval of the KSRP ETF could catalyze a an essential interruption.

The CSRP price formed a potential head and shoulders in the daily chart. Source: Marco13579 At Tradingview

Historical patterns offer encouragement of characters. Earlier, during the slowdown of gold, the KSRP saw a dramatic 1,000% increase. With the gold again retreating, analysts draw parallels, and some design that the price for ribal could climb a high amount of $ 24 in Near the future.

This optimism aligns with the wider news about the growing XRP, including a growing service utility to books for ice and renewed partnerships aimed at improvement Global payment infrastructure.

What is the new Brazilian XRPH11 ETF and why is it important?

Starting XRPH11 ETF is fixed Brazil appeared The role as a leader in regulated crypto investments. Approved by Brazil Securities and Exchange Commission (CVM) at the beginning of this year, the ETF offers a convincing mixture of transparency, security and accessibility.

Trading of Brazil B3 Exchange, XRPH11 targets institutional and sophisticated investors. Hashdek has structured the fund to maintain daily transparency about assets for property, with genius security securities monitoring and genius banks with securing secure custody of KSRP funds.

While the US stopped, Brazil approved the first video XRP ETF from Hashdek, giving the KSRP of its first main institutional breakthrough. Source: Stellar Expert over x

Ripple’s Latin’s head, Silvio Pegado, praised Brazilian attitudes in advance, noted that “XRP’s core useful as fast and efficient settles of settlement makes it a natural fusion for ETF tokenization.”

The XRP ETF He charges a competitive management fee of 0.7% per annum, in addition to 0.1% detention, mirrors typical costs seen in traditional capital ETFs. This economy could regulate the KSRP exposure more attractive for the wider investor base.

Ripple in the USA: Regulatory Afershocks

Accompanying Protective lawsuit In March 2025. years – where Ripple is agreed to pay $ 50 million in Criminal Senate of $ 125 million – a regulatory cloud over XRP has some extent, but uncertainties remain. SEC Depress Ripple continues, especially As for the classification KSRP and adequacy of the Market Supervision Agreement.

Successfully launch XRPH11 could provide key insights for American regulators. As the global market watches Brazilian experimentThe case for approval of XRP ETF in the United States can get a new momentum.

Former Sec Gare GRENSLER resistance to AltCoin ETFS, stating the market concern, may weaken under the new leadership of pro-cripto stool Paul Atkins. This shift boosts hope that SEC RIPLE is Regulatory barriers will eventually dismantle.

Looking forward: Institutional appetite and waves on the market

Initial signs indicate a strong institutional appetite for regulated KSRP exposure. XRPH11 was the first day of trading testified to significant activity, also reflected optimism and optimism about the role of the KSRP in the developing digital economy.

XRP traded about $ 2.19 at the time of pressure. Source: XRP liquid index (XRPLX) via Brave new coin

JpMorgan’s projection that XRP and Solana ETFS It could attract up to $ 14 billion in your first year underlines a huge potential. The KSRP should continue to catch investor confidence and Regulatory supportRipple exchange ecosystem could be dramatically expanded.

Moreover, partnerships like Ripple Bank of America and is in progress a network upgrade Ripple Ledger Promise to secure the Utility and the appeal of the XRP. As the pitch spiders slowly stronger and as Global acceptance The CRIPTO property increases, the KSRP can be uniquely positioned at the head of the next wave of digital finance innovation.

https://bravenewcoin.com/wp-content/uploads/2025/04/Bnc-Apr-27-84.jpg

2025-04-26 23:20:00