XRP correction can end like the upsets watch a 2 dollar excuse

According to analysts, the KSRP is traded near the key accumulation zone, which could strengthen its case for a rates of installments.

In April 8 K mailThe analyst pointed out that the KSRP now fills “liquidity invalid”, basically corrects inefficiency in the price at the end of November. This means in a narrow range between 1.50 and $ 2.00.

The analysted noted that a $ 2 label serves as a critical resistance level and a key accumulation zone. A clean pause above it would signal a potential structure that would officially end the current.

At the time of pressure, XRP (XRP) was reduced by 3.3% in the last 24 hours, exchanging hands to $ 1.80, while his market cap for more than $ 104 billion. The daily scope of trading also dipped 42% to $ 6.3 billion.

Bullish Catalysts for XRP

However, a number of positive developments regarding the KSRP lead many traders to believe that the KSRP could be prepared for the bully.

First, the the the Starting the Teucrium’s lever XRP ETF (XXRP) Indicates the first XRP connected ETF in the US, offering a double daily return to XRP. This sets the main precedent for institutional involvement and legitimizes investment products based on traditional markets.

This milestone comes on the heels of a second Discharge of appeal and settlement The case of ricks with a fine of $ 50 million, effectively removing long-term regulatory uncertainty about the KSRP. Legal clarity has caused the renewed institutional interest, with companies such as Franklin Templeton, in Bobra and 21shares now deals with the video XRP ETFS.

Excitement also grows around the potential launch of the KSRP ETF’s place until the end of 2025. According to Polimarket dataThe approval quotas climbed at 77%, recovering from up to 72% of the observed 7. April.

Second, Ripple has announced The acquisition of premiere brokerage firms hidden road in agreement of $ 1.25 billion, one of the largest in the history of the crypto industry. The move expands Ripple’s institutional imprint using the established network of client hidden roads, positioning the ripla as a more dominant player in global finance.

Third, the metrics on the chain support the bullal view.

The data from the Santiment reveals a permanent accumulation of wallets holding 100,000 to 100 million KSRP, usually considered smart money. This purchase activity during the DIP suggests a strong belief among larger investors, often considered pre-rural movement prices.

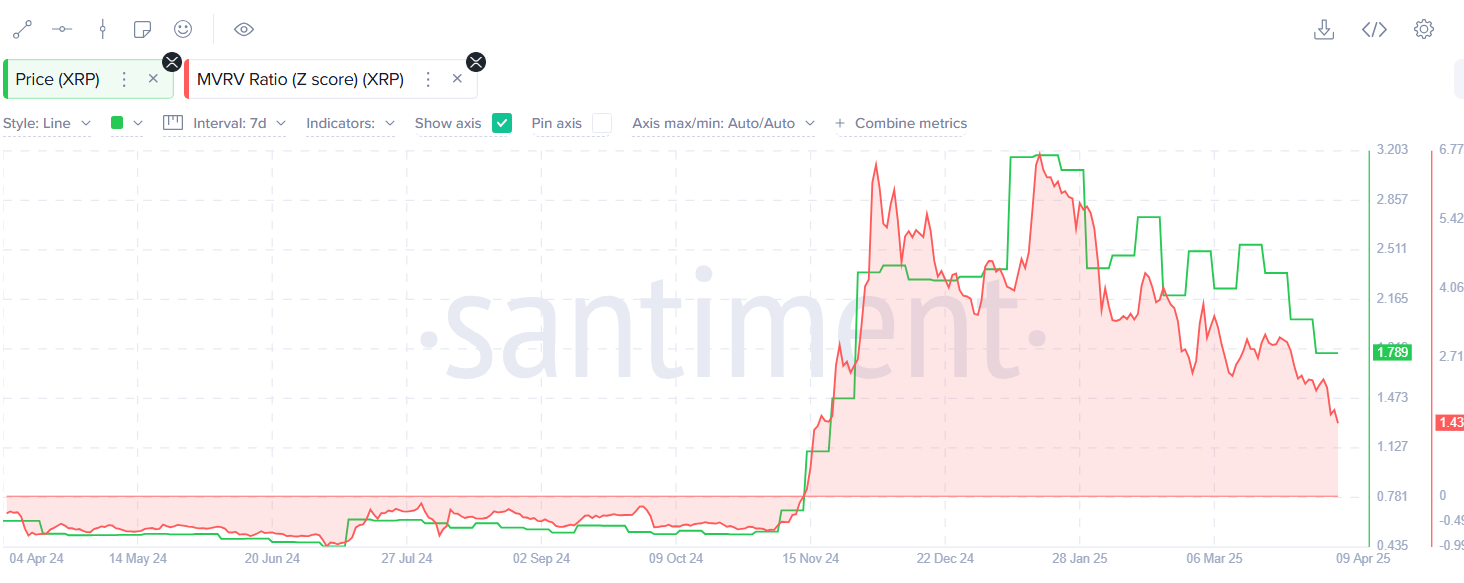

XRP’s MVRV Z-SCORE also fell to 1.43, the lowest level from November last year. It was observed because it was the last time it was a little, the KSRP kicked the bull’s run and eventually hit her all the time in the amount of $ 3.40.

The lower mVRV Z-score usually means that the property is underrated compared to its historical average, which can be a sign that the market is close to the bottom and is thoroughly based on the jump.

Meanwhile, its weighted funding rate returned to green, indicating an improved sense of investors among KSRP derivatives merchants, because more of them are placing Bullish posts after the precaution.

Toward Analysts on Cripto.News$ 2 is most likely the next target for XRP.

Longer time frame, experts on standard a Chartered have set An even higher price price, a 5.5-dollar design as a real goal by the end of the year. Their forecast comes after the XRP is 580% set from November 2024. until January 2025. years, it proposes that there is space for another 214% transition from current levels.

XRP is still in the correction phase

However, the merchant Chetan Gurjar believes The KSRP is still in the wave correction phase 2, based on Elliott VAVE theory, a popular trading method in which the price is moving in patterns of the five waves when the market is moving and three waves down and three waves.

Currently, Chetan thinks XRP in one of those “down” phases, wave 2, usually happens before the next big shift. This DIP sees as a healthy indentation, with possible lower zones around key levels of fibonation: $ 1.48, $ 1,143 and $ 0.8856.

Chetan has some long-term goals in a great long-term measure: at least $ 8 to $ 12, with the possibility of XRP reaches as much as $ 23 to $ 30 during the next big cycle. Still, it has a note that the breakdown below 0.3823) did not undo its current wave number.

Detection: This article does not represent investment advice. The content and materials presented on this page are only only for educational purposes.

https://crypto.news/app/uploads/2024/01/cropped-crypto-news-XRP-Ripple-option02-1.webp

2025-04-09 10:40:00