Will whales cause auction to crash?

Bouncing left parabolically 2025. years, which makes it one of the best cryptocurries in the market.

During the last six consecutive weeks, bounce (Auction) They moved to High $ 67.55 – the highest level of October 2021. Years. He jumped over 712% of his lowest level this year, bringing his market hat at over $ 380 million.

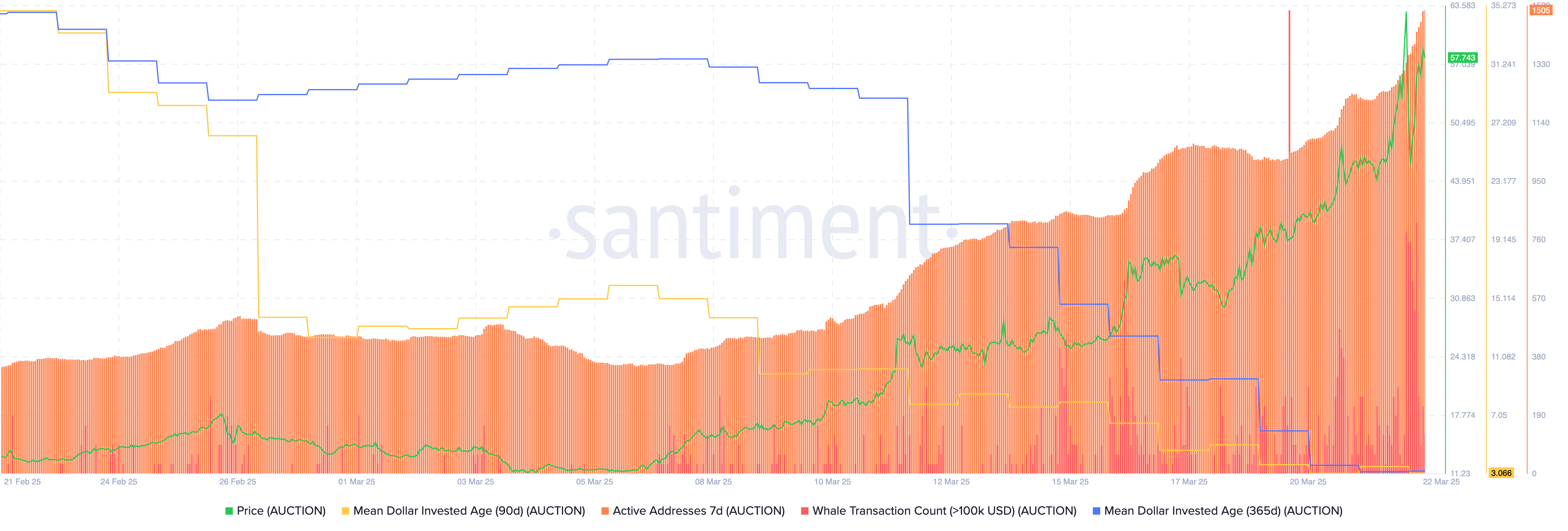

Narj accelerated as many retail investors, accepted fear of missing or FOMO. Santiment data show that the number of active addresses became parabolic, reached high than 1,505. This is a significant increase because seven-day addresses stood less than 400 at the beginning of this month.

More data on data chain that this rush can be part of the manipulation of whales. The number of whale transactions worth over $ 100,000 skipped to the highest level in months. Similarly, transactions worth more than a million dollars agreed.

The growing number of whale transactions could be a good signal, especially when accumulated. Santiment The number of whales transactions does not give more information about whether these whales are buying or selling.

The view of the middle invested age or MDIA sends a red coin warning. The 365-day MDIA indicator crashed from 112 earlier this month at 38.

Similarly, an indicator of 90 days MDIA has switched from 33.4 to only 3. The decline in MDIA indicators is often a sign that the token will have a great turnaround.

The risk of whale manipulation increased because the liquid rush did not coincide with any major news from the finance bouncing.

The latest news occurred on Friday when developers launched an Art Orchain Bounce, a product to tokenize art in the real world.

Dispose of price price analysis

The weekly chart shows that the price of the token bottom bottom to $ 7.10 at the beginning of this month to $ 67.54. He has crossed an important level of resistance to $ 48.95 – the highest level in December last year. It was also moved over 50-week average movements.

There are signs to switch to the Vickoff Theory Tag. This phase usually monitors distribution, and then mark, where the property falls.

The auction price also moved to the level with excessive descendants, with a relative strength and stochastic oscillator index. Therefore, there is a risk that in the coming days they will have a sharp turnaround, because it goes to the distribution phase.

https://crypto.news/app/uploads/2024/08/crypto-news-bear-trading-chart-option03.webp

2025-03-22 16:00:00