Why could BTC fall below $ 70,000 and delete US pre-election gains

Bitcoin trades from $ 86,930 on Tuesday. The price of BTC fell below the support level of $ 90,000 for the first time over three months, generating a negative feeling among traders. Cripto Traders are “fearful” after almost six months of “neutral” and “greed” and “greed”, and the FEAR index for crypto.

In the middle of Bitcoin (Btc) Correcting prices, the new trend appeared among institutional investors. The five-day series of net outflows on the backrest with us The BitCoin ETFs raises concern among merchants. Do institutional investors give up Bitcoin? Is BTC Bull Runover? We explore the chain and technical indicators to identify the following great trade in Bitcoin.

Supply Bitcoin on exchange grows as whales Dump BTC

Bitcoin made the headlines after they hit a turning point of $ 100,000 and new all the time above $ 109,000. After struck at all times, the price of Bitcoin has fallen under the influence of key market drivers such as decreasing institutional interests for investors, American macroeconomic development and exchanges.

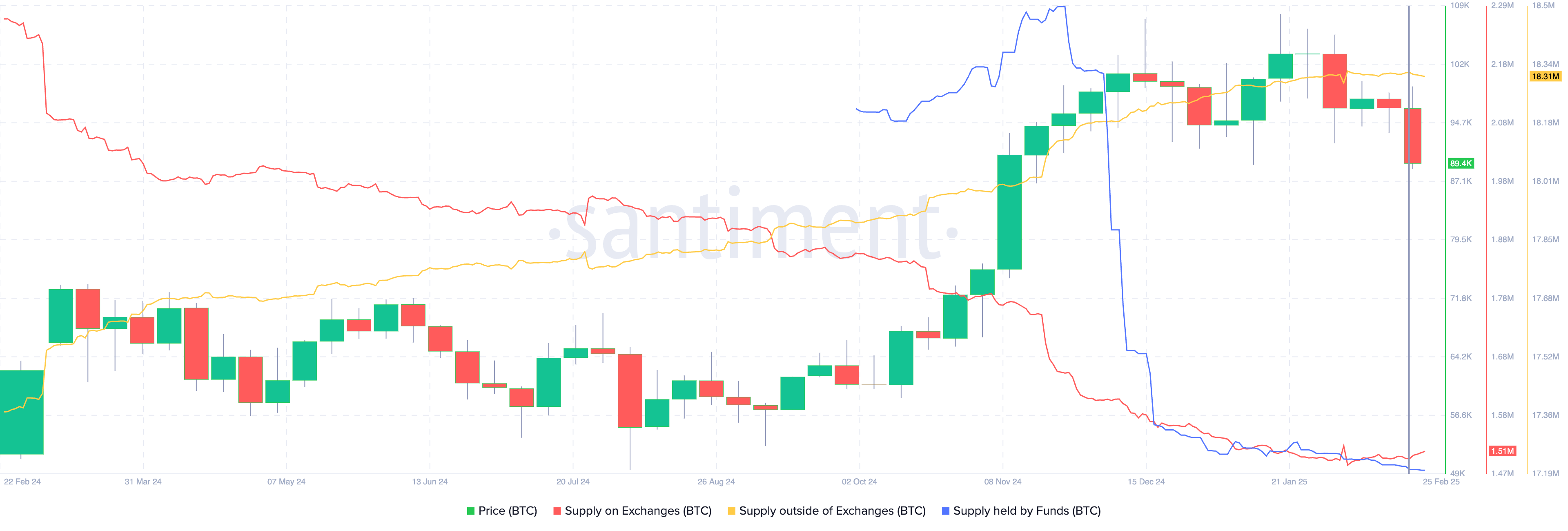

Chain data from Santiment show that the exchange supply simultaneously climbs at the same time as the supply of outside the exchange (which keep whalemen) decreases. Typically, this indicates the entities held by BTC outside the exchange is transferred to invest expenditure of wallet after weeks of consistent accumulation.

Bitcoin accumulation for wallet exchange was considered a sign of Bacak Bacca, so the decline in non-exchanging is not considered expecting further decline in Bitcoin’s price.

Key metrics, BTC Supply of funds, is declining, and this can be interpreted as a decline in Bitcoin estitual estia. This is in line with the Bitcoin spot Net negative flows observed by far-reaching investors.

Institutional investors lose interest in Bitcoin, if you are worried about?

The data on the flow of the Fund from coins show that institutions withdrew 595 million dollars from so far until today. Weekly until today is a total of $ 571 million Bitcoin Funds, while Etherum, Solana, KSRP and perennial means see inflows.

The flows of the net week in the crypto distract the outflows in the Bitcoin-based funds. Coins have compiled data based on the fund streams until 21. February, after which he climbed the BTC offer for exchange. Bitcoin faced additional sales pressure between 21. and 25. February, pushing the BTC price lower, under support of $ 90,000.

Microtratic actions, analysts in 10K research explained correlation between MSTR and Bitcoin’s price trend. Markus Thielen, General Manager 10X Research explains that investors have examined the MSTR as the option of calling Bitcoin, and they have not impropered, the shares overlay 60% above their fair value. 24. February.

When MSTR shares reached the peak, stock is 21. November traded $ 40 billion, and Thielen believes that investors were likely to take part of their positions on retail customers. MPR Customers are therefore likely to sit on significant losses – despite the price of bitcoin remaining apartments in the same period.

Performance and demand MSTR and requirements, therefore affect the sense of trader related to the BatCoin call option. The BTC price drop at $ 90,000, therefore, has a critical impact on these retailers and retail owners as a market dynamic shift is in progress.

Did the whales be plotted by Bitcoin

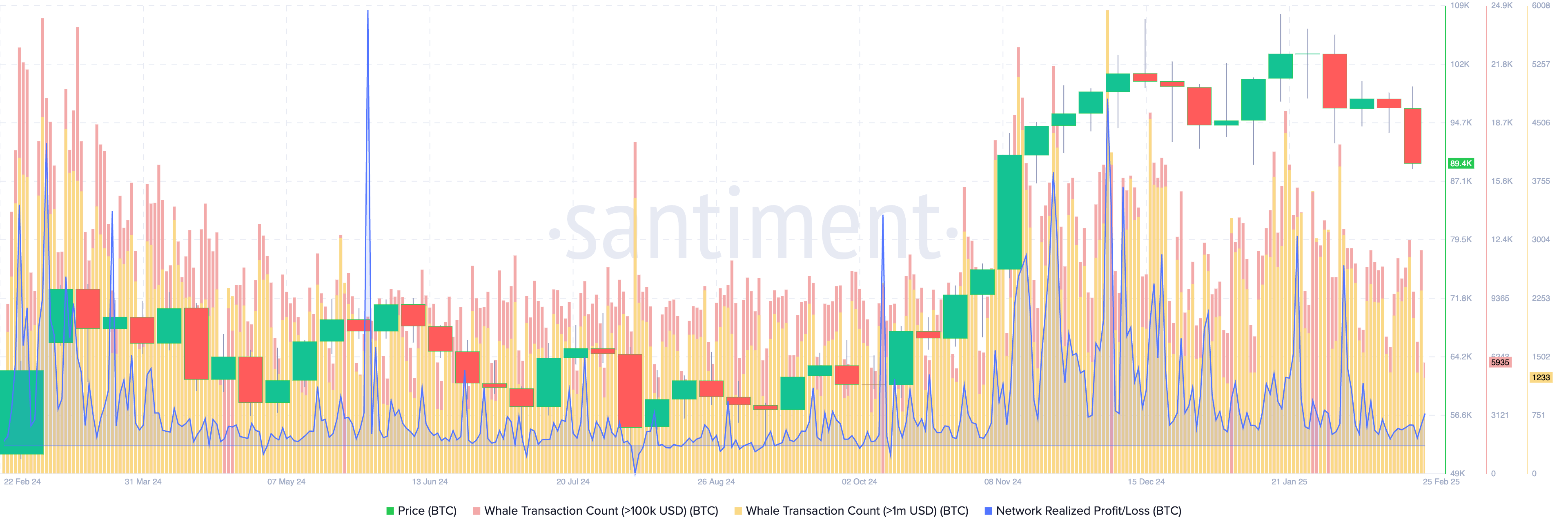

Santimental data on Bitcoin analysis on the chain show a drop in two segment transactions, values worth $ 100,000 or more than a million dollars and more. The trend falls in the transaction number of the two segments started 3. February.

Through the last two weeks, whale transactions in both segments decrease, while taking profits, the measure of the network achieved metrics of profit / loss, continued. Whales broke their BTC funds while taking profits. Typically, consistent profits can increase the pressure of sales on token and a negative impact on price.

The bottom belt of the Santiment below shows the fall of BTC prices, together with the terrible whale prices and the relatively high and consistent gain of the BitCoin Merchant.

Next Big Trade Bitcoin

The price of Bitcoin was sliding key support at the level of $ 90,000 on Tuesday. At the time of writing, BTC trades $ 88,976.24. Technical indicators on the price chart Bitcoin support further correction in the price of Bitcoin.

Three key levels of support that BTC could refuse S1, S2 and S3 to 85,072 USD, 8100, and 76,900 USD. These three levels of support match the upper / lower bounds of the fair value on the BTC / USDT day price.

The following key support after $ 90,000 is a pre-election level of $ 70,577. The decomposition of this support could send Bitcoin to collect liquidity at $ 67,476. The likelihood of mass withdrawal in Bitcoin is less likely, but February opened with Flashcrash at a lower than $ 91,230 on the third.

BTC is currently 12% below your Milestone of $ 100,000, and sufficient pressure on purchases and positive macroeconomic development could press the token more.

Markus Thielen of 10kresetraarch presents its technical perspective at BitCoin price in Last publication 25. February.

In the report, Thielen explains that from the perspective of technical analysis, Bitcoin traded in a sampling pattern of wedge spread.

Three key observations of Thielen are a working action of spreading, a shape of a wedge that appeared in Bitcoin price chart, partial increasing and adjustment that suggests a comprehension and a form that forms at the end of extended upward extended compensation.

Thielen says:

“If Bitcoin follows the expected outcome of this form, a lower side could appear. However, confirmation from trends for volume and further stocks would be necessary before drawing definitive conclusions.”

Ilman Shazhaev, the founder and General Manager of Dizzaract, discussed Babit Haku and influence the price of Bitcoin. Shazhaev said Cripto.News in an exclusive interview:

“Bibit Hack proved that communities can work together on a mission. The group of Lazarus has disrupted a total of 401,3446 cards, worth about $ 1.4 billion. Despite mild solutions recorded during the weekend, negative sales pressure remain on Market. However, feeling in the market is now beyond Bitibit Hack.

The exchange said that she completely complemented his Etherum reserve and all the withdrawal of all users were fulfilled. Although the funds arrived from the loans from industrial partners and OTC purchases, he helped to withstand an unusual bank that launched an exchange like FTX declares bankruptcy. The unity on the market has further set the wider industry into positive light, showing that the current price of the price will probably not last long. ”

Dr. Sean Davson, the head of research on Derivau.xiz commented on a bear shift as institutional funds from his positions in Bitcoin. Dr. Davson said Cripto.News:

“Bitcoin has a 4.5% drop in the last 24 hours, most likely due to the continuous exodus of institutional funds from the main BTC ETFs. More than $ 900 million Net BTC ETF outflows have been recorded. Investors entail funds in the face of macroeconomic instability, including concerns around Trump Presidency, Ukraine, China and Gaza Conflict and potential for growing interest rates.

As a result, a chance to settle BTC above 100K dollars to end 28. Marta fell to 30%, from 39% just 24 hours ago. In addition, the probability of BTC reaches 125k dollars to 27. June fell from 19% to 15%. “

On the decentralized options platform, traders reacted to recent developments by adjusting its positions with a slight increase in BTC 7-day default instability-money (ATM IV), now sitting at 46%. Statistics reflect enhanced insecurity on the market in the price of Bitcoin.

Detection: This article does not represent investment advice. The content and materials presented on this page are only only for educational purposes.

https://crypto.news/app/uploads/2025/02/crypto-news-Bitcoin-stacked-option01.webp

2025-02-25 23:01:00