What encryption investors should know about the last OCC axis on banking services for encryption

OCC redefines and expands banking options for encryption

The intersection of the distinctive assets and the Trafi sector continued to accelerate and develop rapidly with the calendar move until 2025. The prominent events that occurred – realized realisticly on some artistic versions of Sects in Sects. However, OCC is still a strong banking organizer in the United States, and in essence it works as a gatekeeper who can enter into the banking sector participating in certain activities. The activities and banking institutions, unlike the rapid and growing high -tech sector, have a clearly defined organizational structure, and fixed operations to engage with the aforementioned organizers, but it was also among those who demand increasing organizational directives as the market wanders into an increasing position for equipment.

The publication that attracted this interest in recent days can return to the publication of 2020, entitled “Bat” The explanatory message 1170, Which took power and the way banks can provide encrypted services to customers. In the publication of 2020, Occ also repeated that banks that seek to provide services to encryption customers and investors will need to apply the same risk management practices to encryption and are applied to traditional assets. In March 2025, the Acting Currency Observer issued a new publication, An explanatory message 1183And that is required after the clarity and privacy required by the tradfi space to participate in encryption activities.

Even with this new statement, the opening of the similar gates for the completion of Trafi-Crypto to accelerate, there are many major points that investors must take into account.

The encryption is greater than ignoring

One of the clear effects of this movement in OCC policy, especially when it takes in conjunction with other policy amendments so far in 2025, is that the encryption sector has become greater than to ignore it. Through the market value in trillion dollars, the Tradfi institutions in both Wall Street and the outside the street are developing products and services for retailers, institutions, and governments (at federal and loyal levels) that make voices about bitcoin and other digital assets. Investors and policy makers in all fields want to increase exposure to encryption, and the American banking sector needs to take advantage of this increasing demand.

The benefits of tradfi institutions only include those clear opportunities for fees and other lower elements, but also the opportunity to expand offers to Millennial Generation and Gen-Z/Gen Alpha customers. according to The research conducted by Gemini 51 % of the surveyed GEN-Z members have an encrypted currency, while the millennial generation is backward with a 49 % royal level. As both regimens continue to develop professionally and aspiring to diversify investments, Trafi institutions are looking at both groups as future growth engines.

FDIC and OCC move together

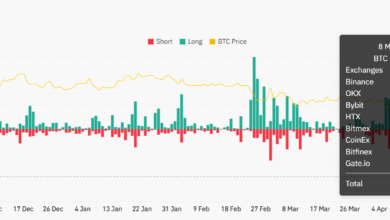

The main headlines on bitcoin reserves and digital asset stocks dominate the conversations, but the changes in politics by FDIC – along with the changes in OCC – quietly reshape the scene and services in the United States in September 2024. Notice of setting the proposed rules This is designed to enhance and clarify the requirements for saving notebooks for bank deposits that help non -bank companies. Although the base itself is aimed at FDIC secured deposit institutions, it will also have a significant impact on non -banking companies that depend on guard accounts to provide encrypted payment services.

The specific requirements that are included in the proposal include the requirements for saving records that emerge and clarify the owners who benefit from the concerned account, the balances that are attributed to the owner, and the ownership category in which these funds are kept. In addition, the proposal requires specific electronic file formats that must be followed, delegations for daily reconciliation, documented policies in this sense, and commitment to submit an annual certificate of compliance.

In short, the FDIC’s proposal seeks to ensure that controls, policies and testing of the aforementioned controls are equally strong for all parties involved in services that touch either Fintech operators other than banks, or the ecosystem of digital assets.

The encryption payments will rise

The encryption payments, despite the increase in the interest and investment that has witnessed the area of digital assets since 2024, continues to fail to wider investment flows. According to the research before Pio Center17 % of Americans who were surveyed or traded, or used the cryptocurrency; The total percentage that has remained unchanged since 2021 was the penetrations, and the ongoing doubts about the safety and security of associations, and the fluctuations that link prices that are linked by symbols such as Bitcoin and Ethereum, all contributed to the total adoption of encryption to pay.

Actions such as the measures taken by OCC and FDIC, against the backdrop of the broader policy changes, create a more hostile environment for encryption payments compared to previous years and under previous departments. With the increasing modification increasing, not only the use of Blockchain for internal purposes, but also to develop products and services for consumer use, coding payments will become almost unavoidable and understandable for consumers, and more secure than the past. In addition to the high rates of ownership and interest in encryption through the increasing life groups, the future of encryption payments remains bright.

https://imageio.forbes.com/specials-images/imageserve/67e05615f4d75c6dfa92c8b9/0x0.jpg?format=jpg&crop=2341,1098,×0,y229,safe&height=900&width=1600&fit=bounds