Visa Buckes StableCoin Infra Doveter BVNK in strategic bet on Stablecoin Payment

The BVNK provided support with visa ventures, marking the latest move of payment vidji to integrate Stablecoin technology into its global network.

Stablecoin The BVNK payment infrastructure provider provided a strategic investment with a visa, deepening traditional passenger gigants in block technology based on blockade-based mixtures. Investment, made through visa ventures was announced Tuesday by director of BVNK Jesse Hemson-Struthers.

Although the financial conditions were not disclosed, the move follows the BVNK series B 1.. Round in December 2024. years, which included the substrate of ventilation with coinbazia, the capital Scribble, Film investor, Avenir and Tiger Global.

Hemson-Struthers described the partnership as “more than capital”, calling it “strong validation of our vision to upgrade global payments with SteadyKoin technology”.

Cripto.News also visited BVNK and Visa repeatedly, but it did not react at the time of publication.

In the announcement, Visa is the head of growth and partnerships, Rubail Birvadker, a rapidly becoming part of global salary and visas, are investing in new technologies and buildings, which is next in the economy, which is next in trade and partners. “

BVNK claims to process 12 billion dollars in the annual scope of payment of Stablecoins and says it has built its ground floor platform to support automated transactions with high quantities. The company positions its service as an alternative to the traditional correct banking system, which writes is too slow and expensive for many modern business needs.

“On the BVNK, we recognized stablecoins as a current global canvas station and a sustainable alternative in the traditional correspondent banking system. We have built your infrastructure from both automation and orchestration of stablecoin salary on the scale, making these new rails.”

Hemson-Struthers

Persecute stability

The investment for the visa comes at the time when Stablecoin sector shows signs of broader institutional interest. At the end of April, the visa united With the boot of the Stripe AKED bridge so that Fintechs would allow you to issue visa cards directly from Stablecoins.

The new product initially launched in six Hispanic countries, allows users to finance cards with stablecoin, which are then converted to a local fiat at the site of sale. Merchants receive payments in their local currencies, without exposing impurities crypto.

The General Manager of Bridge Zach Abrams described cooperation as “mass unlocking programmer, adding that everyone will” be able to use stablecoinsins with only tap. ” The Head of the Visa Product and Strategy, Jack Forezell, emphasized that the company aims to “tightly integrate stablecoins into its global network”, consumer giving more financial options.

The BVNK seems to be part of this wider strategic direction. In his announcement, the company noted that its stablecoin rail could help redefine operating in a digital economy, especially in regions with limited access to effective cross-border banking.

The company also extended to the American market, opens offices in San Francisco and New York earlier this year. His American operations conduct former CEO Blockfi Amit Cheel and the former executive director of the Keith Vander Leest.

‘Trillion-dollar opportunity’

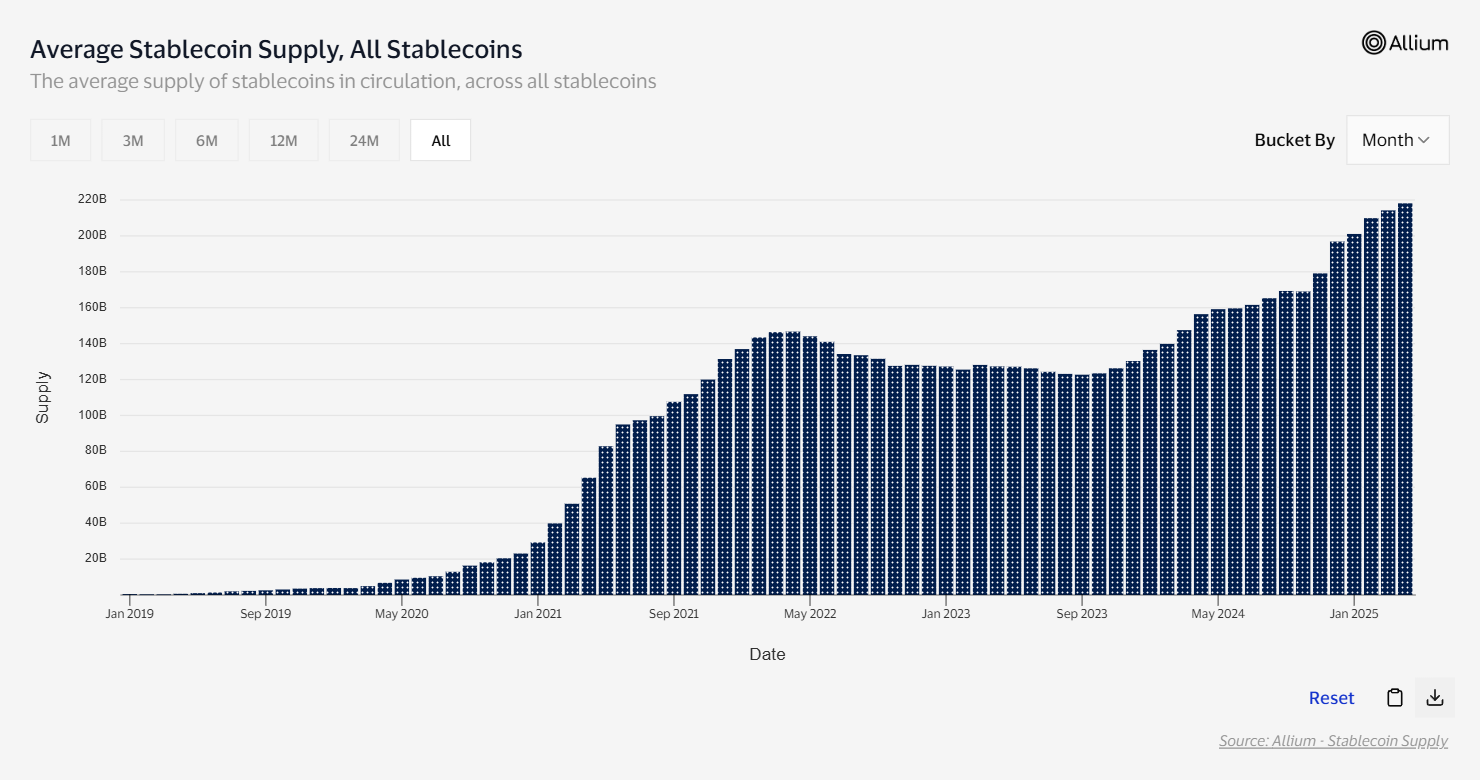

The volume of payment of stablecoins increased in recent quarters. Onchain Analytics Platform Visa’s Onchain reports $ 33.4 Trillion in a global scope of Stablecoin in the amount of 5.5 billion transactions, which indicates the cultivation of trafficking cases.

Citi wealth also noted that Stablecoins “could eventually increase the dominance of American dollars,” especially as a scale for infrastructure stablecoin.

https://twitter.com/hosseeb/status/1874288532686295058

General Partner Capital Dragonfly Haseeb Kureshi has previously also designed In order to mark a turning point for Stablecoins, saying they could become key tools for small and medium enterprises, transition through a speculative crypto store in real payment pay and settlement.

“Using stableCoins will explode, especially among SMB. Not only to trade and guess and guess – Actual companies will start using dollars in the chain for the currently settlement.”

Kureshi

He also added that efficiency and availability would enable stablechoins to draw traditional systems, especially how regulatory clarity improves.

The capital of Panther, another featured cropto company, called StableCoyne “Obligion-dollar opportunity”, noting that they are now over 50% of the transaction transaction activity, compared to only 3% in 2020. Years.

For BVNK, the visa agreement is also a turning point milestone. Hemson-Struthers did this as a return to the first principles in payment innovation.

“I am especially excited about what the partners with visas – original payments, adding this expertise of Vis in the construction of global payment networks, combined with BVNK stablecoin infrastructure, would create” powerful possibilities “.

https://crypto.news/app/uploads/2025/03/crypto-news-Stablecoins-are-inevitable-option03.webp

2025-05-10 14:00:00