Usdc takes the crown in January where Bitcoin looks at the basic PCE data

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

The encryption market passes the water and the largest encrypted coin, Bitcoin, takes the bull break. Its rising momentum is strangled by Trump’s introductory threats, which also send gold prices to an increase in high records and support for the US dollar.

But there is work in some market corners. the The distinctive virtual code has emerged After its last list on Upbit, the Hyperlequid noise code saw 3 % earning. Litecoin also makes waves, with its continuous future interests on the central stock exchanges that climb to 5.19 million LTC, more than December 9, according to Coinglass. Tips for the mutation in the new capital flowing to the market, which is likely to be fueled by the presence of the list of investment funds circulating in the United States in the United States

When talking about Stablecoins, USDC steals the spotlight as the star this month, which includes a great growth in the market of 21 % to $ 53.12 billion. This is his best month since May 2021, according to TradingView data. On the other hand, USDT, heavyweight hero of dollar, has only increased by 1 %. USDC until it surpassed bitcoin, which grew 10 % respectable.

According to InTothheblock, it is likely that the performance over USDC is likely to comply with MICA systems in Europe, while competitors like USDT Confronting the difficult opposite winds. But do not calculate Usdt yet; Its market began to bounce, and the simultaneous growth of USDC provides a bullish motivation for the encryption market.

While we are watching the total scene, the PCE-PCE-scale that can inflate in the Federal Reserve. Expectations For the hot address number, with the basic reading, which excludes food and energy, indicating positive improvements that may help BTC to get out of its dull work near $ 104,000.

However, Ji warns that the dollar may remain strong at the weekend.

She wrote: “If we do not receive any news about Canada and Mexico by the end of the day, there is a risk that the dollar can enhance more when the market begins in pricing at a higher opportunity to announce the customs tariff tomorrow.” So, stay on alert!

What do you see?

- Checks:

- January 31: Crypto.com suspends the purchases of the USDT, WBTC, Dai, Pax, Paxg, Pyusd, CDCTHTH, CDCSOL, LCRO and XSGD currency in the European Union to comply with MICA regulations. Withdrawals will be supported by the first quarter.

- Feb 2, 8:00 pm: Core Blockchain ATHENA Hard FORK Network Upgrade (v1.0.14)

- February 4: PepeCoin (Pepe) half. In the block 400,000, the bonus will decrease to 31250 Pepe.

- Feb 5, 3:00 pm: Boba Network Layer-2 based on Ethereum Mainnet.

- February 5 (after the market closure): Microstrategy (MSTR) Q4 FY 2024 profits.

- February 6, 8:00 am: Schentu series upgrade (V2.14.0).

- February 11 (after the market closed): Exit (exit) movement Q4 2024 profits.

- February 12 (before the market is opened): Koch 8 (Cotton) Q4 2024 profits.

- February 13: Cleanspark (CLSK) Q1 FY 2025 profits.

- February 13 (after the market closed): Coinbase Global (Coin) Q4 2024 profits.

- February 15: QTUM (QTUM) upgrade the difficult fork network In a mass 4,590,000.

- February 18 (after the market closure): Seemler Scientific (SMLR) Q4 2024 profits.

- February 20 (after the market closure): Block (Xyz) Q4 2024 profits.

- February 26: Mara Holdings (Mara) Q4 2024 profits.

- February 27: Riot platforms (riots) Q4 2024 profits.

- March 4: Craft Mining versions (CIFR) Q4 2024 profits.

- Macro

- January 31, at 8:30 am: The US Economic Analysis Office (Bea) launches personal income in December and expenses.

- Basic Prices PCE Mami Pets Index. 0.2 % against the previous. 0.1 %.

- The basic PCE price index. 2.8 % against the previous. 2.8 %.

- PCE Price Index Mom Est. 0.3 % against the previous. 0.1 %.

- Pce Price Index Yoy Est. 2.6 % against the previous. 2.4 %.

- February 2 /

- Manufacturing PMI EST. 50.5 against the previous. 50.5.

- January 31, at 8:30 am: The US Economic Analysis Office (Bea) launches personal income in December and expenses.

Symbolic events

- Voices of governance and calls

- Compound Dao votes on the upgrade of its ruling contracts from Governorbravo to the modern Openzepelin application.

- Balaney Dao votes whether a symbolic exchange will start between Balancer Dao and Cow Dao, which includes 200,000 Bal icons and about 631,000 cow codes.

- to open

- January 31: Optimism (reference) to open 2.32 % of the trading offer of $ 46.39 million.

- February 1: Sui (sui) to unlock about 2.13 % of its inventory supplies of $ 261.91 million.

- February 2: ETANA to cancel a lock of about 1.34 % of its inventory supplies of $ 29.53 million.

- Distinguished symbol lists

- January 31: Movement (movement), Al Dhaheri (Al Dhaheri) and Sundog (Sundog) to be included on Indodax.

Conferences:

Locate the location of the derivatives

- TRX, Trump and Dom recorded the largest increase in permanent future contracts. However, it appears that merchants abbreviate Trump, as is evident from the negative cumulative size.

- BTC, ETH Open FROUTH and CVD are not changed slightly. BTC CME basis hovering about 10 %.

- The flows were kept in the Deribit Options Market, but BTC and ETH calls continue to trade weights more than it is offered.

Market movements:

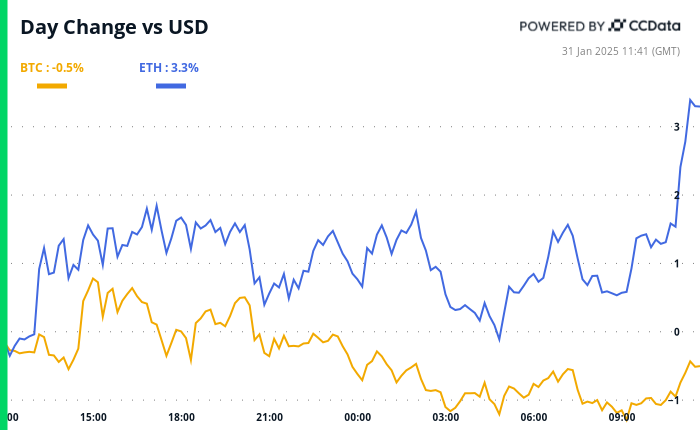

- BTC decreased by 0.29 % from 4 pm East to 104,810.50 dollars (24 hours: -0.47 %)

- ETH rises by 2.39 % to $ 3,324 (24 hours: +3.32 %)

- Coindesk 20 decreased by 0.3 % to 3,838.81 (24 hours: +0.28 %)

- Cesr 4 -bit compound survey rate to 3.07 %

- BTC financing rate at 0.0012 % (1.2961 % annually) on OKX

- DXY rises 0.47 % in 108.30

- Gold did not change at 2,794.77 dollars/ounces

- Silver increased by 0.19 % at $ 31.60/ounces

- Nikkei 225 closed +0.15 % to 39,572.49

- Hang Seng +0.14 % closed to 20,25.11

- FTSE increased 0.3 % in 8,673.13

- EURO Stoxx 50 is 0.39 % in 5,302.75

- Djia closed on Thursday +0.38 % to 44,882.13

- S & P 500 closed +0.53 % to 6,071.17

- Nasdak closed +0.25 % to 19,681.75

- Closed S&P F/TSX Complex +1.31 % to 25,808.25

- S & P 40 America America closed +2.21 % to 2,388.03

- The US treasury increased for 10 years by 2 points per second by 4.536 %

- E-MINI S & P 500 is 0.43 % in 6,125.75

- E-MINI NASDAQ-100 futures increased by 0.79 % at 21,795.50

- The E-MINI Dow JONES Industrial Vilese Index increases by 0.32 % to 45,200.00

Bitcoin Statistics:

- BTC dominance: 59.21 (-0.11 %)

- ETHEREUM ratio to Bitcoin: 0.03127 (0.84 %)

- Retail (seven -day moving average): 781 eH/s

- Hashprice (spot): $ 61.7

- Total fees: 4.97 btc/ 522,698 dollars

- CME FUTERES Open benefit: 176,270 BTC

- BTC at gold price: 37.3 ounces

- BTC market roof for gold: 10.60 %

Technical analysis

- The graph shows that $ 60 has been shown as a strong resistance to the Trade Troude Fund in Blackrock since December, when the bulls have constantly failed to create a foothold above this level.

- These patterns represent a bullish exhaustion and often pave the way for the decline in simple prices that get rid of weak hands, which increases the height of the leg.

Encryption

- Microstrategy (MSTR): closed on Thursday at $ 340.09 (-0.34 %), an increase of 0.2 % at $ 340.77 in the market before the market.

- Coinbase Global (COIN): Closed at $ 301.30 (+3.54 %), a decrease of 0.17 % to $ 300.80 in pre -market.

- Galaxy Digital Holdings (GLXY): Closed at $ 29.33 (+0.83 %).

- Mara Holdings (MARA): Closed at $ 19.18 (+4.13 %), an increase of 0.36 % at $ 19.25 on the market before the market.

- Riot platforms (RIOT): closed at $ 11.90 (+6.06 %), an increase of 0.76 % at $ 11.99 in the market before the market.

- Core Scientific (Corz): Closed at $ 12.26 (+6.98 %), an increase of 3.18 % at $ 12.65 on the market before the market.

- Cleanspark (CLSK): Closed at $ 10.97 (+6.92 %), an increase of 0.55 % at 11.03 dollars on the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.50 (+6.33 %), an increase of 3.47 % at $ 23.28 in pre -market.

- Semler Scientific (SMLR): Closed at $ 52.15 (+0.13 %).

- Exit (exit): closed at $ 61.38 (-31.27 %), a decrease of 2.23 % at $ 60.01 in the market before the market.

Etf flows

Etf flows

BTC Etfs Stain:

- Daily net flow: 588.2 million dollars

- Cutting net flow: 40.18 billion dollars

- Total BTC Holdings ~ 1.18 million.

ETH ETFS spot

- Daily net flow: 67.77 million dollars

- Cutting net flow: $ 2.73 billion

- Total Eth Holdings ~ 3.65 million.

source: Farside investors

It flows overnight

Today’s scheme

- The Move index, which represents a options for the extent of US Treasury fluctuations in the next four weeks, has decreased.

- Low fluctuations in the locker market often preach goodness for risky assets.

While you sleep

- Bitcoin fixed, golden symbols shine with Xau with a standard standard record; Inflation in Tokyo rises (Coindsk): President Trump’s identification threats indicate the opposite winds of Bitcoin, but derivative data indicates doubts about a significant contraction, while traders remain up of bullish and increasing interest in the state -level BTC reserves.

- GrayScale SEC file (CoINDESK): On Thursday, NYSE Arca presented a 19B-4 model with SEC to study Grayscale’s XRP TRUST as ETF.

- The default is 28 % increasing as the list of the distinctive symbol is displayed to the South Koreans (CoINDESK): Virtual price, the original distinctive symbol of the assumption protocol, which is a decentralized Blockchain platform for the creation of artificial intelligence agents, left after Upbit said it will include the distinctive symbol.

- Trump gets the low interest rates he requested from everyone, but the federal reserve (Reuters): Despite Trump’s calls for price discounts, the Federal Reserve remains a slice, while Canada, England and the European Central Bank reduce monetary policy.

- Trump says 25 % are a tariff for Mexico and may not include Canada oil (CNBC): On Thursday, Trump confirmed that customs duties by 25 % on Mexican and Canadian imports will start on February 1, but to leave the oil is uncertain.

- The Japanese economy faces the repercussions of Trump’s threats in China (Bloomberg): Tomoko Hayachi, chief economist in Japan, said that the US -Chinese trade war can harm its country’s economy, although it believes that companies are now more ready than Trump’s first term.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/c6bf82c83bf1c4936b63eec7d06a982528b8ff1c-700×430.png?auto=format