Trump betrays huge fed challenge-sparkling stock exchange credits like gold and bitcoin price

04/21 Update below. This post was originally published 20 April

Bitcoin prices and Cripto are water waters after US President Donald Trump’s Trading War challenged the Haos market It threatens spirally in a complete missed US dollar trust crisis. “

Bitcoin price fell from her January top of almost $ 110,000 per Bitcoin, falling together with the stock market, Like Cripto Hurts Ka Tipping Tipping Tiprich “.”

Now, As the billionaire Rai did warn that the United States would tape the verge of financial crisis and recession that could be worse since 2008. years, The White House was confirmed by Trump explores whether it could evaporate the Federal Development Reserve Jerome Powell – something that could start the “apocalyptic scenario” for markets.

Sign Up now for free Criptocodek–The daily village for five minutes for traders, investors and crypto-curious that will introduce you to you in front of Bitcoin and the cryptic market.

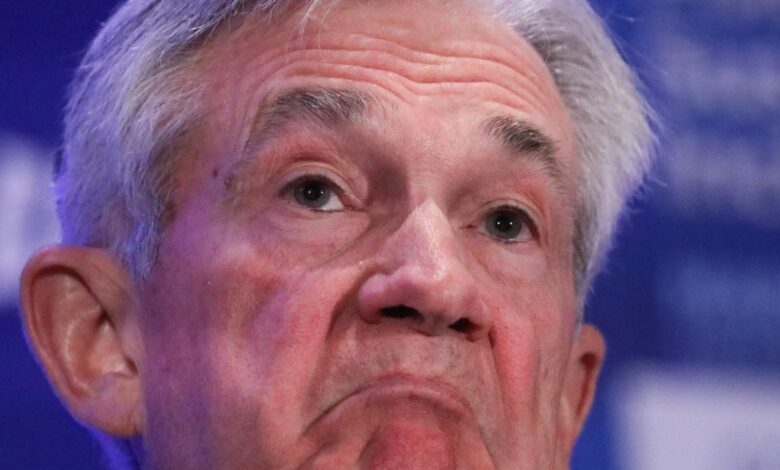

US President Donald Trump judged whether the white house could fire the chairperson of the Federal Reserve … more

“The President and his team will continue to study the issue,” said Kevin Hasett, a trump economic adviser, to the question of whether the foster is the foster chair option and if Trump has an authority to remove Powell.

This week is Trump published on his social account that “Powell’s breakdown can’t be enough” after Powell reiterated his intention of waiting for insecurities due to insecurities due to the uncertainty of the Trump Tariff Trading War.

Last month influential Senator of the Deactivated Democratic Party Elizabeth Warren said Trump could try to climb Powell, a wicked warning, “Nobody’s sure.”

“It would be a huge, huge shock,” Bilal Hafeez, CEO of the company for investment research Macro hives, told Telegraph Newspapers. “All in all, it would almost like an apocalyptic scenario on the market”.

Update: Bitcoin price shot greater after US President Donald Trump has been reducing interest rate reduction, suggesting the Federal Spare Chairs of Jerome Powel to take the Democratic Party in November in September.

“” Preventive cuts “in interest rates does not call them many” Trump published to his social account of truth.

The price of bitcoin climbed to over $ 88,000 per bitcoin, above April account of below $ 75,000.

“With energy costs down, food prices (including biden’s eggs disaster!) Significantly lower and most other ‘things’ collapsed, there is practically no inflation,” Trump wrote.

“This costs so beautifully, only what I predicted will be a slowdown, Major loser, now reduces interest, adding that Europe has” already “synurized”, adding that Europe has “already” reduced. ” “

The stock exchanges opened lower at Wall Street, headed by Nasdak and Tech reduction, while the US dollar hit fresh perennial covers against other major currencies.

The price of gold has increased over $ 3,400 on Trii ounce, new record, as traders cashing capital and in a traditional safe refuge.

“Bitcoin and Gold, in tandem, because the market though, another shock of American President Donald Trump, this time, is an obvious thread in the Federal Reserve of Jerome Pouell,” Nic Puckrin, analyst and the founders of wrought, said in e-mailographic road.

“This made the US dollar fall into a three-year low, but also gold and Bitcoin appear as safe refugees.”

The Trump’s barrage of global trade tariffs exploded established international trade orders, encouraging the insecurity in the market and the ride of investors risks such as Bitcoin and crypto.

Sign up now for Criptocodek-Frequiped, Daily Crypto newsletter

The price of Bitcoin was unable to climb on gold, because Tariff Donald Trump holidays on the market.

Bitcoin price diverged from gold, which rocketed in all the time heights while traders run into a traditionally safe haven, though some have The intended bitcoin will ultimately use and start trading as “digital gold”.

“Powell still sits on the” we will wait and see “accession because it will still believe that tariffs will lead to higher inflation,” Bitcoin and Cripto Investor Lark Davis wrote in his master newsletters in his wealth.

“Just time will say, but firing Power risk leads even more insecurities in markets. However, intervention will need some species, whether it costs a reduction, quantitative relief or trump.” Not if. “

(Tagstotranslate) Jerome Powell

https://imageio.forbes.com/specials-images/imageserve/626e4deb9cb7a8fb2aab7720/0x0.jpg?format=jpg&crop=1181,664,×560,y255,safe&height=900&width=1600&fit=bounds

2025-04-21 17:59:00