Top 2 catalysts for Bitcoin, Altcoinic prices next week

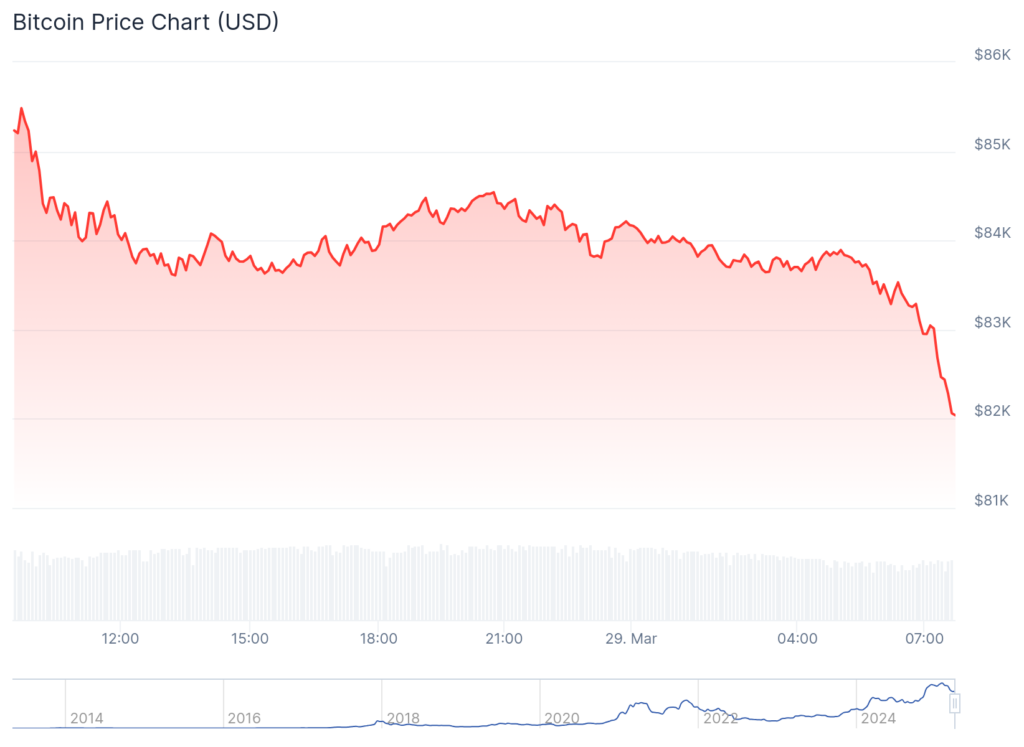

Bitcoin and Top Altcoin suffered a sharp turn over the end of the week, because the fear and greed index remained in the fear zone.

After an increase to $ 89,000, Bitcoin (Btc) Crashed to about $ 82,000 on Saturday morning. Look down.

Meanwhile, a market cap of all digital coins fell to $ 2.73 trillion. This article emphasizes two potential catalysts for Bitcoin and other Altcoyne next week.

Trump’s reciprocal tariffs

Next week, President Donald Trump’s Trump is expected to so-called “the day of release” to which the reciprocal tariffs on top American trading partners will be the main catalyst for many cryptocurrency and supplies.

Reciprocal tariffs aim to cause what Trump views as unfairly imposes at American goods and non-tariff barriers

The European Union is allegedly in view of Concessions, while China plans countermeasures.

Economists warn that These tariffs They will hurt American producers by lifting their costs and influenced their overseas affairs. As consumer consumption and business investment declining, some experts claim that the United States is faced with an elevated recession.

In Monitor Marta AG AG Economists MonitorFor example, 62% of economists say that the American general economy will see recession 2025. years.

Therefore, the Bitcoin and Altcoin prices are expected to react to these tariffs on Tuesday. Theoretically, this property is likely to continue to fall when Trump detects its tariffs.

On the other hand, these assets may be rejected as the market participants cost the tariffs. They can also refuse if certain countries are spoken with the US

American offer information for nonfarm

Another key catalyst for Bitcoin and Altcoin prices will be in Friday data Nefarma Payment lists from the USA.

Economists survey Reuters Expect data to show that the economy created 128,000 jobs in March. It was a large decline of 151,000 created a month earlier. The unemployment rate is expected to increase to 4.2%.

Historically, crippto and shares reacted to job numbers due to its influence on federal reserves. The Fed is in charge of maintaining a stable inflation and low unemployment rate.

These numbers come as a Wall Street is divided what to expect from Fed this year. Some analysts expect that this year will hold rates due to stubbornly high inflation, while others see it later this year as Trump Tariffs run the recession this year.

https://crypto.news/app/uploads/2024/12/crypto-news-altcoin-trading-chart-option01.webp

2025-03-29 17:01:00