“Time to Sell” — Dangerous Warning of Bitcoin Price Collapse Increases Cryptocurrency Sell-Off

Bitcoin and cryptocurrency prices fell sharply along with stock markets –It was pushed down by Tesla billionaire Elon Musk who issued a surprise warning about the price of Bitcoin.

Earn over $3,000 in NFT, web3, and crypto perks – apply now!

Bitcoin’s price, which surpassed $100,000 per bitcoin earlier this week, has fallen to around $92,000 though. A Wall Street investment bank is making a big bet on the game-changing currency Bitcoin.

now, As the Bitcoin and cryptocurrency market prepares for an “imminent” Elon Musk X bombLegendary cryptocurrency investor Arthur Hayes predicted that the price of Bitcoin and the cryptocurrency market would collapse in late March.

Register now for free Cryptocodex—A daily five-minute newsletter for traders, investors and cryptocurrency enthusiasts that will update you on the latest developments and keep you ahead of the Bitcoin and cryptocurrency bull market.

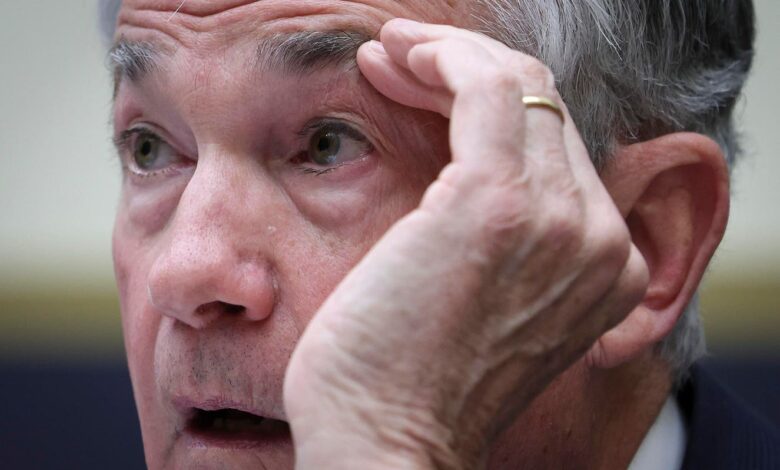

Federal Reserve Chairman Jerome Powell is expected to help support the price of Bitcoin through the end of the year … [+]

“Right on schedule, just like about every other year, it will be time to sell in the late stages of Q1…and wait for positive cash liquidity conditions to emerge again in Q3,” Hayes, a co-founder of the Bitcoin and cryptocurrency derivatives pioneer wrote, BitMex, who founded the Maelstrom venture fund, said in a blog post mail.

The price of Bitcoin and the cryptocurrency market rises despite periods when dollar liquidity increases and falls as dollar liquidity decreases, according to Hayes, who previously predicted that the price of bitcoin will collapse as the inauguration of next US President Donald Trump approaches.

“I still believe this is a potential negative factor that could impact the market in the short term, but against that, I have to balance the liquidity boost with dollars,” Hayes wrote. “Bitcoin, right now, is fluctuating with the pace of dollar emissions.”

According to Hayes, the Treasury Department’s general account will be nearly empty near the end of the first quarter, and the matter will worsen as the United States approaches the debt ceiling and the April 15 tax payment deadline.

The price of Bitcoin fell this week as traders reevaluate 2025 expectations for interest rate cuts by the Federal Reserve in light of the latest strong data showing that the US economy has remained strong.

Register now for Cryptocodex– Free daily newsletter for cryptocurrency fans

The price of Bitcoin has fallen slightly but is still much higher than it was a year ago.

“The Trump dump that some predicted would happen after his inauguration as President of the United States appears to have accelerated as the cryptocurrency market dives deep into the red zone,” Peter Koziakov, CEO of cryptocurrency payment platform Mercurio, said in an email. comments.

In December, Trump He confirmed that he plans to create a strategic reserve of Bitcoin in the United States. “We’re going to do something great in crypto because we don’t want China or anyone else…but others embracing it, and we want to be ahead of the curve,” Trump said. He said CNBC.

“Markets are no longer thrilled that Bitcoin is entering a new era where even the US will hold a strategic reserve of Bitcoin. Instead, Bitcoin’s role as a highly risky, risk-off asset has once again emerged amid signs that the US Federal Reserve may hold interest rates “higher for a longer period than previously expected.”

https://imageio.forbes.com/specials-images/imageserve/633c2741f081733a2a78b209/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds

2025-01-09 11:31:00