The United States regains priority in the cryptocurrency market on Trump’s agenda and demand for ETFs

(Bloomberg) – The center of gravity of the cryptocurrency market returns to the United States as 2025 approaches, thanks to the re-election of Donald Trump to the presidency and expanding demand for digital asset funds and financial derivatives contracts in the country.

Most read from Bloomberg

Trump’s pledge to make America the primary hub of the cryptocurrency sector has sparked a flurry of trading, adding to the boom in activity caused by the surprisingly successful rollout of US Bitcoin exchange-traded funds since the start of 2024.

As a result, the United States has increasingly become a key player in providing digital asset liquidity and benchmark pricing, while for part of the past year Asia appeared to be the biggest beneficiary of the Biden administration’s cryptocurrency crackdown that Trump is now rolling back.

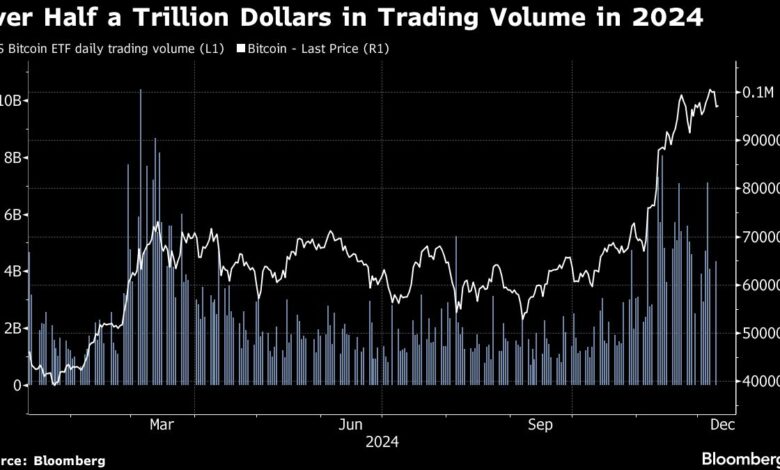

The charts below show the changes in cryptocurrency market structure over the historic 12 months when US demand helped Bitcoin surpass $100,000 for the first time.

The share of daily bitcoin-to-dollar trading that occurs during U.S. business hours has risen to about 53% from 40% in 2021, data from Caico shows. Increased institutional participation has shifted “liquidity dominance” toward America, said Thomas Erdosi, head of CF Benchmarks Products.

U.S. Bitcoin ETFs have recorded a cumulative daily trading volume of more than $500 billion and net inflows of about $36 billion since their launch in January. BlackRock’s iShares Bitcoin Trust is one of the most successful funds ever launched. Under Trump, the pool of US cryptocurrency ETFs is expected to expand beyond the current offerings, which are limited to Bitcoin and Ethereum.

Open interest – or pending contracts – in Bitcoin and Ether futures hosted by CME Group Inc. Based in Chicago, it reached all-time highs this year. The Chicago Mercantile Exchange now ranks No. 1 for open interest in Bitcoin futures, while offshore platform Binance Holdings Ltd. It is the market leader.

The collapse of FTX exchange and sister hedge fund Alameda Research in 2022 severely damaged liquidity. US ETFs and Trump-fueled optimism have helped turn things around. Cryptocurrency market depth — the ability to sustain relatively large orders without unduly impacting prices — has returned to levels seen before the FTX crisis, closing much of the so-called Alameda gap, Caico data shows.

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

https://media.zenfs.com/en/bloomberg_markets_842/79283e8ab18ad35dcc0a7183d836b0cd