The United States is not on CBDCS

Discover: Here are views and opinions belong exclusively by the author and do not represent the views and opinions of the CRIPTO.NEVS ‘editorial.

In the United States for several years, Policy creators They studied, discussed and issued several reports on whether the Federal Reserve Bank should create a central bank digital currency – “Digital dollar” without reaching a definite course of action.

CBDCs are digital versions of traditional paper currencies Fiat supported by governments and issued to promote economic inclusion and wider access to financial services with tokenized payment efficiency. CBCDS improve monetary policy in global payment systems instead of increasing tokenized electronic payments and drop in cash use by providing responsibilities and stability. They mitigate the risk of financial instability derived from creating unregulated private electronic instruments, such as meme / altcins, tokenized assets or stablechoins and corruption.

There are two types of CBDCs. The cruise public uses the retail CBDC, and the wholesale CBDC is exclusively designed for interbank payments and securities transactions.

Vivek Raman, General Manager of EtheraLithesis.io, which connects financial institutions to the largest, safe and open Clockchain ecosystem ecosystem ecoses around the world, he told me:

“We do not believe that CBDC will happen in the United States under the new administration. The CBDC goes against the principle of decentralization and freedom and is better to have a stablecoin and tokenized funds market.. ”

The USA ban CBDC

16. January, President Donald Trump’s treasury candidate, Scott Bessentwhich has been confirmed as 79. The Secretary of the United States Vault, testified before the Senate Finance Committee oppose Introduction of CBDC in the United States. “I see no reason to have CBDC,” stating privacy and economic concern.

After the announcement of Scott Besenta, 23. January, US President Donald Trump signed the executive order officially forbidding, the issuance, circulation and use of CBDC in the United States. AS Rhett Shipp, CEO Avant, Onchain Provider StableCoin, Countries:

“In my opinion, the CBDC would eventually injure the United States because it would reduce the utility increasing the censorability and reduction of privacy. Accepting StableCoin is a better road.“

CBDC development worldwide

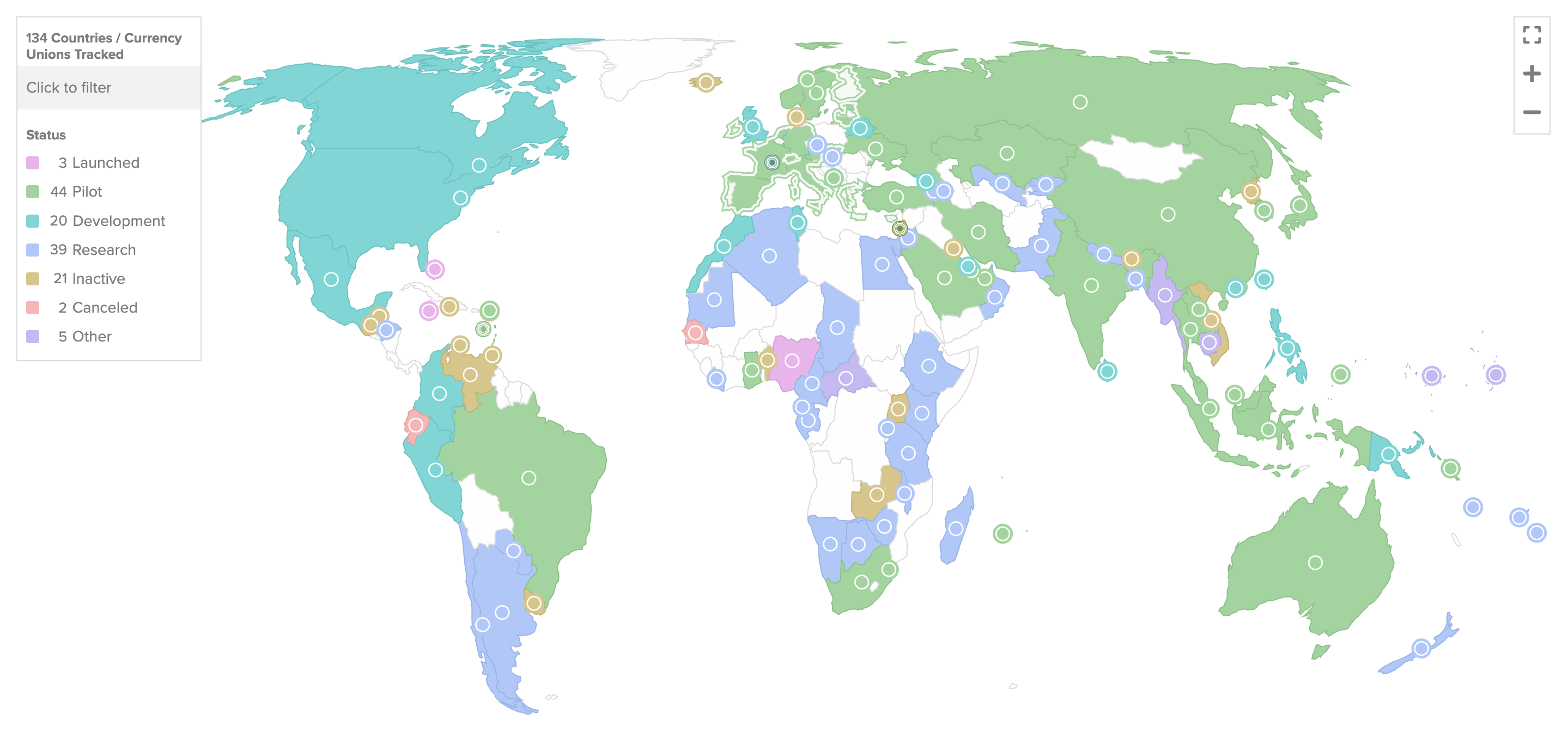

The Global CBCD adoption rate has been monitored by the Atlantic Council tragerwhich follows the development of CBDCs in 134 countries that make up 98% of GDP GDP. So far, 66 countries are investigating the CBDC, with China that leads the way. Only three countries, including Nigeria, Jamaica and Bahamas, issued them.

These countries work at the cooperation of the development of coordinated legislation to regulate the issuance and distribution of CBDC with recommendations of international organizations (see: Sustainable investment in digital property in the global side Author of Selva Ozelli, Introduction, p. 2). However, the intricate interconnected CBDC ecosystem containing central banks, commercial banks, payment providers and technological sellers – face a number of cyber-cursecuriti challenges, worsen using data and privacy vulnerability, points From the Virtual Manual IMF CBDC.

Most used in the world CBDC-E-CNI

China has taken global lead in the development of domestic and cross-border tokenized payment networks through digital currencies. They started piloting the CBDC E-CNI program in 2019. year with 260 million users of banknotes in 17 regions at the level of provincial levels, which makes it the most favorable CBDC pilot in the world. According to Le Lei, the Deputy Governor of the National Bank of China – Central Bank of the People’s Republic of China – from June 2024. years, Chinese digital Yuan performed 7 billion Yuan (982 billion dollars). This figure is almost four times more than 1.8 trillion yuan recorded by the end of June 2023. years.

This e-CNI success can be attributed to the continuous efforts of the Chinese government to expand the range of retail and wholesale CBDC transaction for increased E-CNI adoption. The use case has been extended to include payments for various services, such as payment for public transport, income tax, seal duties and recently, electronic electronic version Red packages (Hongbo), a traditional Chinese way of giving money (“purpose related digital payments”).

However, lucrative efforts in the CBCD CBCD are not limited to the ground. “In Asia and Pacific, Central Bank in China, India, Indonesia, Thailand, Singapore, Japan and Republika Korea already pilot CBDCs” explained Kanna Vignaraja, Assistant Secretary General of the United Nations and the UNDP Regional Director for Asia and Tihok.

President Donald Trump is expected to transfer that in the United States will influence “any retail CBDC projects”, according to Yifan, the founders of red red technology red. “But the point is that I don’t think that no country can even develop the actual retail CBDC in the next 10 years,” he explained to me.

Technology order is a decentralized cloudy infrastructure company based in Hong Kong, which has been based by two leading companies in global CBDC pilot programs:

- A block-based Chinese service network, in addition to the company and department of the Government, which connect different payment networks;

- Universal network for digital payment (UDPN) that uses blockchain and smart contracts to create a decentralized messaging system and platform to enable the transfer of excessive currency and settlements of different digital currencies.

Last year, the UDPN established a digital song for central banks such as standard chartered and Deutsche Bank at trial to make a retail CBDC system, including quotas management, and wallet management. The system is designed to support a variety of retail and wholesale interface CBDC proof of the concept (POC); Regulated stablechoins such as Paypal USD, Pakos Dollar, USDC, Hedera and Tether; Tokenized deposits as well as purpose-related digital payments for interoperation from different countries.

Tim Bailey, Deputy President of Global Business and Operations for Red Technology Date, explained to me in the interview:

“StableCoins and CBDCS transform digital payments, offering 24/7 transactions for companies. As payments increasingly migrate in the chain by adopting StableCoin and CBDC, the need for support below the cross-chain has become clear. UDPN is a trailblazer in the field, offering POC as the first step towards connecting digital payments in a larger digital currency ecosystem. The UDPN architecture allows us to integrate with virtually any digital currency system – whether CBCD, stablecoin, tokenized deposits or purpose-related digital payments via the transaction. Simplifies the adoption of digital currencies in a wide range of applications and reduces integration costs for financial institutions and central banks. “

The EU is an initiative for wholesale of CBDC

The European Central Bank investigates CBDCs in different capacities from 2020. years, including a retail digital euro and wholesale of cross-border settlement between central banks.

In response to CBDC ban USA, ECB 20. February announced To expand the development of its wholesale CBDC payment system for solving transactions between institutions to move towards integrated tokenisone financial infrastructure in two phases. In the first phase, the ECB will build Wholesale CBDC platform. In the second phase of the ECB will integrate the CBCD platform with systems, such as CBDCS, tokenized deposits and tokenized assets can be intensified within a non-based block-based financial system based on a joint book or apartments of interconnected solutions. This initiative will require unifying standards and regulations, first at the level of the eurozone, and may be globally for a more harmonized and integrated European financial ecosystem.

Conclusion

The Innovation hub In the bank for international settlements, the international organization of central banks continues to work with a number of CBDC countries research and cross-border pilot projects with increased interest that encourages disorder caused by disorders caused by the disorders caused by the disorders caused by the disorders caused by the disorders caused by the disorders caused by the disorders caused by the disorders caused by the disruption.

William Quigley, cryptocurrency and block for block-founder Vaks.io Blockiin and Stablecoin Tether (USDTT), explains:

“Each country will adopt the tokenization of the financial sector and implement CBDC at a retail and / or wholesale level on its own tempo. It is inopported that in American digitized Fiat currencies, CBDC is often criticized for privacy concerns, potential threats to individual autonomy. But the reality is that it is inevitable that the growth of digital assets and stablecoin’s distance will be unystependent commercial banking institutions and central banks how people are increasingly turned in tokenized alternatives and countries that did not adopt CBDCS. “

In addition to the US, 19 of the G20 Nations Argentina, Australia, Brazil, France, Germany, India, Indonesia, Italy, Saudi Arabia, South Africa, South Korea, Turkie, Plus European Union – develop an advanced CBDC program phase. “The good news for those countries that are not always a market for old paper new and ancient coins,” an ancient dealer for Kovanica Ozgur Honc, the bank’s founder of the Costa Auction House and the Catalog of Queen Elizabeth II Catalog.

https://crypto.news/app/uploads/2025/03/crypto-news-The-United-States-is-unfocused-on-CBDCs-option04.webp

2025-03-09 15:14:00