The Silor strategy leads Bitcoin “Selling” a warning amid a $ 10,000 collapse prediction

Bitcoin swared violently over the past week as Traders are scrambled to apply for a “Crisis Screen” price.

the Bitcoin price decreased To its lowest levels since early November, with Urging the bearers of panic to avoid the threat of mystery.

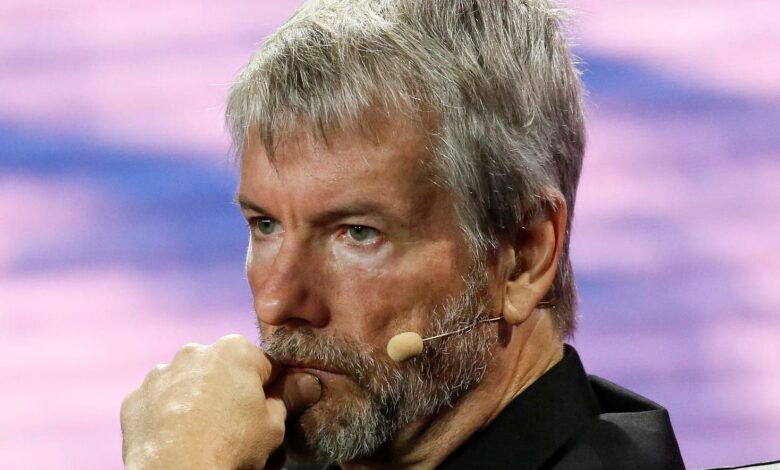

now, While Wall Street giants stare at Bitcoin “” existential “barrel” existential “Michael Silor’s software strategy has warned that she might have to sell some Bitcoin to meet her financial obligations.

Subscribe now for the free time Cryptocodex–A five-minute news message for traders, investors and Crypto-Curious, which will make you update and keep you advanced on Bitcoin and Crypto Market Bull Run

The founder of the strategy, Michael Silor, raised $ 42 billion in bitcoin, and Bitcoin rides … more

“Since Bitcoin constitutes the largest part of the wide assets in our public budget, if we cannot secure stock or debt financing in time, or at favorable conditions, or at all, we may ask the sales to meet our financial obligations, and we may ask these sales at prices lower than cost or not extensively otherwise,” Read.

The strategy said that it expects to record an unrealized loss of $ 6 billion for the first quarter, despite the benefit of the income tax of $ 1.69 billion, and warned that it may not be able to restore profitability in future quarters, especially if the value of bitcoin continues.

The deposit added: “The significant decrease in the market value of our bitcoin pregnant women negatively affects our ability to meet our financial obligations.”

Subscribe now CryptocodexFree daily news message for encryption

Bitcoin price decreased sharply, as it decreased with stock markets.

The strategy share price has almost half since its height to the November summit, which saw its introduction into the prestigious NASDAQ index.

A strategy, which currently possesses approximately 530,000 Bitcoin with a value of $ 42 billion purchased with an average of $ 67,000 per Bitcoin, has feed Bitcoin by selling convertible bonds and shares.

At the end of March, the strategy acquired about $ 8 billion of debt that owes about 35 million dollars annually in interest above about $ 150 million, which it must pay every year in its profits on its shares.

Meanwhile, the encryption analysts are desperately attempts to predict the location of the market after that, as one of the analysts who were closely thrown at the Bitcoin price that will witness Bitcoin’s failure to about $ 10,000.

“Everyone in the long run, as long as it rises,” Bomberg expert in the field of basic commodities, Mike McGlon, wrote in a a report to publish To x.[I] He didn’t know how Bitcoin would get $ 100,000 from $ 10,000 in 2020, but the trends appeared. Now, I see the reversal path again about $ 10,000. “

https://imageio.forbes.com/specials-images/imageserve/62a85e1610a5464e2b6bb580/0x0.jpg?format=jpg&crop=1576,966,×1049,y214,safe&height=900&width=1600&fit=bounds