The Fed’s “biggest nightmare” suddenly became reality as Bitcoin prices soared

Updated 12/18 below. This article was originally published on December 16

Bitcoin suddenly soared higher, surpassing its previous all-time high and rising to over $106,000 as President of the United States. Donald Trump confirms his game-changing plan for Bitcoin.

Earn over $3,000 in NFT, web3, and crypto perks – apply now!

Bitcoin’s price has more than doubled since falling to its lowest levels in August, With the help of Tesla billionaire Elon Musk, which raised the flames of doubt about the future of the US dollar.

now, The leak reveals that Russia may be ready to overtake the United States in Bitcoin reservesThe Federal Reserve warned that the “biggest nightmare” could come true in 2025.

Register now for free Cryptocodex—A daily five-minute newsletter for traders, investors and cryptocurrency enthusiasts that will update you on the latest developments and keep you ahead of the Bitcoin and cryptocurrency bull market.

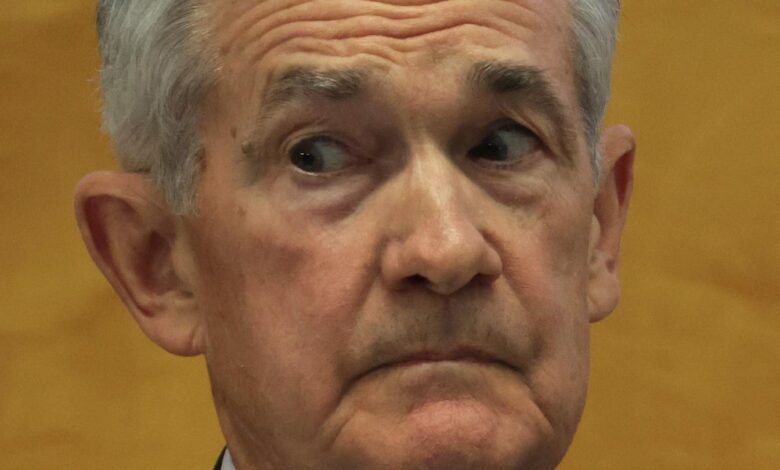

Federal Reserve Chairman Jerome Powell could see the Fed’s “nightmare” scenario unfolding next … [+]

“We believe stagflation will come in 2025, which is the Fed’s biggest nightmare,” analysts at The Kobeissi Letter to publish to X, referring to a combination of economic recession and high inflation.

Al Qubaisi analysts pointed out that A a report From asset management giant Apollo predicting “inflation will rebound in 2025, not decline, to justify the Fed.” [interest rate] Discounts.”

“It is increasingly likely that the Fed will have to raise rates in 2025,” Torsten Slok, chief economist at Apollo, wrote in the report. “Will we see a repeat of the 1970s when the Fed eased policy too quickly, causing… Led to higher inflation in 2025?

Last week, influential billionaire investor Ray Dalio warned of a looming “debt crisis.” This is expected to lead to a sharp decline in the value of the US dollar.

US debt has soared in recent years, topping $34 trillion at the start of 2024, as coronavirus stimulus measures and lockdowns fuel massive government spending and help send inflation out of control in 2022.

Inflation exceeding 10% forced the Federal Reserve to raise interest rates at a historic rate, resulting in higher debt interest payments and Which raises fears of a “death spiral.”

Update 12/18: The Bitcoin and cryptocurrency market is preparing for the Fed to cut interest rates by 0.25% when it concludes the two-day policy meeting, with the market pricing in a 95% chance of a 25 basis point cut.

However, Fed Chairman Jerome Powell’s comments during the subsequent press conference could change the expected interest rate path for next year, with traders urged to remain cautious.

“Investors should remain vigilant, as the Fed’s policy decisions are influenced by multiple factors, including inflation rates and economic resilience,” Haider Rafiq, chief marketing officer at cryptocurrency exchange OKX, said in email comments. “The upcoming meeting may also provide insight into the Fed’s outlook for 2025, which could further influence market dynamics.”

Some fear that lower interest rates combined with higher inflation risk causing “stagflation.”

“If the Fed cuts interest rates as inflation continues to rise, it risks creating a situation of rising prices and slower growth — a combination that could lead to stagflation,” says Chamath Palihapitiya, a technology investor who claims to have bought Bitcoin for the first time in 2011. to publish To

This week, the Fed is widely expected to cut interest rates by a quarter of a percentage point, despite data showing that inflation rose last week, with inflation rising. Bloomberg Survey of Economists find Consensus for three more interest rate cuts in 2025.

However, A Financial Times Survey of economists Found Next year, the Fed will take a more cautious approach to interest rate cuts because of concerns that the Trump administration’s policies, which include sweeping tariffs, carryovers, tax cuts and regulations, could lead to higher inflation.

Register now for Cryptocodex– Free daily newsletter for cryptocurrency fans

The price of Bitcoin rose to an all-time high this year, skyrocketing like the Federal Reserve … [+]

“Inflation has come down more easily than I and most people expected, but I think we may still be seeing that more recently [getting to target] It’s going to be a little more difficult, and it’s certainly an unlikely environment for the Fed to rush into cutting interest rates, said Jonathan Wright, a former Fed economist who now works at Johns Hopkins University. foot.

Expectations of a Federal Reserve rate cut this week have helped push Bitcoin’s price higher, with analysts predicting momentum could help it rise further in the coming weeks.

“Bitcoin’s move to all-time highs, including this morning’s rally above $106,000, confirms the bullish bias,” Alex Kuptsikevich, senior market analyst at FxPro, said in email comments.

“This is especially important after holding steady for three weeks near the $100,000 level. Growth is now likely to accelerate if unexpected news from traditional financial markets does not halt this rally.”

https://imageio.forbes.com/specials-images/imageserve/675fe4285374cbe566aeb869/0x0.jpg?format=jpg&crop=1579,1057,×972,y96,safe&height=900&width=1600&fit=bounds