The Bitcoin Domination Grows as Altcoin Market Fight

Crypto.NEVS was caught in the main principal General of Nasara Achkar to discuss current cryptic air conditioning, Bitcoin’s late passance, current macro tensions and landscape in progress.

Bitcoin (Btc) She broke down below $ 81,000, 10. March, falls 5% in the last 24 hours due to a wide market, while the total crypto market capitalization slid to $ 2.7 trillion as the digital agent investors liquidated virtual currencies.

Nassar Achkar, which represents a Cripto Cripto Cripto, discussed many topics with Cripto.News in the interview, including how $ 100,000 remain a psychological obstacle for bitcoiners and submerging below $ 70,000 is a little probable. Below is the transcript of the interview.

Q – Based on the exchange of activities (quantities, inflows, withdrawals) are the cropto investors who buy this DIP?

A – The current crypto market shows new norms-investors who buy BTC instead of Altcoin. This shift led to a clear separation between bitcoin and a wider AllCoin market.

First of all, following Bibit’s incident, bynance in one week in one week in one week within $ 4 billion. Instead of classic purchase-DIP scenario, this transmission seems to be guided by a sense of risk, with large amounts of capital consolidation in one security exchange.

Meanwhile, Etherum (El) was on the trend down, and Sol faces significant unlocking tokens, encouraging investors to wait for lower entry points. Even as a BTC slightly challenges, the entire market feeling is cautious, and investors decide to hold property, not aggressive investment.

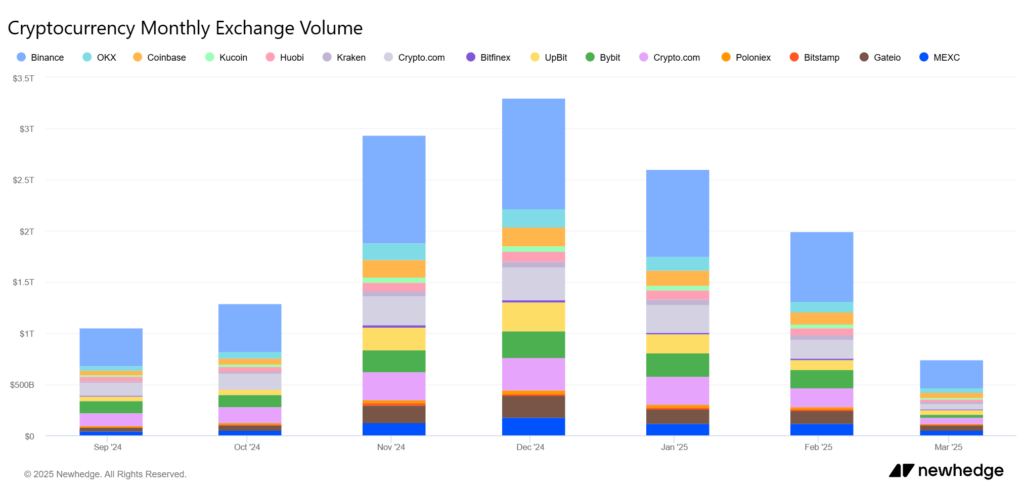

The recent position of Trump PRO-CRIPTO has further strengthened the dominance of bitcoin, drawing more attention and liquidity towards BTC, not in Altcoys while traders await clear signals before they have made significant moves. In fact, in the past three months have seen a stable decline in the total amount of CEK trade, reflecting the predominant insecurity and fear emotions in the market.

K – Bitcoin is 23% down from its Attka. Tom Lee Fondovitrat said we could fall as much as 24% to $ 62,000, maybe this week or march. Does BTC Require Red Book color similar image? Are there strong offers and buy orders around these levels?

A – Predicting price movements is always risky, but the Coinv’s account suggests that the real customer and seller’s point is focused on about $ 100,000, not drop below $ 70,000.

While the BTC was temporarily dipped in the $ 70K range, rejected above $ 90,000, strengthening the belief that it is $ 100,000 and a psychological milestone and a strong level of support in this cycle. Based on current performance on the market, we do not provide for BTC to be significantly below 70K dollars in close time.

Q – Are there indicators to the possible bottom of the market? Are beters in bets for further working hours or accumulating tokens at these levels?

A – Coinv carefully observes Trump’s potential influence on the market. Historical trends indicate that the price of the BTC is very connected to the American movement of stock exchanges and M1 money supplies. Given that American actujes spilled $ 3 trillion in value, it is not surprising that BTC is experiencing price fluctuations.

In addition, the stage recently liquidated its self-supporting property, while ET and Sol face sales continued. Even the funds of joining Trumps like VFLI, who previously invested in Altcoin Portfolio, are currently at a loss.

At this stage, the market remains in the period of insecurity, waiting for key macroeconomic factors such as interest rate adjustments, digital property reserves and ethereum potential resources. Given these circumstances, it is reasonable to remain careful and predicts a further lack of term.

P – Some say we are in a cyclic bottom channel, other arguments of macro factors have depressed prices crypto in the market. Why is Cripto going down?

A – As mentioned above, BTC is increasingly separated from the wider crypto market, and the traditional four-year cycle theory proves inefficient. Instead, BTC’s working action is now closer to the American dollar, capital markets and ETF flows.

If we continue to classify BTC as a crypto tool, then the wider weakness of the crypt market can be attributed to the uncertainty of macro policy. However, when BTC is analyzed separately from Altcoin, a different image will be:

- AltCoin Market, who led Eth, lacking a strong narrative or cupping of swing.

- ZK, Laier-2 and VC tokens do not support the market.

- Solana (Salt) Other alternative chains are very speculative, primarily run Meme coins.

- Liquidity has completely dried after Trump is launching tokens, leaving AltCOINS without a powerful support base.

The combination of external macroeconomic pressures, separation of BTC from Altcoin, high costs ETE and Meme liquidity drainage coins can be a real reason for the current falls falling down crops markets.

https://crypto.news/app/uploads/2024/08/crypto-news-bull-and-bitcoin-option01.webp

2025-03-10 17:46:00