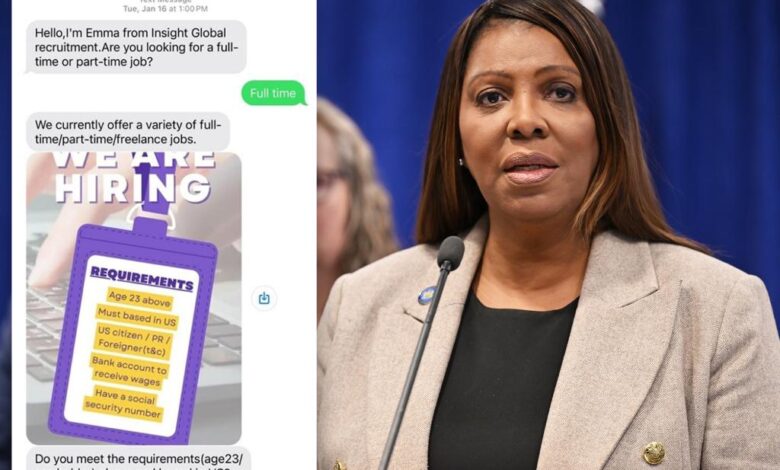

Text scammers attacking bogus job offers steal $2.2 million in cryptocurrencies, NY AG says: ‘A nightmare that never ends’

Text scammers posting fake job offers scammed several people out of $2.2 million in cryptocurrency, New York’s attorney general alleged on Thursday.

The lawsuit filed by Attorney General Letitia James’ office covers seven alleged victims in Queens County and Nassau, as well as two from Virginia and Florida, who each lost between a few thousand dollars to more than $300,000 in the cryptocurrency-based scheme.

“I’m going to die,” one victim said after losing her meager savings in the scam, according to court papers.

Another victim described it as a “never-ending nightmare,” the recording states.

The devious scheme continued for at least half a year between January and June last year, with fraudsters subjecting their prey to the same rules of the game, regardless of where they live, the Attorney General’s Office said.

Scammers start sending unsolicited text messages from fake numbers about great remote job opportunities with high wages and flexible hours.

Victims who responded were told that the carts were asking them to review products online. But they were first asked to open cryptocurrency accounts — or online wallets — and maintain a set balance to cover the value of the branded products they were hired to review.

“Victims were assured that they were not purchasing the products, but maintaining those account balances helped ‘legitimize’ the data they were generating,” the lawsuit said.

Scammers invented phony companies with names like Digistore24, CultureFit Technology, FeraAI, Birdeye, Summit Digital Marketing, Diverse Staffing, Page Zero Media, Work Source Inc. and Sachs Marketing Group to represent fraudulent staffing companies, court documents allege.

“Defrauding New Yorkers looking to work remotely and earn money to support their families is cruel and unacceptable,” said James, who filed the lawsuit in Queens Supreme Court.

“Scammers sent text messages to New Yorkers promising them flexible, well-paying jobs only to trick them into buying cryptocurrencies and then stealing them from them.”

Commissions were promised based on the value of products reviewed via fake websites that set up the operation, and bogus user accounts even showed false earnings.

Eventually, victims receive a congratulatory notification that they will be conducting bulk reviews of expensive items – meaning they will also receive huge commissions.

The lawsuit states that the pressure to review the most valuable products and reach supposed “cash points” pushed victims to their financial limits through credit advances, bank loans and borrowing money from friends and family.

For example, a 39-year-old Queens man, originally from India, used his credit card to buy cryptocurrencies and borrowed “more than $12,000 from friends and family, including people from India,” according to the lawsuit.

The Attorney General’s Office said he lost more than $58,000, but many others lost more than that.

The lawsuit claims a Florida woman who fell into a texting trap deposited more than $300,000 in just 20 days into online wallets.

One Queens teacher, named “Mel” in the lawsuit, lost more than $100,000 over a seven-week period, court documents allege.

When the scammers demanded that he deposit thousands more in cryptocurrency for him to review more products — or in order to withdraw his phony earnings, he eventually ran his personal bank account to a negative balance of $84, according to the lawsuit.

Mel repeatedly told the scammers that he couldn’t offer more, stating that he “couldn’t even pay the rent.”

But he received notice that he needed to complete 10 additional product reviews — requiring him to deposit more than $100,000 in cryptocurrency into his online wallet — before he could withdraw any of his earnings, the lawsuit details.

“After Mel got over the shock, he responded that he was shaking and needed to go to the emergency room because he was about to die,” the lawsuit states.

To maintain his trust, the scammers allegedly told Mel that, fortunately, they were able to negotiate a deal for him and that they only needed $44,000 to pay off his debts.

Desperate to finally withdraw his supposed earnings, the 31-year-old teacher took out a $30,000 bank loan and borrowed money from friends.

In total, Mel lost nearly $120,000 in the scam, James’ office said.

Another Queens resident — a 28-year-old woman from India who goes by “June” as a pseudonym — had her savings of $6,250 wiped out by scammers.

After transferring the last of her money, plus a cash advance from her credit card, June begged her scammer, named Alexander, to let her withdraw her supposed winnings.

Instead, he asked her for another $12,000.

“John knew she could not meet this amount and immediately told Alexander I was going to die,” the lawsuit states.

“The defendants’ theft of all the little money June had was the only reason she was not defrauded further,” the lawsuit alleges.

The investigation — a joint effort between James’ office, the Queens District Attorney and the U.S. Secret Service — identified several cryptocurrency wallets controlled by scammers with stolen funds amounting to approximately $2.2 million.

Those accounts have been frozen, and the lawsuit seeks a court order to collect and return the stolen funds, as well as penalties and permanent suspension for scammers who send unsolicited text messages in New York.

Since only cryptocurrency wallets have been identified, these anonymous owners will be served in a new way, the prosecutor’s office said, by depositing a non-fungible token (NFT) into their wallets, and linking them to the pleadings.

James said any New Yorkers who believe they may have been involved in a text message scam should contact her office to file a complaint.

https://nypost.com/wp-content/uploads/sites/2/2025/01/96458050.jpg?quality=75&strip=all&w=1024

2025-01-10 01:13:00