Bitcoin ETFS Jump, but the inflow hit 2025 low

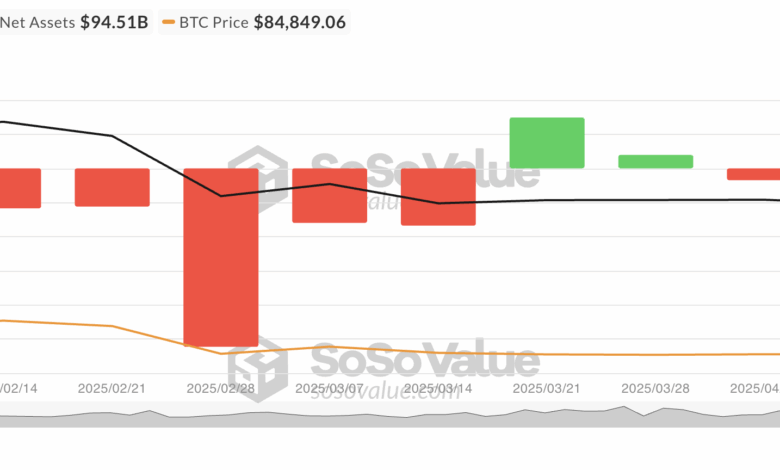

The Means for Exchanging Bitcoin (ETFS) recorded a modest net inflow of $ 15 million last week, marking a significant reversal with sharp outflows of the previous week exceeding $ 713 million.

However, despite the positive change in capital flow, last week’s figure represents the lowest weekly net inflow recorded since the beginning of 2025.

Doljev for Bitcoin ETF falls on 2025 low

Last week, between 14. April and 17. April, institutional investors added capital to BTC Spot ETFS, bringing a net inflow in these products to 15.85 million dollars.

Bitcoin Spot ETF Net inflow. Source: Sosovala

Despite the positive movement, this latest Fund inflow represents the smallest net inflow for BTC ETFS since the beginning of the year, further confirmation of slowing down in Bullish feelings.

Slowing down in the midst of escalating global trade tensions, which introduced fresh insecurity on financial markets. As the main economies make trade policies and retaliation are mounted, institutional feelings became more careful, making them adopt access waiting and seeing, while they are transferred their capital.

BTC is pushed more but merchants go out of position

BTC trades from $ 87.64 at times of pressure, getting 3% worth in the last 24 hours. However, the ropes Futures open interest fell by 2%.

BTC Futures Open Interest. Source: Koinglass

The open interest of property refers to the total number of outstanding futures or contract options not placed or closed. When it falls during the costs of price, it suggests that traders close their positions, not to open new ones, indicating a lack of strong conviction for the price rates.

This feeling extends to the Coin’s options market, how it is reflected in today’s high search for putting the contract.

BTC Options Open Interest. Source: Deribit

When there are more placement than such calls, indicates a bear market feeling, because traders position them for the potential side or search for pricing reduction.

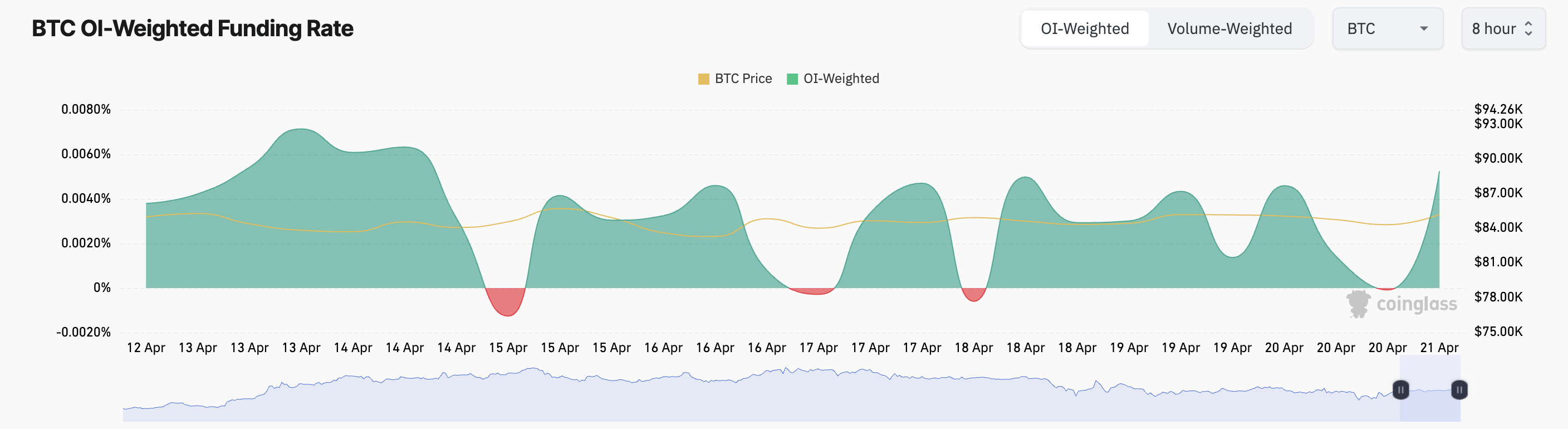

Although this is combined with a BTC open interest, it indicates a market that still gazes carefully in the middle of a wider insecurity, a positive financial financing rate offers a break. At the time of pressure, according to the coigiglass, this stands at 0.0052%.

BTC financing speed. Source: Koinglass

When the funding rate is positive like this, long traders pay shorts, indicating that the bulls are dominated and demand for long positions higher.

They suggest that, despite a careful tone in the derivatives and streams of ETF, some traders remain confident and predict further upside down.

(Tagstotranslate) bitcoin

2025-04-21 11:17:00