Twice the bottom formation in the game

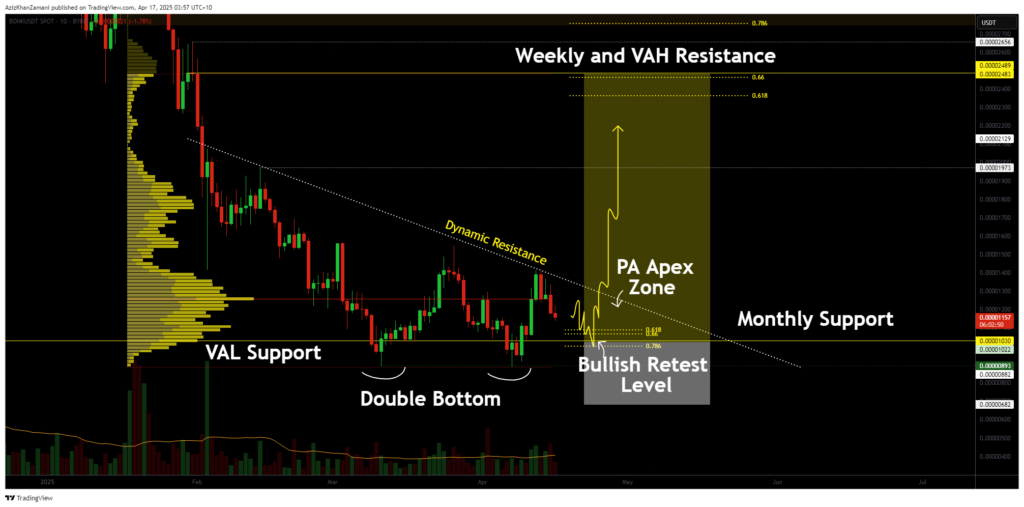

Bonk is traded at a time frame support support level while displaying potential rotation of trend. The double bottom forms develops, and the interruption above dynamic resistance could confirm the change in the market structure, setting the stage for the bully.

After the extended bear, which is marked with successive lower high and lower lower letters, BONK (Stifle) now traded by a key decision-making point. Asset has respected a significant level of support twice, forming what can be developed in double lower formations. However, the certificate is still ongoing and depends on the next few weeks of price action. The market now expects piercing from the Zones of the APEX, where resistance and support are firmly converted.

Covered key points

- Bonx printed a potentially twice the bottom of the formation after the bear

- The current support level held twice to dollars, indicating potential strength

- Confirmed through the premises through the dynamic resistance would signal the bikovska shift

The price of the price has repeatedly tested low support value, resulting in two significant bouncing. This created the potential for the double below form, which is often considered a classic reverse signal. However, without Igarian higher low and piercings, the pattern remains unconfirmed.

Currently, the price is compressed into the APEX zone, a point in which monthly support and dynamic resistance is converted. This price for tightening prices often precedes the main interference. For Bonk, a pause above the dynamic resistance line would mark the structural shift from the bear in Bullish to the daily time frame. This would confirm double the bottom and suggests that it is a potentially almost trend.

In order to break the validity, the volume certificate is crucial. A powerful move through resistance, supported by increased volume, will probably lead to pressure towards weekly resistance and high levels of value. While this does not happen, traders should look after further consolidation within the Apex Zone.

What to expect in the upcoming price of the store

In the short term, expect BONK to continue in the range within the Apex Zone. Daily higher low formation near monthly support could signal the early power. If the price is terminated above dynamic resistance with strong volume, this can start violence according to the weekly region of resistance. On the teasing side, the interruption below support would not reverse the current structure and probably lead to lower pricing goals.

https://crypto.news/app/uploads/2024/09/crypto-news-BONK-exchange-traded-product-option03.webp

2025-04-16 21:13:00