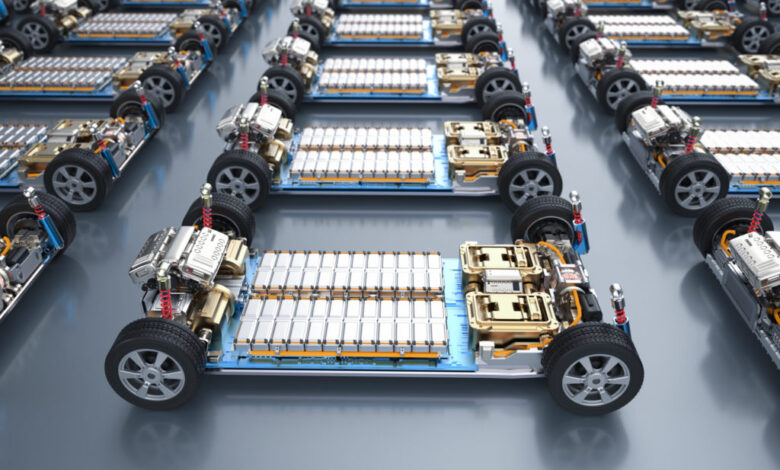

Supply-demand imbalance looms for critical battery raw materials by 2030: McKinsey

The consultancy says such a forecast means the industry is “likely to face persistent, long-term challenges” in line with demand.

In particular, its reports highlight that automotive OEMs are paying more attention to reducing Scope 3 emissions from the use of materials, which contribute a significant portion of battery emissions. As a result, sourcing of battery materials has become more important for battery producers.

Based on the latest estimates, McKinsey’s analysis expects demand to exceed basic supply for some items, requiring additional investments and leading to fear of shortages and price volatility, among other challenges.

Supply shortages loom

Based on current market observations, battery manufacturers can expect challenges in securing supply of many essential battery raw materials by 2030, the McKinsey report said.

Battery makers use more than 80% of the total lithium mined today, and that share could grow to 95% by 2030. As technological advances shift in favor of heavy-duty lithium batteries, lithium mining will need to increase significantly to meet demand in 2030, he says. Mackenzie.

For nickel, fears of shortages caused by the shift to battery electric vehicles have already led to significant investment in new mines, especially in Southeast Asia, but more supply needs to be brought online. The McKinsey report suggests a slight shortage is likely in 2030 as the battery sector continues to compete with steel and other sectors for grade 1 nickel.

While the share of cobalt in the battery chemistry mix is expected to decline, absolute demand for cobalt for all applications could rise by 7.5% annually from 2023 and 2030, McKinsey estimates, adding that cobalt shortages are unlikely, but its supply will be low. Driven by nickel and copper since it is largely a byproduct of their production.

Meanwhile, the supply of manganese is expected to grow moderately through 2030, but growing demand for the material used in batteries will likely outstrip supply, requiring the development of new refineries.

To account for the rapid adoption of LFP (lithium iron phosphate) technology, the McKinsey study models the 2030 supply and demand balance under two scenarios.

Under the base case, only about 20% of HPMSM (high purity manganese sulphate) supplies will meet requirements for battery applications (30% if all announced projects are implemented), which in itself will represent only about 5% of total manganese demand.

In a world where rapid adoption of LFP technology is coupled with declining growth in electric vehicle production, demand for battery materials may look different:

Global trends

Although overall demand for batteries and raw materials is growing rapidly, supply is – and will remain – largely concentrated in a few countries with natural resources, including Indonesia for nickel; Argentina, Bolivia and Chile for lithium; McKinsey says the Democratic Republic of the Congo for cobalt.

Meanwhile, the refining process usually takes place elsewhere, often in China (for cobalt and lithium), Indonesia (nickel), and Brazil (niobium).

According to McKinsey, setting up this value chain imposes additional considerations for regions such as the European Union and the United States, both of which have a high demand for imported materials and often rely heavily on single-country sourcing.

For example, the European Union imports 68% of its cobalt needs from the Democratic Republic of the Congo, 24% of its nickel from Canada, and 79% of its refined lithium from Chile.

Supply chain transparency

Furthermore, although it is possible to know the supply concentration of materials such as refined nickel, cobalt and lithium, complete visibility into the origin of the raw materials is sometimes not possible.

This is the case for high-purity manganese, more than 95% of which is produced in China, with small quantities coming from Belgium and Japan; graphite, which is almost entirely refined in China; and anode production, which is almost monopolized by China.

Limited transparency in the sources of supply of battery raw materials also raises broader ESG concerns and concerns. For example, the EU Battery Regulation aims to make batteries sustainable throughout their entire life cycle, from material sourcing to battery collection, recycling and reuse. As a result, McKinsey believes that pressure to address ESG concerns is likely to increase going forward.

Recent supply chain disruptions, such as those affecting magnesium, silicon and semiconductors from 2021 to 2023, have increased buyer needs to enhance supply chain resilience for critical battery raw materials.

The risks of buyers’ import dependence are further heightened by recent trade restrictions imposed by exporters, including Chinese export controls on certain materials (such as synthetic graphite and natural graphite products used in battery electric vehicles) and Indonesia’s ban on nickel ore exports.

https://www.mining.com/wp-content/uploads/2024/12/AdobeStock_547322417-scaled-1-1024×682.jpeg