Stocks mixed as merchants predict the reduction of rates in June

Markets do not expect a lot from the Federal Reserve meeting this week, but good news can be on the horizon for June.

The action indices on Monday saw mixed performance, because traders were expecting the announcement of the Federal Reserve. Dow Jones traded in 41,414, increasing 96.64 points or 0.23%. Meanwhile, the S & P 500 slipped 12.9 points or 0.23% to 5,633, and NASDADAA reduced 54.21 points or 0.30% to 17,923.

According to LPL financial economists Jeffrey Roach, Fed can use this week of meeting to prepare investors for Incoming reduction. The combination of inflation data and data statistics, according to Roach, suggests to reduce the foot reduction for June, October and December.

Inflation remains stable, but the reduction of rates are probably cut

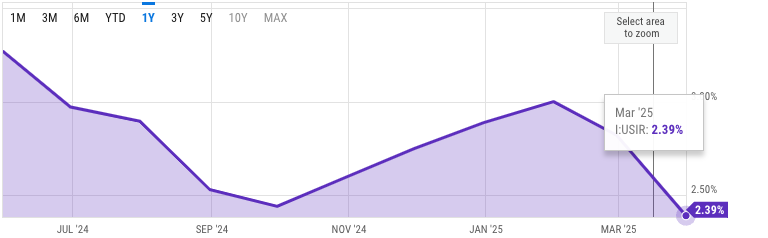

Although inflation is still held above the Feds of 2%, Currently at 2.39%It saw two consecutive months of the fall. The main reason for cooling inflation is likely to be demand from discharge due to inflation risks. This is despite the fears that American tariffs will, especially in China, begging the effects of consumer prices.

Good news about the front of inflation is that the OPEC + announced that it will raise it Exit for 411,000 From 1. June. The news contributed to a sharp decline in oil prices, which were soon stabilized. Oil prices are the main contribution to inflation, and their falls will have positive effects on consumer prices.

In trade politics, markets have set up new Donald Trump plans to impose 100% Tariff on layered movies. On Monday, 5. Maja, the president has accused foreign countries to offer stimulating stimulates from the United States and called it a “threat of national security”.

One of the biggest losers today was a multinational conglomerate, Berkshire Hathavai. His stock fell 4.33% on the news to make her founder, Warren Buffett, would Retire as Executive DirectorWhile you still remain president of the company.

https://crypto.news/app/uploads/2024/05/crypto-news-crypto-related-stocks-option01.webp

2025-05-05 21:24:00