StockmktNewz news achieved one billion views: major visions of encryption traders | Flash news details

From the perspective of trading, the increase in the sharing of the stock market content in coming opportunities in the encryption markets can indicate, especially for the symbols that are exposed to institutional interests or risk assets. For example, BTC/USD on Binance witnessed a 24 -hour trading volume of $ 1.8 billion as of 12:00 pm UTC on May 7, 2025, which reflects a fixed benefit in the tinnitus of the stock market. Likewise, ETH/USD recorded a volume of $ 750 million in the same time frame, for all Binance data. The relationship between the morale of the stock market and the coding price procedures remains clear, as the days of news of the positive stock market are often witnessing an increase in flows to encryption. Merchants should monitor pairs such as BTC/USDT and ETH/USDT to obtain hacking opportunities if S&P 500 maintains gains more than 5,200 points, which is a major resistance level observed in recent market reports. In addition, coding stocks such as Coinbase (Coin) and Microstrategy (MSTR) can be seen increasingly active; The coin was traded at 215.30 dollars, an increase of 2.1 % at 11:00 am UTA on May 7, 2025, according to Yahoo’s financing data. This indicates that the institutional funds may revolve to the destroyed encrypted stocks, and may have predicted the bullish momentum of the Bitcoin if the flows continue. Retail feelings, which are amplified by influencers such as StockmktNewz, can increase the consumption of short -term pumps in Altcoins such as Solana (SOL), which was traded at $ 145.20, an increase of 1.5 % at 1:00 pm UTC, based on CoinMarketcap numbers.

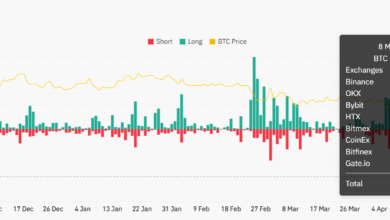

Dive into technical indicators, the Bitcoin (RSI) relative index (RSI) reached 55 on the daily chart as of 2:00 pm UTC on May 7, 2025, indicating a neutral momentum with an upscale space, according to TradingView data. RSI of Ethereum was slightly lower at 52, indicating similar capabilities to achieve gains if the stock market was optimistic. The scales on the series support this view; Active Bitcoin has increased by 3.2 % to 620,000 over the past 24 hours as of 3:00 pm UTC, for all Glassnode data, which reflects the growing network activity that may be linked to the retail interest that the stock market sharing. BTC trading volume on major exchanges such as Coinbase increased by 4.5 % to $ 450 million in the same period, indicating accumulation. Meanwhile, the correlation coefficient between Bitcoin and S&P 500 remains at 0.68, based on the last 30 days of Coinmetrics, highlighting a strong positive relationship. For traders, the main levels that must be monitored include Bitcoin resistance at $ 63,000 and supported by $ 61,000, with a higher break from the possibility of confirming the upcoming continuity of Workwinds Tailwinds.

The interaction between stock markets and encryption markets is emphasized through institutional behavior. As of May 7, 2025, Bitcoin ETF flows reached $ 120 million for today by 4:00 pm UTC, according to Farside Investors, indicating that traditional financial players benefit from the morale of the positive stock market to increase exposure to encryption. Institutional capital flow often exaggerates the price movements in Bitcoin and Ethereum, creating opportunities for swinging trading on pairs such as BTC/USD. On the contrary, the sudden shift in risk in stocks can lead to external flows, which presses encryption prices; Traders must set the main support levels to reduce the risk of the negative side. The increasing effect of the stock market news, as it is clear from StockmktNewz, is a reminder of the interconnected nature of these markets, and urged traders to adopt a cross asset strategy to achieve optimal results.

Instructions:

What is the current relationship between Bitcoin and S&P 500?

The correlation between Bitcoin and S&P 500 currently is 0.68 based on 30 -day data starting from May 7, 2025, indicating a strong positive relationship as the stock market gains are clinging to increased bitcoin prices.

How can the securities market news affect the trading of encrypted currency?

Securities market news, especially when they are amplified by influencers who have large followers such as StockmktNewz, can pay retail morale and capital flows to encryption. Positive stock market updates are often associated with risk behavior, which enhances encryption prices as shown with Bitcoin’s rise by 1.2 % to $ 62300 on May 7, 2025, along with S&P 500 RISING 0.5 %.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg