Standard purchase of $ 765 million and the ongoing legal issue

The company’s strategy, previously known as Microstrategy, while the legal action is underway, has taken another bold step on its driving in the world of bulls of encrypted currencies.

Last week, The company is led Michael Sailor I announced a purchase 7,390 Bitcoin For approximately total value 764.9 million dollarsWith average price less than just 103,500 dollars per unit.

The process was announced through an official document submitted on May 19 to the Securities and Stock Exchange Committee (SEC) in the United States.

However, as expected, while the strategy enhances its location as the owner of the main company for Bitcoin, it is simultaneous Collective lawsuit.

The lawsuit, which was filed at the United States Court of the Eastern Region in Virginia, accuses the company’s executives of providing misleading information about the profitability of the investment strategy in Bitcoin.

Moreover, the accusation is also not to connect the risks related to Extreme volatility.

Buying new MAXI for BTC by the strategy while the legal procedure is launched

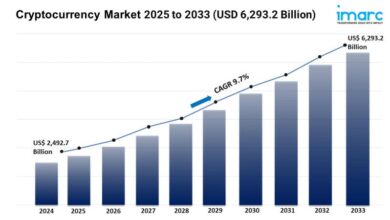

Despite the legal differences, the numbers are clear: as of May 18, the strategy was held 576,230 BTCIt was purchased in total for about 40.18 billion dollarsWith average price 69,726 dollars per currency.

In the current market values, these holdings are worth the end 59.2 billion dollarsGetting Unintended profit of 47 %It equals 19.2 billion dollars.

The general performance of the company’s Bitcoin strategy is 16.3 %As a result of the long -term vision of Michael Sailor and his team, despite judicial disturbances.

The legal case includes direct managers of the company: Michael Sailor, CEO, Fung LuPresident and CEO, and Andrew KangExecutive Vice President and Financial Director.

According to the accusation, the executives claimed several provisions of Securities exchange law 1934In Special Sections 10 (B) and 20 (A), in addition to 10B-5 rule.

The legal document argues that their executives I am wrong or misleading data Regarding the expected profitability of the Bitcoin investment strategy and it was not revealed transparently Risks associated with volatility Subordinate Current currency.

These are serious accusations that can have great repercussions on the company’s reputation and future operations of the company.

The acquisition of the strategy comes at a particular time Coded market. according to Coinmarketcap Data, bitcoin price at the time of writing this report is there 102,615 dollarsWith an increase 20.3 % last month.

This positive trend undoubtedly contributed to enhancing the company’s confidence in the accumulation strategy.

A model that inspires other companies

The vision of the strategy was not isolated. More and more companies depend on a Treasury strategy in BitcoinInspired by the success of the American company.

It is a recent example that the manufacturer of luxury watches be SupremacyAnd that witnessed her shares more than that 60 % in pre -market trade After announcing the intention to collect bitcoin and change its name to Asiastrategy.

Asiastrategy has announced cooperation with Sora Ventures To implement the new strategy. Sora Ventures had already worked with metaplanet In 2024 to create the first Bitcoin wardrobe in Japan.

Today, metaplanet holds Bitcoin more than Salvador It itself, the first country in the world adopted bitcoin as a legal tendency. Even in the Middle East, there are signs of attention.

A public trade company based in BahrainWith the marketing of the market 24.2 million dollarsHe recently adopted a similar strategy in cooperation with the investment company 10x capital.

The current context places a strategy in a complex position but is likely to be useful. On the one hand, the company continues to enhance its leadership in the cryptocurrency sector, with a strategy that has already produced Big returns.

On the other hand, Legal accusations It can undermine the investor confidence and attract attention Organizational authorities.

However, it is possible that the impact of the lawsuit will be determined by the company’s ability to show The transparency of its connections and Stiffness of its financial strategy.

In a constantly developed market like the encrypted currency market, the investor’s confidence is designed not only on the numbers but also on Credibility and integrity One of the corporate leaders.

Conclusions: between risks and opportunities

The purchase of 7,390 Bitcoin by the strategy is an additional confirmation Long -term vision In the future of encrypted currencies.

Despite the legal challenges, the company is still a reference point for companies that want to integrate bitcoin into their treasury strategies.

The adoption of similar models by other companies, in Asia as well as in the Middle East, indicates that Bitcoin Ministry of Treasury It can become increasingly widespread.

It remains to see whether the strategy will be able to overcome the legal difficulties and unify its role as A pioneer in the world of financial encryption. But there is one certain thing: with more than 576000 BTC in its wallet, the risks are higher than ever.

https://en.cryptonomist.ch/wp-content/uploads/2025/05/strategy.jpg