Solana price drops 50% of AT at-while Memecoin trading slows down

The Solana withdrew more than 50% of its all $ 295 in January, which probably launched a decrease in Mema trading activity.

Solana (Salt) He had the worst monthly performance of FTX collapse in November 2022. years, falls 38% in the last 30 days. Reducing Memecoin Trading Activities, which previously contributed to the massive scope on the Solana chain, was the main factor.

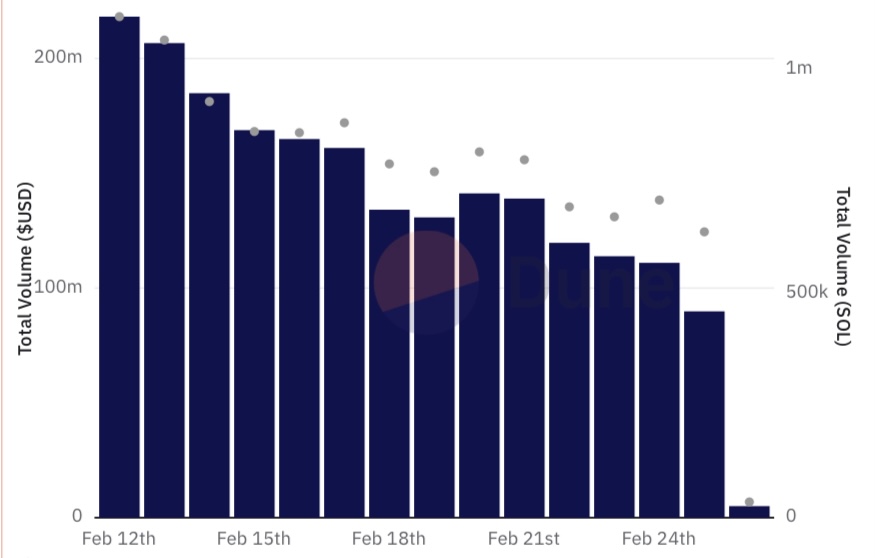

From 26. February, a cloak of 8.1 million tokens was installed on pumps.Fun, Solan Memecoin Trading Platform. The platform was then created by $ 577 million fees. 12. February, the daily Volume for Trade Pump.Fun reached the peak on a monthly level of $ 218 million. But the momentum seems to slow down.

Data from the Dune Analytics commandboard It shows that the scope of trading decreased 94% in one day, of $ 89.5 million, February 26 at only $ 5.03 million. February. Most tokens are from 80-90% of their peaks, reflecting the decline in a larger memecual market.

Solan decentralized financial ecosystem saw significant outflows as a result of this crisis. Toward DefilesSolanav TVL fell from $ 12 billion in early mid-January to $ 7.13 billion, he lost $ 5 billion in less than a month.

In the last 30 days, Raidium, a decentralized exchanges that pumps.fun-graduated memecoins saw 50% TVL crash. The capital also moves to other networks as Solana Vanes activity. In the past 30 days, more than $ 500 million was bridged in Etherum (El), Arbitrum (Bow) and sound (Sonic)

SOL is currently trading from $ 142, the lozenge is 15% in the last 7 days. The bulls are struggling To establish a level of support, with $ 140 acting as a key threshold. If the SOL does not hold above this level, the following great support lies between 125 and $ 130. The distribution below this range could press salt to the lowest price of 2024. Years.

The salt should return a $ 150 brand and testifies to revival in TVL and a wheelchair on the chain to continue its momentum. Until then, there is still a strong potential for more paids, which increases uncertainty.

Upcoming 11.2 million tokens unlock 1. Marta could put pressure on salt. In addition, there is a small chance soon that the ETF Solana is approved, which reduces the probability that the institutional trigger occurs.

https://crypto.news/app/uploads/2024/12/crypto-news-Solana-protocol-option01.webp

2025-02-26 08:09:00