(Bloomberg) – The mat is pulled. Sniping. Trading “Kabalovi”. The world’s world’s world on Solana BlocCchain is full of dangers for those who are not familiar with mahinations that cause token prices to rise abruptly and then collide.

Most reading from Bloomberg

While Memecoin Crazas focused on the Upstart network during its beginning two years ago, including Donald and Melania Miley, as well as Argentine President Javier Miley who controlled a major slice of participants who control the large slice of the current corner cryptocurrent corner. It made the sector as an insider on the market of many in the industry, and those who are in the knowledge that provide the earliest stores and retail investors often bears the burden of losses.

The first Memecoys were issued only a few years after the birth of cryptocurries such as Bitcoin, with developers who were engaged in the popular Internet meme as a joke. Breakout Memecoin on Solana was Bonk Ina, created after the failure of FTX Exchange. It was an immediate hit at the end of 2023. year, as speculators tried to turn rapid profit about essentially useless, but the popular token that was on the clouds, because Pad Fried Fried Fried Fried fried over the crypt.

When launching Memecoin, today, the chances are that it will be on Solana Blockia, which was to be faster and cheaper than a revolutionary Etherum network. In reality, Solana became a preferred choice for the priests, for blocking the participants behind the crippling, launching it, which saw it repeated that repeats it repeated this recurrence of earlier CRIPTO cycles.

“Launch Memecoin is promoted as an antithesis” Municipal “coins where the VC insiders can invest in 100 times lower values and retail sale,” Jordi Aleksandar, founder of the capital Seline-Aset for Tokens, “,” said. “In the truth, Memecoin often runs as many – if not more – insider benefits.”

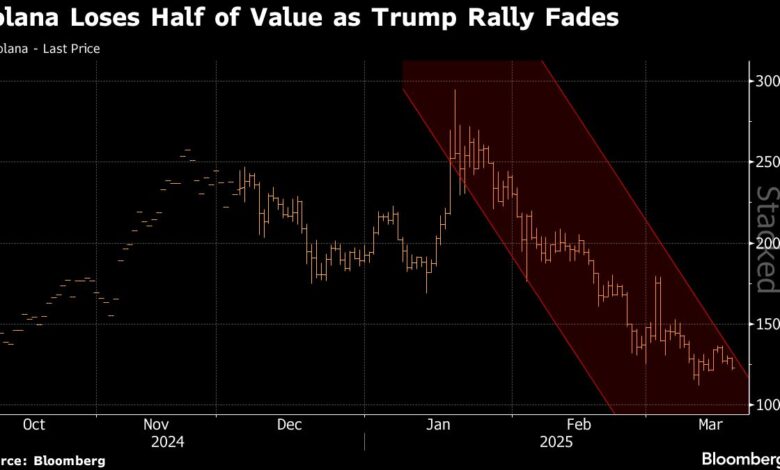

The risks to those who enter late can be easily seen in Memecoin’s market. Trump Memecoin jumped at almost $ 74 a day before his inauguration and has since shed about 85% of its value, in line with CoinMarketCAP prices. The melani token is about 95% in the amount of high. In the midst of all high losses, Solana Blocchain’s parent sales salt lost more than half of its value since mid-January.

The most visible participants in Memecoin are those called key leaders of opinions or circuits, who are often social influences with great monitoring on platforms like X. They are crucial to obtain recognition due to the sea at hundreds of memos that launches every day after the platforms are like a pump.

Collects often invest in tokens in deep discounts before starting a project in exchange for the promotion of their followers. While memecoins are often claimed to accept the model “fair launch” – where all the tokens are available to the public at the same time – it is rarely case, according to Mohamed Ezeldin, the Head of Tokenomy in Animoca Brands.

‘Pump and landfill’

Barstool sports founder Dave Portnoy, recently accepted Memo’s trading, said in X Space. February that he was called to support the launch of the scales, which included an interview with Miley. Portnoy said he was offered money coins before launch in exchange for his support, but he said he did not take any coins. The portnoy did not answer the comment request.

Remove often associated with creators through what Cripto Traders call “Kabbalah”, which are groups that are specialized to start memo. In this category Haiden Davis’ Kelsier, responsible for launching the scales, belongs to this category. These groups are often deeply involved in creating and allegedly manipulate the prices of different memes for exploitation of retail investors, according to Joseph Edwards, the Head of Research in Enigma of Securities in London.

“There were various market manufacturers who worked similar things 2021. years – dark liquidity of the pool,” Edwards said. “They would help to get toke tokens launch and that would be pump and landfills every time.”

A few apartments knew that Davisa was long until he discovered his participation in the scales during the interview with Youtube known as CafeSilla. He also claimed to be involved in Melania and Enron Memecoins. Other cabals such as phantom troupes and La Vape Cabal are mostly pseudonimons. Davis did not answer the comment request.

One of the techniques used by Kabbalah is called Sniping, which refers to bots trading for the token during launch, and then quickly sell them to sell them normally short-term winners. The sniper gained nootorodiousness during the launch of Trump Memecoin, when certain digital banknotes have gained tokens in negligible costs before they soon leave them after starting, causing the price to fall. One wallet, which has gained Memecoin in the launch, only a few hours before Trump announced his debut to the truth Social, Bloomberg reported Bloomberg before.

In the leakable sound of conversation between motives, co-founder of the CRIPTO project defiot and Ben Chow, a decentralized exchange of Solana-based meteors, said he saw Davis and his family and his Sniping Enron family. He said bloomberg that the sound was real. Chow did not answer the comment requests.

While pumping.fun The most popular boot platform and memory, the meteor has increased in change. Trump, Melania and Libra are all launched through the meteor. The meteora is part of Jupiter, a wider Solana ecosystem that aggregates of the token trading. The Jupiter also owns Moonhot, an application that allows users to buy and sell memecoins through credit cards or Apple salary. Shortly after the scales, Meteora was Chow, who said the sound of the sound that he connected Kelsier’s share with that Melania Token, deviated.

“With the growth of platforms such as pumps.fun, what is really allowed to increase those who are focused only on ROI and are not focused on bases or communal services,” the brands of Animoca Ezeldin, referred to the return of investment. “They are just focused on ‘How can I come in as early as possible and how can I go out as close as the top?” In doing so, we created a zero sum game. “

‘Fearing fell’

Still, the controversy seems to nurture the look for memecoins. At the end of February, American securities and commission staff said Memecoins are not considered securities. The SEC staff compared Memecoine to collectibles, noting that they have limited or not used or often accompanied by statements about their risks and lack of usefulness. As a result, people who offer and sell Memecoin do not need to register with the Agency, and customers are not protected by federal securities laws.

“The message is loud and clear from the regulator,” said CEOs for investing in ARK Cathie Wood at the interview of Bloomberg television. “There will be some fears decreases in the prices of some of these means of memories. And, you know, there is nothing like the loss of money to learn.”

– With the help of Emily Nicolle and Olga Kharif.

Most read from Bloomberg Businessweek

© 2025 Bloomberg LP

(Tagstotranslate) Melania Trump (T) Solana BlocCchain (T) Javier Miley (T) Participants in the market (T) Dave Portnoos (T) Bloomberg (T) Launch

https://media.zenfs.com/en/bloomberg_markets_842/186b44cba994c65fe4173576a222415b

2025-03-22 16:30:00