Coins flashes warning that crypto winter came early this year – DL News

Ramp

- Bitcoin is about 20% since then the Trump Inauguration.

- Coinbase warns that this can be a sign of bear market.

The version of this story appeared in our Roundup Bulletin 18. April. Apply Here is.

Hi! Eric Here is.

The North Hemisphere may enjoy the first signs of spring, but the waite warns that the cold crypto winter may already be on us.

In the research note this week, David Duong, a global research chief of CRIPTO Exchange, a warning set that a bear market He has his claws firmly around crypto – and will keep his prince for the foreseeable future.

Most metric points in that direction. Bitcoin fell about 20% since January record, and its average price in the last 200 days fell.

While investing investment investments picked up In the first quarter of 2025. The trend is about 50% below the level in the cycle 2021. until 2022. year, Duong said.

That was not assumed to be like this.

Return to the old days of November, Donald Trump was elected to be 47. American President. He ran into the pro-cripto platform and his campaign was instead of encouraging $ 200 million In donations with crypto lobby to influence the vote.

As his January inauguration approached, crypto lobby was expected to cash promises Trump made on a campaign trail, asking the stage for a new bull ride.

Exactly, Trump delivered some of these promises.

Released Ross UlbrichtThe convicted owner of the silk road, moved to launch a Strategic Bitcoin Reserveand he finished bidin administration Cripto crackdown with the smear of executive orders and Key meetings.

However, the White House also assured global financial markets with an aggressive tariff regime and increased Chances for recessionTell analysts.

Risk assets such as technical actions and cryptocurrencies felt the burden of these tariffs.

The difficult-difficult NASDAK 100 index is about 16% of its January, and the crypto market has lost almost 28%, or $ 1 trial, overall in the same period.

Things look grim.

For Dug’s role, he warns traders to take the “defensive attitude” in the next few months.

Silver lining? Also expects things to be improved in the third quarter.

Maybe.

We’ll see.

Andrew Flanagan and Edward Robinson Dig in IPO Filfing in Galaxy Digital To find out why Seven-Yearly CRIPTO Company with 520 employees said it has higher income from Netflix, Visa and Starbucks. Alert Spoiler: It’s not. Not really.

The largest altcoin in the world is in a few functions despite what it has determined some of its key problems. Liam Kelly He finds out why.

Investors of the bank on federal reserves of interest rates before the end of June, and this could be a boon for Bitcoin, Kyle Baird Reports.

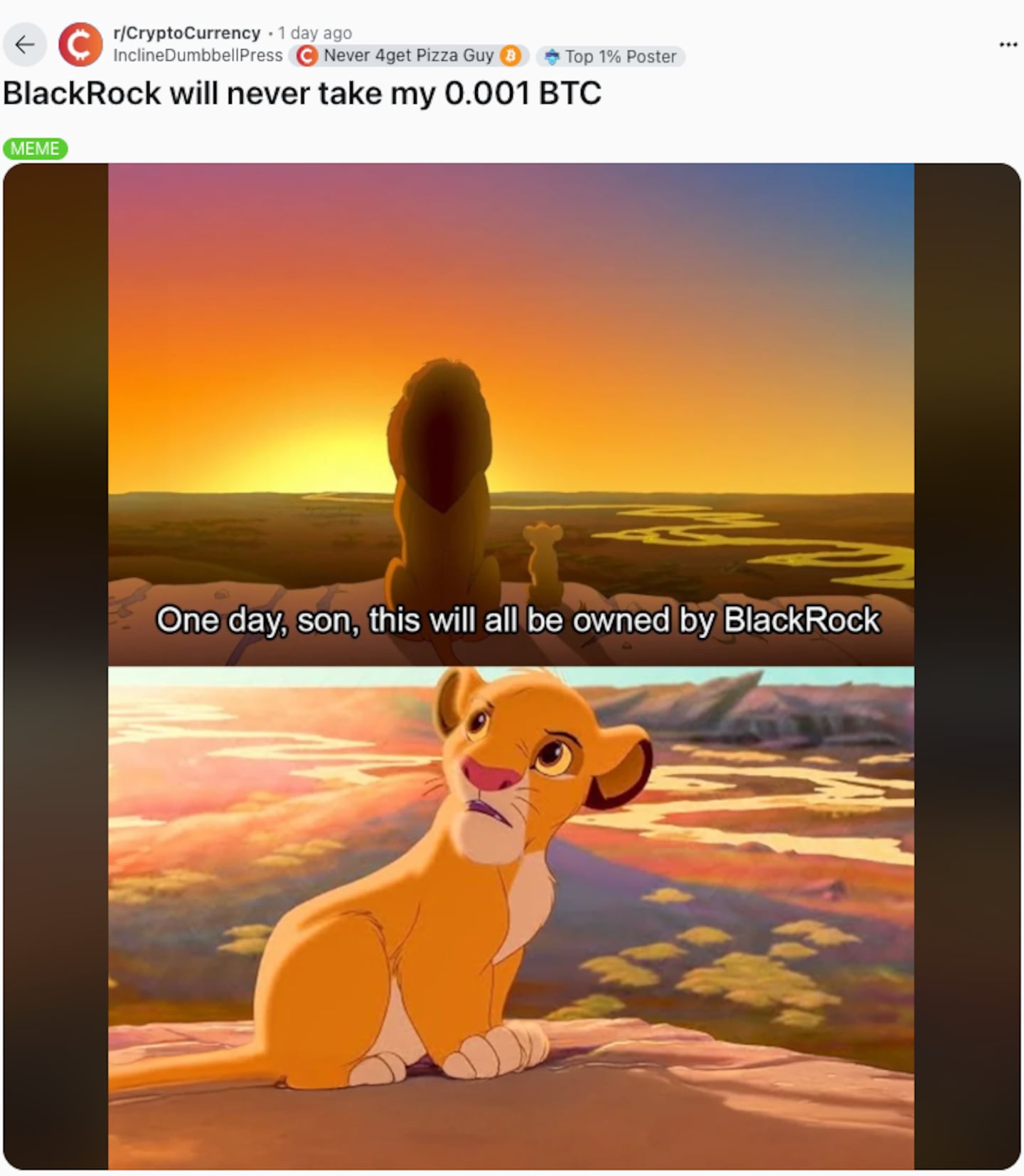

Post of the week

Investment Div Balkrock has sucked up 48 billion dollars In Bitcoin from starting his place to exchange places for Bitcoin’s place last year, which makes it one of the largest digital property holders in the world.

(tagstotranslate) bitcoin

https://www.dlnews.com/resizer/v2/RDDI7SBMWNECLFOWLVLCSHHRKA.jpg?smart=true&auth=a7d94aa183795c3ef4cd5faf17c0324ca619f8ec8b54a4924117ee9d8ee514f1&width=1200&height=630

2025-04-18 17:50:00