Robinhood & Kalshi Debit Sports Market Forecast for Faculty Basketball

Robinhood and Kalshi launched the forecasting market for men’s and women’s basketball tournaments, allowing users to trade agreements on events on the results of the Games.

Slave It seems to top up the foot fingers further in the prediction markets, associating with kalshim to allow users to trade with basketball matches of college. Instead of just filling the carrier, fans can now buy and sell business agreements, and prices fluctuate in cents based on the way market shows the chances of each team.

In a Blog announcement On Monday, 17. Marta, Robinhood says that in launching the so-called predictions market will trade contracts for what will be in May the upper limit of the target funds in May, as well as forthcoming men’s and women’s basketball tournaments. “

“You can now trade on the outcome of each match in basketball and women’s basketball tournaments, including the final championship,” Menlo Park-Heedrhered announced on a dedicated website. Users who have contracts on conquering in the settlement will receive 1 USD payment under the contract, and the loss of contract will not be worth anything.

How does the Robynhood forecasting market work

Robinhood says no hidden tricks: If the contract costs at 53 cents, it means that the market sees approximately 53% chance that this outcome is happening. Users can also sell their positions before the event ends, allowing them to take earnings or reduce losses based on pricing movements.

Each event agreement follows a simple format of DA-or-not, similar to other predictions markets such as polymeters. “Any contract you possess, will pay $ 1 if that contract is resolved on the page you own. This will pay $ 0 if not,” Robby explains in FAQ.

Users can take or “yes” or “no” on a given contract, but cannot keep both sides for the same event at the same time. However, they can take more than one position in different matches. The platform also displays an open interest – the number of active contracts that benefit users – to allow insight into market activity.

Robbhood charges a commission of $ 0.01 per contract aside, and the mediation of an ordered order can utter additional fees, the company added. The brokerage gigant says that his contracts for trading commissions commissions are offered in partnership with their Rival Kalshi, another forecasting platform, which allows users to bet in elections, news and pop culture.

Hidden traps

Plans of wobbly to expand its prediction market remain uncertain, because space had its true part of controversy, and disputes about market resolutions is a repetitive issue.

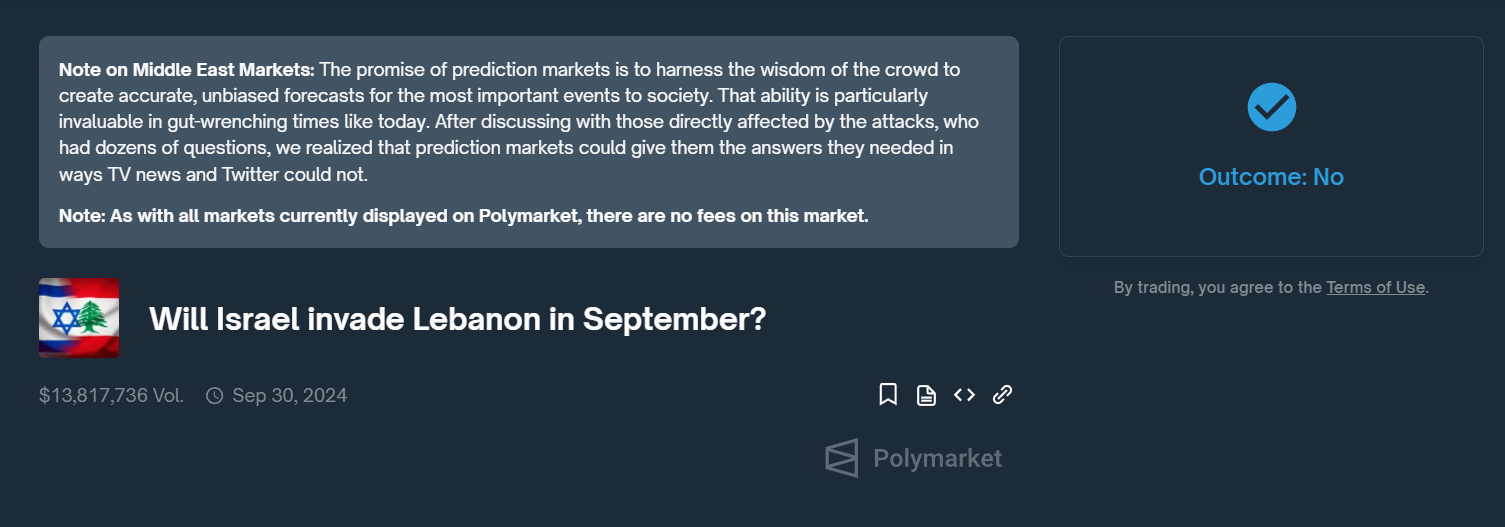

Polimarket, one of the largest traditions of trading scope, has several times with criticism for its resolution process. One of these cases included a market Under the name “Will Israel Invamerate in Lebanon in September?”

In the night of 30. September Israel launched military operations in Lebanon to press the forces of Hezbollah from the border. Although the main news widely sent the action as a “invasion”, suggesting the market to decide to, eventually, eventually solved as not, sparking back from the merchant.

The decision depended on strict interpretation of their rules. Although Israeli troops entered Lebanon, some participants claimed that “invasion” required an official statement or effort to grab and keep the territory – Israel criteria is not explicitly fulfilled. Despite the widespread use of the term “invasion” in media coverage, the market ruled that technically fulfilled the conditions for IE outcome.

The transition to robust in events contracts adds a wider trend of financial platforms that offer new types of trading beyond traditional actions and crypto. Moreover, it is also not the first attempt at broker in the prediction markets, as before the elections in November, Robatin briefly presented His service and later announced the market for the outcome of Super Bowl. However, in February, Robbinism has withdrawn the offer after CFTC sent the company that “does not allow customers to access” sporting events contracts.

At that time, Robby expressed disappointment, stating that there were in “regular communication with CFTC on our intention and plan to offer this product” before launch.

https://crypto.news/app/uploads/2024/03/crypto-news-Robinhood-option03.webp

2025-03-17 18:33:00