Ripple XRP News: Japanese financial giant SBI Holdings awarded shareholders with XRP

This initiative Highlight SBI long-term commitment to cryptocurrency adoption and technology Blocchain in traditional finances.

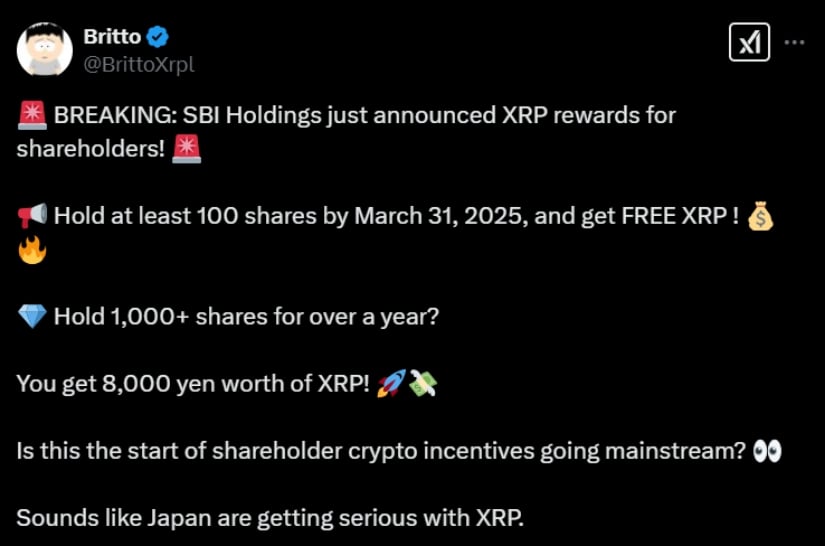

SBI Holdings announced to pay their shareholders using XRP. Source: Britto over x

Through this program, eligible shareholders can choose between XRP or choices of health and wellness products from SBI Alapromo co., Branches specialized for functional food and cosmetics. This move includes SBI’s broader digital asset integration strategy into the main financial services.

How does the XRP Rewards program work

SBI Holdings has set special eligibility criteria for shareholders to participate in Rewards. Investors are listed on the SBI shareholders Register as at 31. March 2025, they qualify for the benefits based on the number of shares held by:

-

100 to 999 shares or at least 1,000 actions that are less than a year: eligible for 2,000 yen XRP or selected health products.

-

1,000 or more actions for more than a year: Eligible for XRP worth 8,000 yen or wider selection of superior cosmetics and wellness products.

In addition, all shareholders of less than 100 shares receive a 50% discount voucher for purchases from SBI Alapromo.

Investors who want to receive the KSRP must be further from Japanese nationality, over the age of 18 or held an account on the SBI VC store, a Cripto Trading of SBI platform, between other requests. XRP will be distributed before 31. July 2025. in accordance with Japanese regulations.

SBI’s strong support for XRP and Ripple

SBI Holdings has always been quite loud in supporting Ripple and KSRP cryptocurrency, constantly building a solution focused on blockchain in its financial ecosystem. It has already integrated Ripple technology into cross-border payment services, so it proves a belief in the usefulness of assets.

SBI Holdings once again offered XRP as the benefit of shareholders, which provides coupon code for 2,000 Jena KSRP, with distribution expected until 31. July 2025. Years. Source: Crypto Eri over x

Cripto Analyst Cripto Eri told the latest SBI move: “That would be a major statement about their dedication to XRP.” The General Manager of SBI Holdings, Ishitaka kitao, was similar to Sanguine on the future KSRP – assuming regulatory barriers globally.

“Once the court decides KSRP is not security, we expect a great price,” said Kitwood, based on anticipation of further adoption.

The impact of the KSRP is growing in the Japanese banking sector

The SBI XRP Rewards program comes at the time when it spreads in Japan in Japan. Over 60 Japanese banks, covering almost 80% of the banking sector in the country, is partner with Ripple to improve cross-border transaction. This level of institutional support could submit further adoption of the KSRP to pay in the real world.

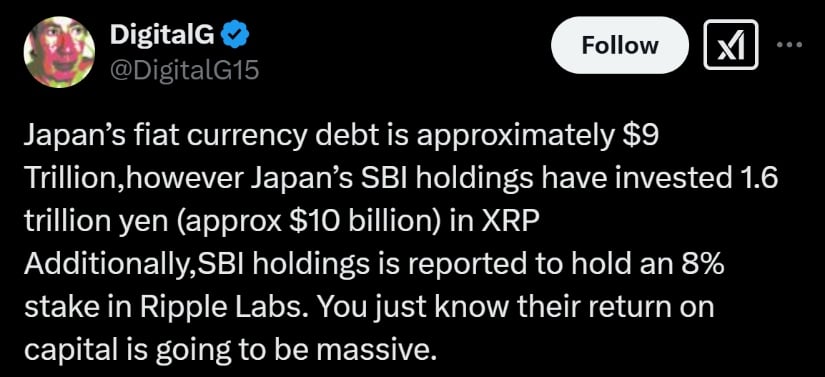

SBI Holdings has invested $ 10 billion in KSRP and has 8% ripla, Ostam is massive return despite Japan of three trillion dollars. Source: Digitalg over x

The CRIPTO analyst Gene AbilsAv predicts that the price of XRP can increase depending on the volume of adoption. It announced three potential scenarios:

-

Minimum adoption – only a few banks use XRP, pushing its price on $ 3- $ 5.

-

Moderate adoption – If half of Japanese banks implement XRP, the price could increase to $ 10 to $ 25.

-

Full adoption – if each bank integrates XRP, the price could reach 50 and more than $ 100 or more, significantly strengthen its market capitalization.

This projection underscores the potential impact on the Japanese banking sector at the KSRP market dynamics.

XRP ETF an inch approval closer

The table below shows that Current ETF approval Odds for various digital assets, how rated Bloomberg analyst is rated James Seiffart. Details details that submitted S-1 for Spot ETFS assets, first 19B-4 sign-in dates, whether SEC recognized these submission and projected decision deadlines.

Current SEC Stance on whether any property is considered goods, which is a key factor that affects the approval coefficient. Family, Litecoin and Dogecoin have a higher chance with approval (90% and 75%, greatly due to their likelihood of their chamber as goods.

Meanwhile, Solana, XRPAnd Dogecoin faces several regulatory insecurities, it is reflected in a slightly lower approval coefficient (70%, 65% and 75%, respectively). The recognition of the submission for Litecoin and Solana suggests hunger path towards potential approval, while KSRP and Dogecoin are still waiting for recognition. The HBBA and the polkadot are in a flat earlier phase, without official applications or estimated quotas, although analysts suggest that they could have the opportunity depending on future prescribed development.

Odds of the approval of the KSRP ETF 2025. Years are 65%, source: James Seiffart Via K

Market trends and Outlook price XRP

At the time of writing, XRP is trading to $ 2.43, after light movements in the range of $ 2.26-2.57. According to analysts, a breakthrough above $ 2.57 resistance can file a $ 2.96, while the slider of $ 2.26 could see it will be referred to $ 1.97.

Ripple (XRP) traded about $ 2.43, in the last 24 hours in the last 24 hours at the time of pressure. Source: XRP liquid index (XRPLX) via Brave new coin

Meanwhile, the signs of the growing interest of investors are sparking on the chain of activities. According to the cryptocalant, the number of transactions on the KSRP network jumped 12% after recent correction potentially indicates the accumulation of investors in case of interruptions.

Step toward mass adoption?

Ripple’s leveled legal battle with Secu took an unexpected turnaround. One of the more intriguing shifts is Transmission of Jorge Tenreiro, Leading figure in Sec’s cryptic unit for implementation and key player in case of Ripple, to another department. This sudden staff changes have launched speculation that the regulator can mitigate his aggressive attitude that potentially cleans the path of a more favorable outcome for Ripple.

However, the price KSRP did not follow the suit. Despite this legal binding, the token fell approximately 24% in the past week, which was currently hovering near 2.40 dollars. This fall is surprisingly, especially in light of what many consider a positive legal momentum for Ripple. Analysts suggest that they are wider market forces in the game, especially the Bitcoin struggle to maintain a crucial support level, which could weigh the KSRP price. In February, XRP Presidential Prices The analysts softened as the market was cooled.

On the legal front, excavator – legal officer Ripple, Stuart alderi, remains compensatedwhich suggests that the shifts of leadership within seconds could rub the way for more cryptological policies. Legal experts also indicate a recent SEC decision not to oppose the request of Coinbase for the interlocution appeal, the interpretation interpreted as a potential sign of soften attitude on crypto.

SBI Holdings’ Decision on rewarding shareholders With XRP emphasizes Ascending crossroads between traditional financial and digital funds. In addition to encouraging investments, the bids of cryptocurnence as a tangible benefit normalizes the use of digital assets in corporate finances.

If Riple continues to see the entry within Japan Banking IndustryThis can be a case study for other financial institutions in Japan to integrate crypto rewards and areas of payment.

https://bravenewcoin.com/wp-content/uploads/2025/02/Bnc-Feb-11-21.jpg

2025-02-11 23:22:00