Parts of the Wrap blocks 09/09/2025: Organizational updates for the main encryption and market trends | Flash news details

Trading effects of market movements across this market are great for encryption investors who are looking for opportunities for volatility. The simultaneous decline in BTC and ETH prices with S&P 500 on May 8, 2025 indicates a growing connection between traditional and digital assets, which are likely to be driven by institutional funds. According to a report of parts of the blocs, which are shared on May 9, 2025, the founding investors reserve the capital from the shares to encryption during the declines, where they view Bitcoin as a possible hedge against inflation concerns. This behavior was clear with the increased open interest of BTC Futures on CME by 15 % to $ 5.8 billion between May 7 and May 9, 2025, indicating the growing institutional participation despite the low prices. For merchants, this offers a potential purchase opportunity in BTC/USD and ETH/USD pairs, especially with prices approaching the main support levels. On Binance, the BTC/USDT pair witnessed a 30 % increase in trading volume, reaching $ 1.5 billion on May 8, 2025, at 15:00 UTC, indicating the interest of the strong market. In addition, the decrease in the shares related to encryption, such as Coinbase (Coin), which decreased by 3.1 % to 210 dollars on May 8, 2025, said Marketwatch, reflects a direct impact on feelings of encryption origins. Traders can monitor these shares to obtain recovery marks, as the bounce in the coin often precedes the biological movements in BTC and ETH. It seems that the appetite of the risk in the market is diminishing, but strategic traders may benefit from the excessive sale conditions in both markets.

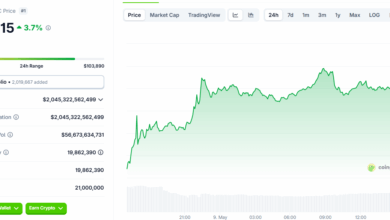

From a technical perspective, the price of Bitcoin and ETHEREUM on May 8, 2025 shows a clear momentum, with BTC cuts less than 50 days moving average of $ 61,000 at 14:30 UTC, according to TradingView data. Ethereum also violated its main support at $ 2,500, as it decreased to 2450 dollars by 16:00 UAE time, with the RSI to 38, indicating the sale conditions. The scales on the series support this analysis, as Glassnode reported a 10 % increase in BTC exchange flows on May 8, 2025, reaching 45000 BTC, a sign of potential sale pressure. However, the same data shows a decrease in ETH Exchange flows, indicating that their holders are less inclined for sale at the current levels. In terms of links to the market, the 30 -day correlation plant between BTC and S&P 500 reached 0.75 as of May 9, 2025, according to Coinmetrics, highlighting the strong link between these markets. This higher association means that any other declines in stocks can press encryption prices, but this also means that the stock market recovery can raise digital assets. The flow of institutional funds is still a decisive factor, as Bitcoin Trust (GBTC) registered from GRAYSCALE net flows of $ 120 million on May 8, 2025, according to its official files, indicating constant interest despite the contraction. For traders, monitoring the level of $ 60,000 support for BTC and $ 2,400 for ETH will be very important in the coming days, as these levels can determine the next main direction.

The interaction between stock markets and encryption markets is emphasized by influencing traded investment funds and coding stockpiles. The Prosthares Bitcoin ETF (BITO) strategy witnessed a decrease of 2.8 % on May 8, 2025, which reflects the low BTC prices, as the trading volume extends to 8 million shares, an increase of 20 % over the previous day, according to Bloomberg. This indicates that traditional investors also interact with encryption fluctuations, which may exaggerate price fluctuations in digital assets. The institutional focus on Crypto continues with the growth of alternative assets category, with reports of parts of the blocks on May 9, 2025, indicating that the hedge boxes are increasing allocations for BTC and ETH during the market drops. This dynamic creates a unique trading environment as the morale of the stock market directly affects the liquidity of encryption and vice versa. For merchants, understanding market relations across the market is necessary to determine the points of entry and exit, especially since the total economy events continue to increase fluctuations across both sectors.

Instructions:

What caused Bitcoin and Ethereum to drop on May 8, 2025?

The decrease in Bitcoin and Ethereum prices on May 8, 2025, was mainly driven by wider feelings in the financial markets, in conjunction with a 1.8 % decrease in the S&P 500. Bitcoin decreased by 3.2 % to $ 60500 in a state of Malaysian understanding.

How does securities market movements affect encryption trading volumes?

The decrease in the stock market on May 8, 2025 led to a significant increase in encryption trading volumes, with a bitcoin trading volume of $ 1.2 billion in 24 hours, an increase of 25 %. The BTC/USDT pair has also witnessed an increase in the volume of 30 % to $ 1.5 billion, indicating an increase in trading activity during periods of cross market volatility.

https://image.blockchain.news/features/DC3788979712BF4DFF603597AAC46E7C52F8B5EF76BC21453D757F37CDB271FE.jpg