MicroStrategy (MSTR) rose 13% after buying more Bitcoin

Shares of software company MicroStrategy (MSTR) It rose to $339.66 on Friday after its recent decline. The rise came after the company announced that it had purchased 2138 Bitcoin With an average price of $97,837 for a total of $209 million. This marks the eighth consecutive week of Bitcoin purchases, bringing their total holdings to 446,400 Bitcoin acquired at an average cost of $62,428 per coin.

Don’t miss our New Year offers:

The company’s Bitcoin strategy has drawn both praise and skepticism. While MicroStrategy outperformed Bitcoin and Nvidia (NVDA) This year, while also securing a place in Nasdaq 100 (NDX), critics argue that the company acts more like a bitcoin holding company than a software company, exposing investors to high risks and volatility. In fact, some analysts warn that such an aggressive strategy for Bitcoin could undermine shareholders’ long-term stability despite its short-term market gains.

However, CEO Michael Saylor, a staunch Bitcoin advocate, continues to support the cryptocurrency’s potential and insists it is a transformative asset.

HC Wainwright is bullish on cryptocurrencies

Similar to Michael Saylor, HC Wainwright is also bullish on cryptocurrencies. In fact, the company expects encryption The mining sector is expected to boom in 2025 and reach a total market value of $100 billion. And also expect Bitcoin will reach $225,000 by the end of the year. The company believes that mining stocks will outperform Bitcoin itself as market fundamentals and prices improve. Furthermore, it has highlighted pure miners like Marathon Digital (Mara)Riot control pads (riot)And Clean Spark (CLSK) As the best shots.

Is MSTR a good stock to buy?

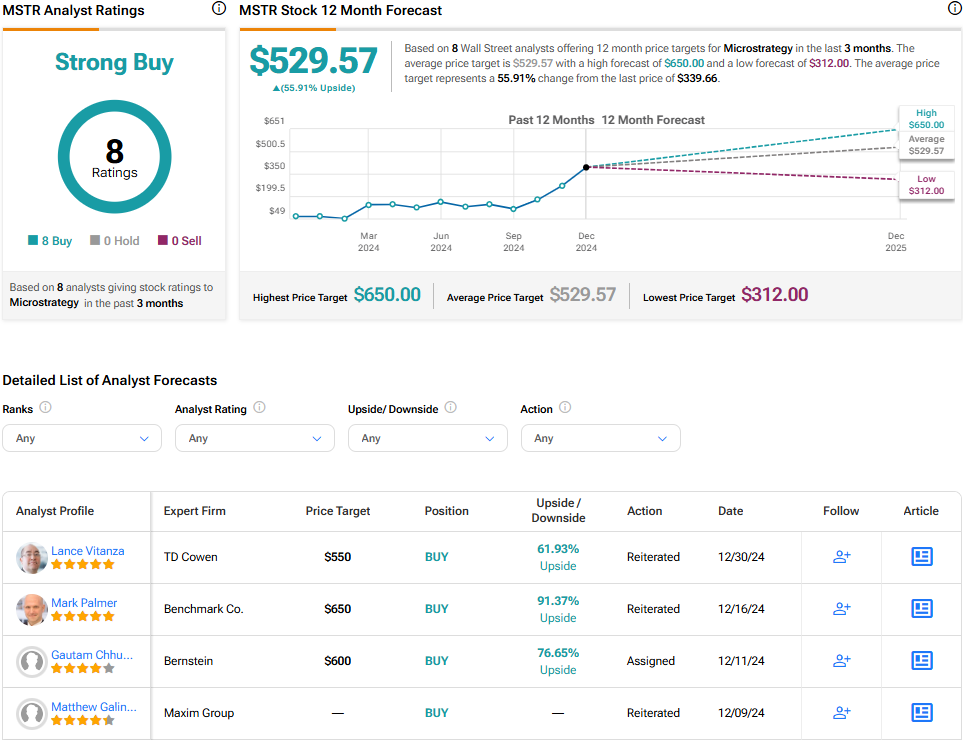

Overall, analysts have a Strong Buy consensus rating on MSTR stock based on eight Buys set in the past three months, as shown in the chart below. but, After its share price increased by 418% During the past year, MSTR’s average price target is $529.57 per share It indicates an upside potential of 55.9%.

https://blog.tipranks.com/wp-content/uploads/2025/01/shutterstock_2491707321-750×406.jpg

2025-01-04 01:07:00