MicroStrategy bought more Bitcoin for the seventh week in a row

(Bloomberg) — MicroStrategy, which is set to enter the Nasdaq 100 on Monday, announced it purchased an additional $561 million worth of bitcoin at an average price near last week’s record high.

Most read from Bloomberg

This marks the seventh straight week of buying for Tysons Corner, the Virginia-based dot-com-era software maker turned leveraged Bitcoin proxy.

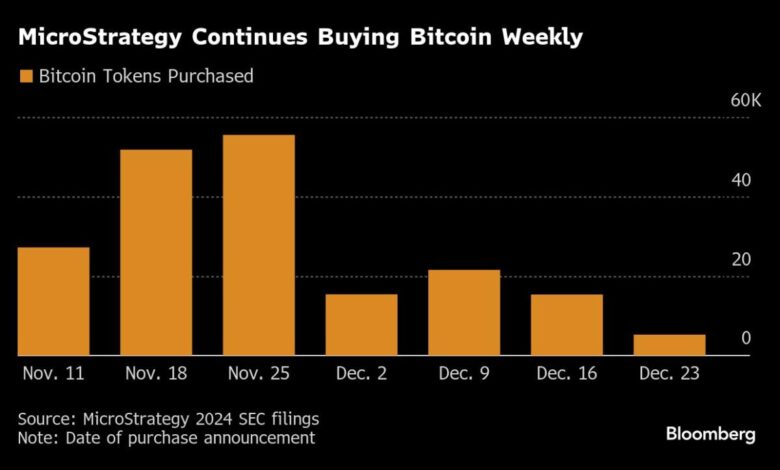

MicroStrategy bought 5,262 bitcoin tokens at an average price of about $106,662 from Dec. 16 through Dec. 22, according to a filing with the U.S. Securities and Exchange Commission on Monday. This is the lowest number of bitcoins the company has purchased in several weeks, with the price of the token hitting a new high of over $108,000 during the buying period.

The bitcoin treasury company aims to raise $42 billion in capital over the next three years through market share sales and convertible debt offerings for the purpose of purchasing more bitcoin. The company has already exceeded its 2025 capital goals, and co-founder and Chairman Michael Saylor told Bloomberg TV on Wednesday that MicroStrategy will reconsider its plan and develop a new one once it is complete.

When MicroStrategy first announced its capital plan in October, some observers thought it might have been aggressive, but now it appears the company will be able to continue raising more money, according to TD Cowen analyst Lance Vitanza, who has a “buy” rating on Stocks.

“We’re not even at 2025 yet, and they’re two-thirds of the way there,” Vitanza said in an interview. “So I think it’s a surprise to us, but it’s less surprising on Monday than it was last Monday or the Monday before.”

Hedge funds have been driving some of the demand as they seek to use MicroStrategy for convertible arbitrage strategies by buying bonds and shorting stocks, essentially betting on the volatility of the underlying stocks.

MicroStrategy shares fell 11% last week, driven by falling Bitcoin prices. The price of the native cryptocurrency fell following the Fed’s interest rate decision and 2025 rate cut expectations, falling to a low of $92,149 on Friday after hitting an all-time high of $108,316 earlier in the week.

MicroStrategy’s value still depends on its underlying Bitcoin holdings and its price. If Bitcoin experiences a prolonged downturn, it will pose a risk to the company.

https://s.yimg.com/ny/api/res/1.2/0BpJZ8bC7v.ifjuQIAV1UA–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD03MzA-/https://media.zenfs.com/en/bloomberg_markets_842/97ac39e1891c54bdc43d22ae21825ad2