Michael Sailor reveals a key strategy in K1 2025 Close Earnings

In the Investor, the financial results of K1 – including the $ MSTR, $ strk and $ strF-as well as statements that look forward should not miss the investor.

Attached to earnings 1. May, Michael SailorCEO and a wild successful BTC engineer (Btc) Straiznica The company’s strategy, stated that the company was playing a crucial role in spreading institutional interest.

On the call, Sailor began repeating BTC’s unique proposal value: “Bitcoin has no risk in opposites,” the investor said: “No company”. No creditors. No competition. No competition. There is no currency. No Chaos.

He added that the global adoption progresses quickly progresses, while predicted that “the first nation for printing its currency was buying Bitcoin winning.”

“The adoption of Standard Bitcoin by several companies is useful, legitimizes Bitcoin and attracts more capital. As more companies join, stabilize and starts the price of bitcoin,” said said said.

The highlighting of the Capital Market Marketing, which say that the cash register in K1 is common in stock and preferred 61,497 BTC, a $ 5.8 billion “and $ 5.8 billion” and $ 5.8 billion. ”

In addition, Sailor celebrated BTC’s adoption of over 70 public companies, framing strategies as a leader in the “digital golden haste”. He fired the BTC’s unpaid concern, emphasizing long-term appreciation and justified purchases under the accumulation of debt, despite the loss of $ 4.2 billion unrealized losses with fair value.

Sailor’s bikarska vision casts BTC as a digital capital ready to dominate fundies, but shine risks like crossing prices, levers and potential dilution of shareholders from constant preferred stocks.

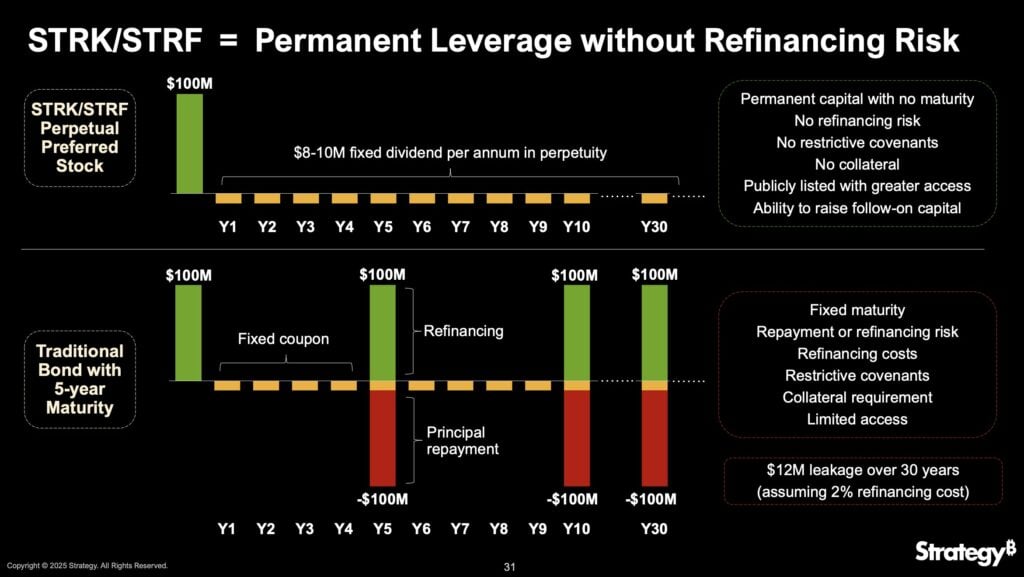

However, critics pointed out numerous problems with an extremely used strategy model. While the company takes a 50% increase in the price of the price price list, and the $ 12.7 billion earnings from the calculation of fair value, its reliance on bonds to finance BTC purchases introduces significant risks. Issuance of $ 2 billion in 0% of convertible higher notes by 2030. years and constantly preferred supplies with high divideed obligations (8% for strk, 10% for STRF) commit a strategy to significant obligations. These instruments, at the same time giving capital, burden the balance sheet with high claims that could destroy the shareholding value if the BTC instability turns in the south.

However, Sailor remains Bullosh, publishing a conveniently generated and the image on K shortly after the call.

https://crypto.news/app/uploads/2024/01/cropped-crypto-news-Michael-Saylor-option04.webp

2025-05-02 16:21:00