Michael Sailor hints to buy Bitcoin coming from a strategy amid price fluctuations

Main meals

- The strategy, which was previously microscopes, hinted at the purchase of a new bitcoin with price fluctuations.

- The company has made about $ 15 billion in unreasonable gains due to large bitcoin possessions.

Share this article

On Sunday, Michael Sailor, one of the founders of the strategy, posted Bitcoin Tracker to X, indicating a possible resumption of Bitcoin’s acquisitions after a week’s break. This hint comes as the Bitcoin price fluctuates, and it immerses less than 96,000 dollars earlier today before a recovery over 96,500 dollars, according to Coingecko.

Death for blue lines. Green points live. pic.twitter.com/sotfhroykd

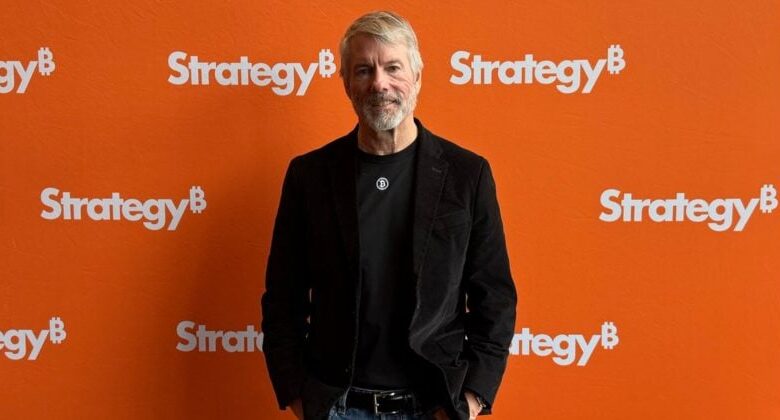

Michael Saylor (Saylor) February 9, 2025

The strategy, previously known as Microstrategy, is currently 471,107 Bitcoin with a value of more than $ 45 billion at the current market prices. The latest company Get 10,107 BTC It was made in the week ending January 26, at an average price of $ 105,596 per currency.

Tysons in Virginia invested about $ 30 billion in Bitcoin at an average price of $ 64,500 per currency, which led to $ 15 billion gains.

The potential purchase will represent Bitcoin’s first acquisition since Bitcoin’s announcement of its companies’ commercial brand on Thursday, when the company revealed a new visual identity under the title Bitcoin.

The strategy also reported a net loss of $ 670.8 million for the fourth quarter, with the addition of 218,887 Bitcoin to its property. Revenue decreased by 3 % on an annual basis of more than $ 120 million, and expectations were reduced by about $ 2 million.

The company’s expenses increased by 700 % to $ 1.1 billion, which attributed to “21/21” plan to invest $ 42 billion in Bitcoin over three years. The strategy used $ 20 billion in this plan, especially through upper conversion notes and debt financing.

Surprises of the encryption market for volatility

Bitcoin decreased by 11 % of January 20 altitude of $ 108,786, after President Donald Trump opened. ASSET Crypto was traded by about $ 9,6500 at the time of the press, where about 3 % decreased last week.

Despite a number of positive organization and legislative Developments After the transformation, the customs tariff imposed by President Trump shook the markets, causing a Sell in encryption assets. The risk of a commercial war increased from uncertainty and reducing the investor’s appetite for the most dangerous assets.

Whether the encryption market is heading north or south, the strategy is likely to adhere to the bitcoin purchase strategy.

Share this article

https://static.cryptobriefing.com/wp-content/uploads/2025/02/09122608/8b6d4b99-ad83-4246-807f-28562df15380-800×420.jpg