Massive hole of bitcoins on bining in front of the CPI report – is BTC Cena Crash coming?

The inflow of bitcoin on the stage has increased over the past 12 days as well as today’s data on data release – are investors sold?

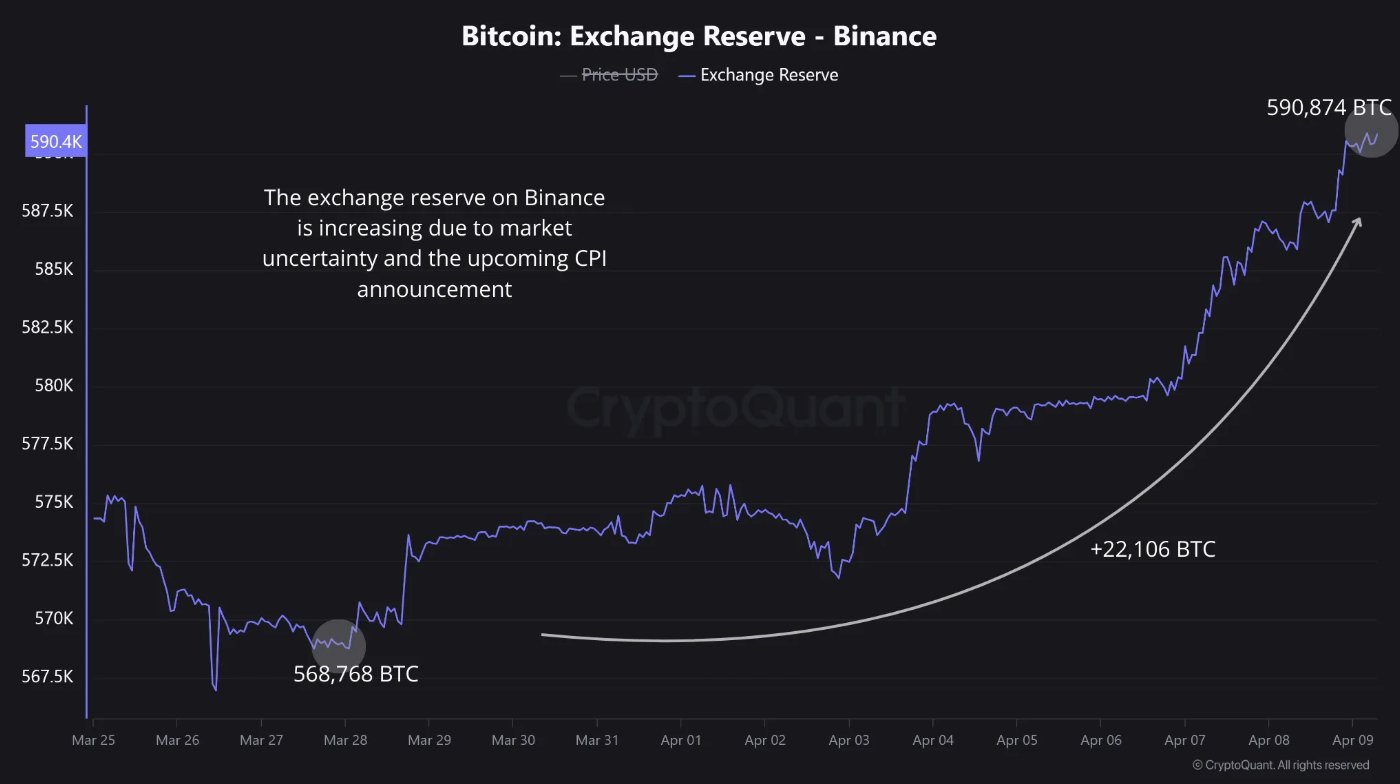

In a recent Mail to KCriptokuant’s Maarten Regterschot pointed out that over 22k Bitcoin (Btc) – Valid approximately 1.82 billion dollars – transferred to binance in the last 12 days. This has led a total BTC BTC reserves at about 590,874 BTC.

“This shows a strong acceleration in the BTC inflow of the bineness,” said Regterschot. “It is likely that investors are actively moving funds in binance due to macronic insecurity and before the upcoming CPI announcement.” he wrote.

The American Bureau of Statistics of Labor is set to publish the CPI report today, 10 April. CPI is expected to show that 2.6% will increase a year in a year. Reuters Survey Economist suggests If the index probably increased by only 0.1% per month, reflected a slowdown of inflation that was driven by lower energy prices and reduced influence of the early match. In February, the CPI increased by 0.2%.

If the CPI projections have a modest monthly increase of 0.1% and the annual rate of 2.6% will improve the customer’s hopes that inflation could easily easse the pressure on the Federal Reserve to maintain a narrow monetary policy. This would be seen as a positive signal for risky property such as bitcoin.

In this context, the increase in BTC inflows on binants does not necessarily point to the upcoming sales pressure, but also strategic positioning. Merchants can move their BTC on binance in anticipation of price volatility, preparation for a quick place or derivatives of the craft at the affordable CPI report. Such as Swiftk lead analyst pus told COINTELEGRAPH, these inflows can only mean that the bynnants will be transferred by property assets in their hot bills to meet the growing demand.

However, inflows can still reflect hedging behavior, even if the CPI comes soft. Some investors can prepare for the “Sales News” scenario – probably and expecting that even a favorable CPI print can already be at the price, especially after Recent stock price after Trump’s Tariff Break. Bitcoin is currently trading from $ 89,636, more than over 7% in the last 24 hours.

No matter what CPI will show, there seems to be more stories about the opportunity of BTC’s bineness. One comment by Alex Metric said The amount of inflows is actually tiny, notes that in the last 30 days binant experienced net outflow 888.9 BTC. “You point only the last part with the banging,” he wrote.

https://crypto.news/app/uploads/2024/08/cropped-crypto-news-bear-bitcoin-option07.webp

2025-04-10 15:43:00