Kanye West adds to Memecoin’s disorders, where a wider market screams

Written by Francisco Rodriguez (at all times ET unless it is indicated otherwise)

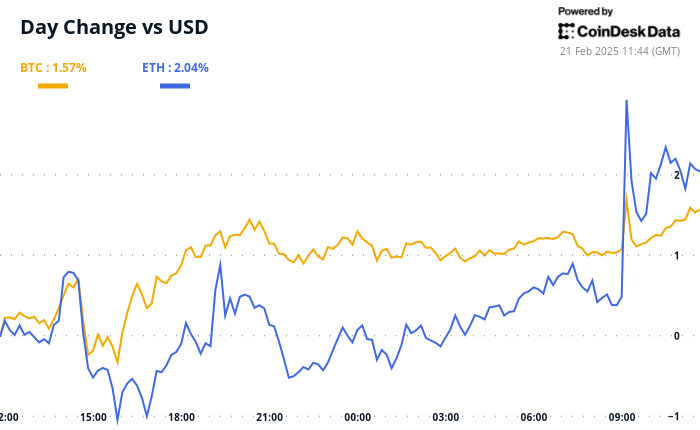

The prices of cryptocurrencies rise after the previous encryption application unit in the Securities and Stock Exchange Committee Go to the e -technologies unit Amid the comments from the President of Atlanta in the Federal Reserve, Rafael Bustic.

The renality of encryption and electronic unit is important because it shows that the agency moves away from its encryption concentration, which often led to a lot to The organization’s accusations of implementation Legal battles with major industry participants.

“Most likely, it is likely that the regulations are probably clearer, which leads to improvements in the market infrastructure,” said the founder of the backpack and CEO Armani Ferrante of Coindesk. Bitcoin now exceeds $ 98,000 after adding 1.2 % in 24 hours, while the broader Coindesk 20 index increased by 1.35 %.

However, the fluctuation remains Relatively low. “These environments may feel slow and frustrated, but they rarely last for a long time – the fluctuation tends to return,” said the Wintermute otc Jake O merchant of Coindesk.

With the increasing tensions between the United States and its European allies, investors hope that the German elections will lead to a stable coalition government that will push economic reforms to stimulate growth and increase defense spending. Germany is the largest economy in Europe and can lead a positive result to a more risk approach.

I have already open attention before the elections. However, the encryption market It lacks positive stimuli In the short term, JPMorgan analysts, led by Nikolaos Bengirgzoglu, wrote in a report.

In fact, the market is close to decline – as immediate prices rise higher than future contract prices – in “negative development” that indicate “poor demand” by institutional investors who use future CME contracts regulating the market exposure. Stay on alert!

What do you see?

- Checks:

- Macro

- February 21, 9:45 AM: Flash Month of the American Procurement Directors Index (Flash).

- PMI Prev. 52.7

- Manufacturing PMI EST. 51.5 against the previous. 51.2

- PMI EST services. 53 against the previous. 52.9

- February 24, 5:00 AM: EUROSTAT launches inflation data in the euro (final) area for January.

- Yoy Est. 2.7 % against the previous. 2.7 %

- Yoy EST inflation rate. 2.5 % against the previous. 2.4 %

- February 21, 9:45 AM: Flash Month of the American Procurement Directors Index (Flash).

- Profits

Symbolic events

- Voices of governance and calls

- to open

- February 21: Fast code (FTN) to open 4.66 % of the $ 78.6 million trading offer.

- February 28: Optimism (OP) to open 1.92 % of the trading offer of $ 34.23 million.

- March 1: SUI (sui) to open 0.74 % of the trading offer of $ 81.07 million.

Conferences:

Coindsk consensus in occurrence Toronto from 14 to 16 May. Use today’s code and save 15 % on passes.

Distinguished symbol speech

Written by Oliver Knight

- With a failed launch of Argentine President Javier Millie and a symbol proposed by Nazi Kanye West, now known as you, this week was in Mimkewin Land one forgotten.

- Nick Carter, Castle Island Ventures, said that madness “Undoubtedly,” A view that may be reinforced by a report that reveals that the West is Planning to submit Yzy Token – it will have 70 % of the offer.

- The rest of the encryption market is still relatively disturbed by the potential disappearance of the sector: ETH and LTC increased by 3 % this week, while TRX rose by 7.7 % as liquidity appears to spin speculating symbols to more utilitarian projects.

- Near the leadership of the package on Friday, and it rises by 11 % yet Advertisement Artificial intelligence agents “the first independent”. The agents will be able to own and manage assets independently on assets.

Locate the location of the derivatives

- The open interest in the central stock exchanges increased by 5 % to 37.3 billion dollars during the past 24 hours. This, in addition to the reflection of funding from positivity to negativity, indicates a possible short pressure scenario. The short qualifiers dominated the future contracts market during that period, as it approaches a total of $ 110 million, compared to 6.11 million dollars in length.

- Among the assets of more than $ 100 million of open interest, the DAO maker, the assumptions and supernatural intelligence witnessed the highest increase in one day, an increase of 39.2 %, 35.5 % and 28.00 %, respectively.

- Among the options tools, the BTC connection option was traded at a $ 99,000 strike price and February 22 delusion with the largest size on Deribit. The following most popular options tool is the BTC call at a $ 108,000 strike price, which ends on February 28. The procedure hints of the short -term optimistic feelings in the market during the past two days.

Market movements:

- BTC increased by 0.28 % from 4 pm East to 98,632.42 dollars (24 hours: +1.35 %)

- ETH increased by 2.09 % at $ 2,800.02 (24 hours: +2.15 %)

- Coindesk 20 increases by 0.92 % to 3,298.29 (24 hours: +1.49 %)

- The Staking Ether Cesr rate has not changed at 2.99 %

- BTC financing is 0.0010 % (1.0961 % annual) on Binance

- DXY is 0.29 % in 106.68

- Gold decreased by 0.31 % at 2,929.76 dollars/ounces

- Silver decreased by 0.12 % to $ 32.91/ounces

- Nikkei 225 closed +0.26 % in 38,776.94

- Hang Seng +3.99 % closed at 23.477.92

- FTSE increased 0.20 % in 8,680.19

- EURO Stoxx 50 is 0.18 % in 5,471.08

- DJIA closed on Thursday, a decrease of -1.01 % to 44176.65

- S & P 500 closed -0.43 % in 6,117.52

- Nasdak closed -0.47 % in 19,962.36

- Closed S&P F/TSX Complex -0.44 % at 25,514.08

- S & P 40 America America closed +0.76 % at 2,480.21

- The ministry of the Ministry of Treasury in the United States decreased for 10 years by 2 points per second at 4.49 %

- E-MINI S & P 500 Future has not changed at 6138.25

- E-MINI NASDAQ-100 futures increased by 0.13 % at 22,170.75

- E-MINI Dow Jones Industter Indust Vitter

Bitcoin Statistics:

- BTC dominance: 61.02 (-0.35 %)

- ETHEREUM ratio to Bitcoin: 0.02842 (2.01 %)

- Retail (seven -day moving average): 807 EH/s

- Hashprice (spot): $ 54.92

- Total fees: 5.34 BTC / 526,892 dollars

- CME FUTERES Open benefit: 178,500 BTC

- BTC at gold price: 33.4 ounces

- BTC market roof for gold: 9.49 %

Technical analysis

- Tao as one of the most powerful assets has emerged during the past week, feeding the DynamicTao upgrade. This momentum pushed the price above all the main averages of the main lower movement in the daily time frame, indicating renewable strength.

- In addition to the upscale feelings, the main procedure formed a reverse and shoulder head.

- The last TAO list has provided an additional catalyst, which has led its price to nearly 20 % to $ 495 since the initial announcement.

Encryption

- Microstrategy (MSTR): closed on Thursday at 323.92 dollars (+1.65 %), an increase of 0.37 % at 324.85 dollars on the market before the market

- Coinbase Global (COIN): Closed at $ 256.59 (-0.80 %), an increase of 0.86 % at $ 258.80

- Galaxy Digital Holdings (GLXY): Closed at $ 25.65 (+1.30 %)

- Mara Holdings (MARA): Closed at $ 15.95 (+1.08 %), an increase of 0.38 % at $ 16.01

- Riot platforms: closed at $ 11.60 (+0.35 %), an increase of 0.52 % at 11.66 dollars

- Core Scientific (Corz): Closed at $ 11.84 (-1.50 %), an increase of 0.51 % at $ 11.90

- Cleanspark (CLSK): Closed at $ 10.06 (+1.72 %), an increase of 0.80 % at $ 10.14

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.49 (-1.27 %), a decrease of 0.31 % to $ 22.42 dollars

- Semler Scientific (SMLR): Closed at $ 52.24 (+0.04 %), unchanged

- Exit (exit): closed at $ 47.80 (-1.26 %), a decrease of 2.72 % to $ 46.50

Etf flows

BTC Etfs Stain:

- Daily net flow: -364.8 million dollars

- Cutting net flow: 39.63 billion dollars

- Total BTC Holdings ~ 1.169 million.

ETH ETFS spot

- Daily net flow: -13.1 million dollars

- Cutting net flow: 3.16 billion dollars

- Total Eth Holdings ~ 3.807 million.

source: Farside investors

It flows overnight

Today’s scheme

- Bitcoin price raised short qualifiers with a total of $ 97.9 million at 98,890 dollars, according to Coinglass. The following main resistance levels, based on the filtering heat map, are 99,185 dollars and 99,332 dollars, where the qualifiers are collected at a value of $ 65.2 million and $ 67.9 million, respectively.

- On the negative side, important long licenses are placed at 97,415 dollars and 97,194 dollars, amounting to 69.3 million dollars and 70.7 million dollars, respectively. These main levels highlight the potential areas of volatility as Bitcoin moved within the current price range.

While you sleep

- Jpmorgan says the encryption market faces a weak demand, and needs Trump’s initiatives to start. (Coinsk): JPMorgan said that CME FUTERES data reveals a weak institutional interest in encryption, with any pro -profit initiatives from the Trump administration is unlikely to appear until the second half of the year.

- South Africa Bitcoin Heating initially on the continent (Bloomberg): Altvert Capital Bitcoin adopted to be backup assets for the Treasury. BTC bought one and is considering selling $ 10 million to expand its digital holdings.

- Block shares decrease on profit, loss of revenue (CNBC): At calling Q4 2024, executive managers commented Block (XYZ) on Proto, their Bitcoin Mining Initiative. The financial manager, Ameta Ahuja, said that the project should push growth in the second half.

- Japan’s yield decreases as UEDA warns that BOJ can enter the market to facilitate (Bloomberg): The Governor of the Bank of Japan, Kazu Oda, pledged to buy government bonds if they are long -term returns. Earlier, revenue for 10 years reached 1.455 %-more since 2009.

- Retirement sales in the United Kingdom for the first time in five months (The Wall Street Journal): In January, retail spending in the United Kingdom increased by 1.7 % from December, led by 5.6 % in food store sales with more people at home.

- The new Microsoft Chip shorten (Cointelegraph): River Maharana from Microsoft from Microsoft-River Microsoft said, although it was not a threat-it could reach a measure of one million dollars by 2027-2029, which could enable attacks on Blockchain.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/d884afbe5b53a7e89960cbb6a386ad90b7f4e6b8-700×430.png?auto=format