Is separation here to stay?

In April, many observers wrapped about the constant separation or divergence of bitcoins from equality, which means that the path of Bitcoin took a different direction compared to inventories and actions. Bitcoin and gold are up, while the US dollar and supplies are down. However, the opinions between market experts on whether the Market Bitcoin and Capital are really different.

Some delightful declare that Bitcoin separated from risky funds and joined gold as a safe haven. The reason is not difficult to see: Lately, Bitcoin and Gold are the only great property with positive pricing movements. 21. April 2025. years, the price of gold for the first time, it crossed the Mark $ 3,400. This unseen set is widely observed in response to growing insecurity among investors, inventories and altcoins passed through the wave of liquidations and some strongest decreasing years, and encouraged the shift towards gold.

For most of the 2020s, the price of gold crashed between $ 1,800 and $ 2,000, starting only in the fall of 2023. Macrotrends indicates a correlation between the price of gold and global economic uncertainty. Another correlation is harmonizing gold prices with the level of American national debt.

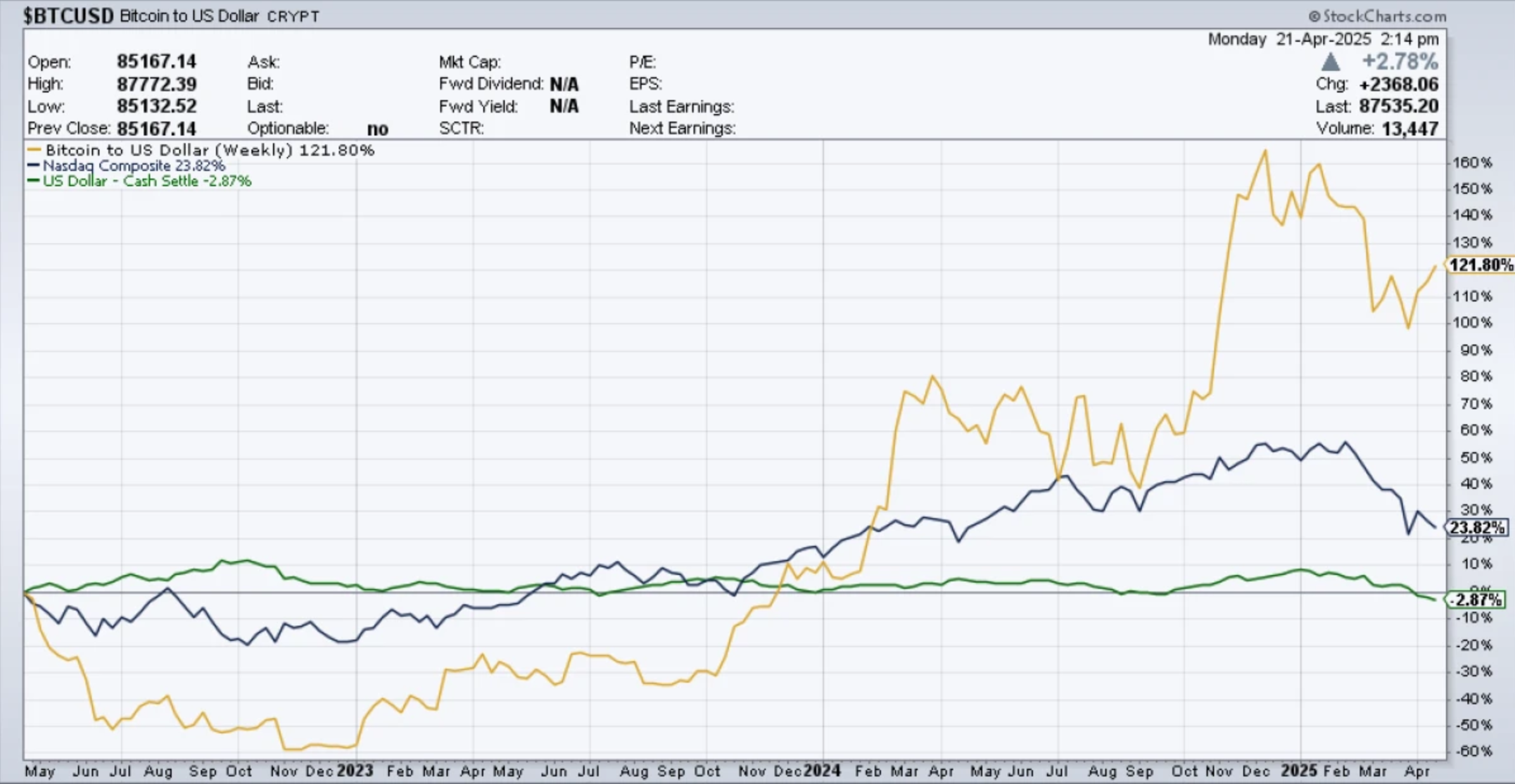

Gold is traditionally seen as a safe refuge. Bitcoin has a similar reputation for many investors. However, the inflow of institutional investors who purchased Bitcoin led to the relative harmonization of the BTC price with inventories. Some watched Bitcoin as an expansion of the stock exchange, but with a higher price amplitude. The chart below clearly shows that in the past three years, Bitcoin is accelerated by the Napada of Movement, imitating its rises and falls with sharper swings.

Experts remain divided into this. For example, in March 2025. The Blackrock was Robbie Mitchnick stated that Bitcoin was still consistently moving in line with Wall Street, although it is predict It will happen as more long-time investors start trading Bitcoin.

Was Bitcoin really break down from the stock?

The second half of April in April is Bitcoin and Gold, while the main property, including supplies and USs, has declined. 22. April, Bitcoin received 7%, while the funds of the risk ended the day on the negative territory.

Many in the CRIPTO community reacted quickly, declaring that Bitcoin was passing into stock separation. Bitcoin and gold seemed to confirm their roles as safe refugees, while other assets appeared all risky and more vulnerable in the middle of political and economic turmoil.

However, the discussion of whether Bitcoin would really assess. Although there is no doubt that Bitcoin is currently different from inventories and dollars, some market observers warn that this could be a short-term phase. They suggest that it is also seemed to be made of water, Bitcoin can eventually follow the spread of the abdomen on the stock exchange. In other words, the current divergence could only prove temporary fluctuation.

Some commentators attributed to Mitting Bitcoin on reinforced liquidity, encouraging investors to “ignore noise”. They claim that Bitcoin can move through the technical activated drivers even when the news is mixed. The others pointed out the macro titles as the main driver of the demand for Bitcoin, including the comments of the American Secretary SCOTT Bessent, which suggests possible de-escalation between the US and China. Meanwhile, the titles reported that India considered sanctions against China, and China herself appealed to countries to refuse cooperation with the US

In this light, Mitting Bitcoin seems to be at least partially guided by news. Such main economic prerex often does not happen often, suggesting that current separation can be more excellent than permanent. Bitcoin could have submitted a market stock market after trading tensions.

Why is separation important?

We asked our market analysts and traders, Ekta Mouriato enlighten our readers on this topic. Here’s what she replied why separation is important and whether she sees the current separation as a temporary or long-term phase:

“Bitcoin’s separation comes at a time when the biggest correlation of crippouts with gold. The BTC wipe against Nasadak marked the pivotal shift in Bitcoin’s price of this cycle, returning the narrative of” digital gold “.

30-day coefficient of 30 days Bitcoin correlation with gold is from -0.7 in March 2025. To 0.45 and rise Since April 2025. For traders, this signals the opportunity to enter long positions; Opens the re-examination door Bitcoin’s elimination of $ 109 thousand.

The divergence of Bitcoina from the stock exchange feels more like a temporary blip, not constant shift. Market volatility, tariff tensions and weak earnings rattled American acts, while Bitcoin grabs offer as a safe haven for traders. However, structurally, BTC has always stood; It is a high beta funds with a growing complaint for portfolio diversification. Both retail and institutional traders should watch Bitcoin for its evolved risk profile / reward and gain. “

https://crypto.news/app/uploads/2024/06/crypto-news-bitcoin-option61.webp

2025-04-25 21:21:00