Incolar’s inflation data may get rid of BTCO

Written by Francisco Rodriguez (at all times ET unless it is indicated otherwise)

Bitcoin (BTC) (BTC) (BTC)) may change the recession this week.

In recent years, the number of January was tending to show a significant price rise. Last year, for example, the month’s data put an end to a series of low readings, and the repetition of a pattern was also seen in 2023. Because companies often evaluate their costs and increase prices at the beginning of the year, such as It indicates Wall Street Journal.

Lori Logan, President of Dallas, Chairman of the Models Council in Dallas, said in a speech last week that the expected higher inflation report can indicate that “monetary policy has more work to do it.” The Federal Reserve has already indicated that it does not rush to control interest rates after 100 basis points of discounts last year.

It also takes into account the definitions of the Trump administration, with the Federal Reserve in Boston Noting a possible increase of 0.8 % To Core PCE, the inflation measure focuses on the Federal Reserve. However, in 2018 and 2019, definitions had minimal effects.

On the other hand, the soft inflation report It can be useful for asset risks Including bitcoin. The low number is likely to be expected to be expected to raise the rates of interest rate, which may weaken the US dollar index and reduce cabinet revenues, Omkar Godble said from Coinsk.

Meanwhile, the demand for the largest encrypted currency bears strength. Only this week, Japanese mobile phone game revealed plans for About $ 6.6 million accumulates BTC value, while Kulr Technology Group The encryption bias increased To 610.3 Bitcoin.

Likewise, the Goldman Sachs 13F file shows that the banking giant has greatly increased its instant bitcoin and the ether qualifiers in the fourth quarter. And do not forget the bitcoin purchases close to the strategy.

Bitcoin, which measures the difference between the BTC price on the American Stock Exchange and Binance, Recently turned negativeThe suggestion that American merchants are cautious about the upcoming inflation report.

Caution comes amid the increasing opposite winds of the encryption market, which may have reached the top of its session. BCA Research recently shared a note with customers who refer to the registrar ETF and Memecoin Craze are warning signals.

There are warning signals elsewhere, with a recent JPMorgan report indicates this The growth of the ecosystem for encryption slows down Last month, while total trading sizes decreased by 24 %. The activity is nevertheless before the place it was in front of the United States elections. Stay on alert!

What do you see?

- Checks:

- Macro

- February 12, 8:30 AM: The American Labor Statistics Office (BLS) launches a consumer price index report in January (CPI).

- The basic inflation rate is Ami Pets. 0.3 % against the previous. 0.2 %

- Yoy Est. 3.1 % against the previous. 3.2 %

- The rate of inflation is 0.3 % against the previous. 0.4 %

- Yoy EST inflation rate. 2.9 % against the previous. 2.9 %

- February 12, 10:00 am: Federal Reserve Speaker Jerome Powell submits his semi -annual report to the American House of Representatives for Financial Services. Livestream link.

- February 13, 8:30 am: The American Labor Statistics Office (BLS) launches the product price index report (PPI).

- The basic ppi mom 0.3 % against the previous. 0 %

- Basic ppi yoy estt. 3.3 % against the previous. 3.5 %

- PPI mom EST. 0.3 % against the previous. 0.2 %

- PPI yoy prev. 3.3 %

- February 13, 8:30 am: The US Department of Labor launches the weekly request for unemployment insurance for the week ending February 8.

- Initial unemployment allegations. 216K against the previous. 219k

- February 12, 8:30 AM: The American Labor Statistics Office (BLS) launches a consumer price index report in January (CPI).

- Profits

- February 12: Cotton 8 (hut), Before the market, $ 0.05

- February 12: Irene (Irene), Post -market, -0.01 dollars

- February 12: Redit (RDDT), After the market, $ 0.25

- February 12: Robinhood Markets (Hood), after the market, $ 0.41

- February 13: Coinbase Global (currencyAfter the market, $ 1.89

- February 14: Remixpoint (Tyo: 3825)

- February 18: Coinshares International (Sto: cs), Before the market

- February 18: Seemler Scientific (SmlrAfter the market

Symbolic events

- Voices of governance and calls

- Morpho Dao discusses 25 % Decrease On both Ethereum and Al Qaeda after another reduction, it entered into force on January 30.

- Dydx Dao votes on Dydx Treasury Subdao Take Control Stdydx Within the treasury of the protocol community and any symbols that accumulate through automatic vehicle bonuses.

- Dow curve votes on Increase the 3Pool amplification coefficient To 8000 more than 30 days and raising the official to 100 %. To improve liquidity, as part of the experiment, 3Pool will have higher fees while strategic reserves provide fewer fees.

- February 12 in the evening: Display (offer) to Broadcasting of Amnesty International Discord Ama session.

- to open

- February 12: Aethir (ATH) to open 10.21 % of the $ 23.80 million trading offer.

- February 14: The sand box (sand) to open 8.4 % of the trading offer of $ 80.2 million.

- February 16: Arbi (ARB) to open 2.13 % of the trading offer of $ 42.93 million.

- February 21: Fast code (FTN) to open 4.66 % of $ 78.8 million trading offer.

- Launching the distinctive symbol

- February 12: Avalon (AVL) to be included on the Bybit.

- February 12: Game7 (G7) to be included on the Bybit, Gate.ioHashkey, Mexc, XT and Kucoin.

- February 13: ETHEREUMPOW (ETHW) and MATAC are no longer supported in Deribit.

Conferences:

Coindsk consensus in occurrence Hong Kong on February 18-20 In Toronto from 14 to 16 May. Use today’s code and save 15 % on passes.

Distinguished symbol speech

Written by Shuria Malwa

- The car code in the Central African Republic has decreased by 95 % from the peak of the two, with the marketing of the market now about $ 40 million.

- The car was released late on Sunday and was promoted by the President of the Republic

Fausin-Archengéra as a origin can help finance public facilities in the poor country. - Touadéra claimed that Car Token’s revenues are used to rebuild and supply a secondary school, whose details were not in general.

This high school is deteriorating quickly over the past few years, endangering students at the risk of losing their access to education. With help $ Meme, we are able to support the reconstruction and furnishing of the school, giving students an opportunity for a better future. pic.twitter.com/ifpsbprousoi

-Faustin-Archenge Touadéra (fa_touadra) February 10, 2025

Locate the location of the derivatives

- After the statements of the Federal Reserve Chairman, Jerome Powell, hinted at a potential delay in quantitative mitigation until interest rates approached, market morale became more cautious, which led to a sharp decrease in open interest across Altcoins.

- Rocket Pool, Venice Taken and TST have seen the most important drops, with an open interest rate by 44 %, 32 %, and 30 %, respectively, over the past 24 hours.

- On the other hand, Binance Ecosystem Momntum has gained momentum, with a prominent bnx. BNX’s open interest increased by 57 % to $ 166 million within one day, while its price jumped by 18 % to $ 0.868.

Market movements:

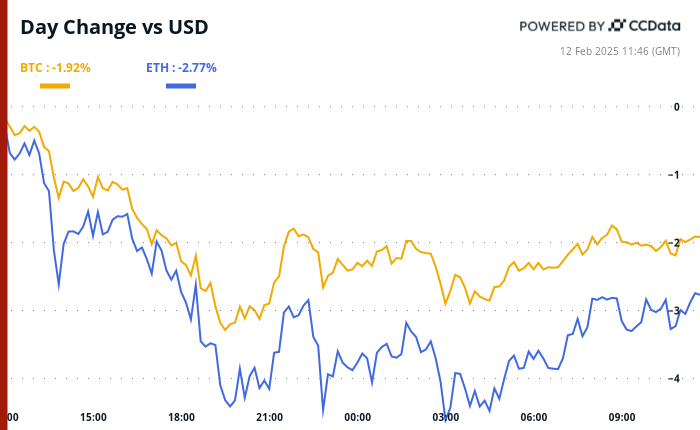

- BTC decreased by 0.4 % from 4 pm East to 96,029.62 dollars (24 hours: -1.97 %)

- ETH decreased by 0.17 % at 2,619.27 dollars (24 hours: -2.87 %)

- Coindesk 20 increases by 0.66 % to 3,178.54 (24 hours: -2.74 %)

- The ETHER CESR 5 -bit compound rate is increased to 3.1 %

- BTC financing is 0.01 % (10.95 % annual) on Binance

- Dxyy has not changed at 107.99

- Gold decreased by 0.15 % at $ 2908.1/ounces

- Silver decreased by 0.22 % to $ 32.16/ounces

- Nikkei 225 closed by 0.42 % in 38,963.7

- Hang Seng +2.64 % closed in 21,857.92

- FTSE has not changed at 8,781.91

- EURO Stoxx 50 is 0.1 % to 5,396.36

- Djia closed on Tuesday +0.28 % at 44,593.65

- S & P 500 closed unchanged at 6,068.5

- Nasdak closed -0.36 % in 19,643.86

- Closed S&P F/TSX Complex -11 % in 25,631.8

- S & P 40 America America closed +0.65 % at 2,444.58

- The treasury rate in the United States increased for 10 years 1 bits by 4.54 %

- E-MINI S & P 500 Future decreased 0.16 % to 6,082.5

- E-MINI NASDAQ-100 did not change in 21,777

- The E-MINI Dow Jones Industrial Indust Index decreased by 0.21 % at 44,616

Bitcoin Statistics:

- BTC dominance: 61.32 % (+0.06 %)

- ETHEREUM ratio to Bitcoin: 0.02728 (+0.33 %)

- Retail (seven -day moving average): 800 eH/s

- Hashprice (Stain): $ 53.56

- Total fees: 5.25 btc / 505,060 dollars

- Cme Futures Open benefit: 167,470 BTC

- BTC at gold price: 33.1 ounces

- The maximum BTC market against gold: 9.4 %

Technical analysis

- Dogecoin reaches support and resistance to the critical point of 25 cents, with prices expired around this level since February 3.

- Traders may see Divergence Divergence (MacD) from DOGE, which tracks relative changes in prices over specific time periods.

- The index is heading up with clear purchase sizes since February 3, which indicates a gathering if the MACD line crosses over zero.

Encryption

- Microstrategy (MSTR): closed on Tuesday at $ 319.46 (-4.53 %), an increase of 0.82 % at 322.30 dollars in the pre-market.

- Coinbase Global (COIN): Closed at $ 266.90 (-4.75 %), an increase of 0.88 % at $ 269.25 in pre-market.

- Galaxy Digital Holdings (GLXY): Closed at $ 26.54 (-2.57 %)

- Mara Holdings (MARA): Closed at $ 16.02 (-4.42 %), an increase of 1 % at $ 16.18 in pre-market.

- Riot platforms: closed at $ 11.14 (-4.21 %), an increase of 0.81 % at $ 11.23 in the market before the market.

- Core Scientific (Corz): Closed at $ 12.26 (-4.37 %), an increase of 0.24 % at $ 12.29 in pre-market.

- Cleanspark (CLSK): Closed at $ 10.28 (-8.05 %), an increase of 0.39 % at $ 10.32 on the market before the market.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 22.34 (-4.94 %), an increase of 0.12 % at $ 22.46 in the market before the market.

- Seemler Scientific (SMLR): Closed at $ 46.98 (-5.3 %), unchanged in the market before the market.

- Exit (exit): closed at $ 49.16 (-3.95 %), unchanged in pre-market.

Etf flows

BTC Etfs Stain:

- Daily net flow: -56.7 million dollars

- Cutting net flow: 40.46 billion dollars

- Total BTC Holdings ~ 1.174 million.

ETH ETFS spot

- Daily net flow: 12.6 million dollars

- Cutting net flow: 3.17 billion dollars

- Total Eth Holdings ~ 3.785 million.

source: Farside investors

It flows overnight

Today’s scheme

- Ethereum has decreased to 17 in terms of weekly revenues in all sets of episodes and applications, with explicit health by network health of $ 7 million.

While you sleep

- Bitcoin may see CPI gains in the soft United States, and a significant increase in the risk of BTC has appeared unlikely (Coindsk): Bitcoin and other risk assets may get a batch if the consumer price index report shows soft inflation, but Trump’s tariff is likely to curb greater price cuts and put brakes in a sustainable march.

- Trump to benefit (Coindsk): It was reported that Brian Quintns, former commissioner for commodity futures trading committee (CFTC) and encryption cannons, was chosen by President Trump to be the agency’s head.

- Bitgo Crypto Custing Bitgo weighs the public subscription as soon as this year (Bloomberg): Crypto Custodian Bitgo is studying the general subscription for the second half of 2025, where he joined companies such as Gemini and Kaken, which is also expected to display this year.

- Why inflation report today is especially important (The Wall Street Journal): American inflation data in January – with the release of the consumer price index today, PPI tomorrow, and PCE on February 28 – are important to predict the policy of the Federal Cash Reserves because companies usually raise prices at the beginning of the year.

- Sanguine Powell knocks bonds and gold (Reuters): The Senate Certificate in Shari Powell on Tuesday, which reduced the urgency in interest rates unless inflation weakens or weakens the labor market, and increases the treasury and dollars revenues, with the sending of oil and gold prices.

- China technical shares enter the Taurus after the Deepseek (Financial Times): Chinese technology shares increased by 20 % in one month of AI’s Deepseek recovery on the confidence of investors in Internet companies, which helped the Hang Seng Tech index of Nasdaq 100.

In the ether

Update (Feb 12, 12:03 UTC): GPS adds derivatives.

https://cdn.sanity.io/images/s3y3vcno/production/7a44ab0417f1fd7ee6ab10690ae3d1b6a4dd0a80-700×430.png?auto=format