How New Application Application Revolution Signals Large Fintech Cripto Landgrab – DL News

- Fintech firms are increasingly muscle in crypto.

- Their interest in the sector will become at the collision course with industrial companies.

The version of this story appeared in our Roundup Bulletin 28. Marta. Apply Here is.

Hello, Eric Here!

The revolution comes for Customers CRIPTO companies.

On Tuesday, UK Neobank rolled a new mobile app for its CRIPTO Exchange Revolution X, with the specified goal of “causing other exchanges”.

The application will initially be available only across Europe, but a spokesman He told me This revolution aims to eventually start it in the United States.

“Cripto is a key area for the revolution”, Bank Challenger said In an advertisement for a new crypting product marketing manager.

Such as thrown gantletleti, it is a large “UN.

Neobank offered CRIPTO services since 2017. years, but it is They are increasingly pushed into the space.

Last year, he increased his crypt team by 60%, vanilla Virtual cards who have allowed customers to pay crypt and posted an Annual profit Of $ 545 million, partially driven by her crypt by pushing.

And it’s not alone challenging Cripto-native firms like coinbase, the largest US Cripto Exchange.

Stock trading apps such as wobbly and ethoroa, which submit To go to the United States in the United States in the United States, and the Digital Paypal Payment Provider is all muscular in the crypt.

It became more attractive for these companies to do it after US President Donald Trump promised To relax cryptic laws as part of his offer to transform the country into the crypto capital of the world.

These firms have a weight to be thrown.

On Friday, Revolut’s top investor Schroders upgraded Evaluation of the share in Fintech by about 80%, which would be assessed by the Challenger bank to 48 billion dollars. By comparison, the market capitalization of coinbase is about $ 48 billion, while Roby’s $ 38 billion.

Fintechs also have an advantage based on customers, one-finals for each financial need of customers. Cripto is just one service among many, some warm sauce for customers looking for another way to invest.

In February Note, Morgan Stered Analysts mentioned the history of regulatory regulatory regulatory regulatory regulatory and name recognition will allow him to catch the actions of the crypto market. A similar argument can be easily made for other Fintechs.

Nicklas Nilsson, analyst at the research company Globaldata, He told me In December, 2025. will be a year when newer new rivals of Jostle is in position at the crypto market.

“We will see all the more sophisticated crypto products from Fintechs,” Nilsson said.

Use a revolution to launch your new mobile app this week, Nilsson’s predictions seem to be realized.

To a great extent this week, Osato Avan-Nomaio It reports that Nigeria has accused the Minister of Information to the world’s largest cheating in the world of terrorists to use their infrastructure to facilitate payments.

Alex Gilbert He was sitting in a confirmation of Paul Atkins who heard as Trump’s choice to keep the Securities and Exchange Commission.

The millenniums are a key driver behind the growth of crypt’s companies. However, the upper financial markets in the UK guards warned this week that too many young people invested in digital property without understanding risks.

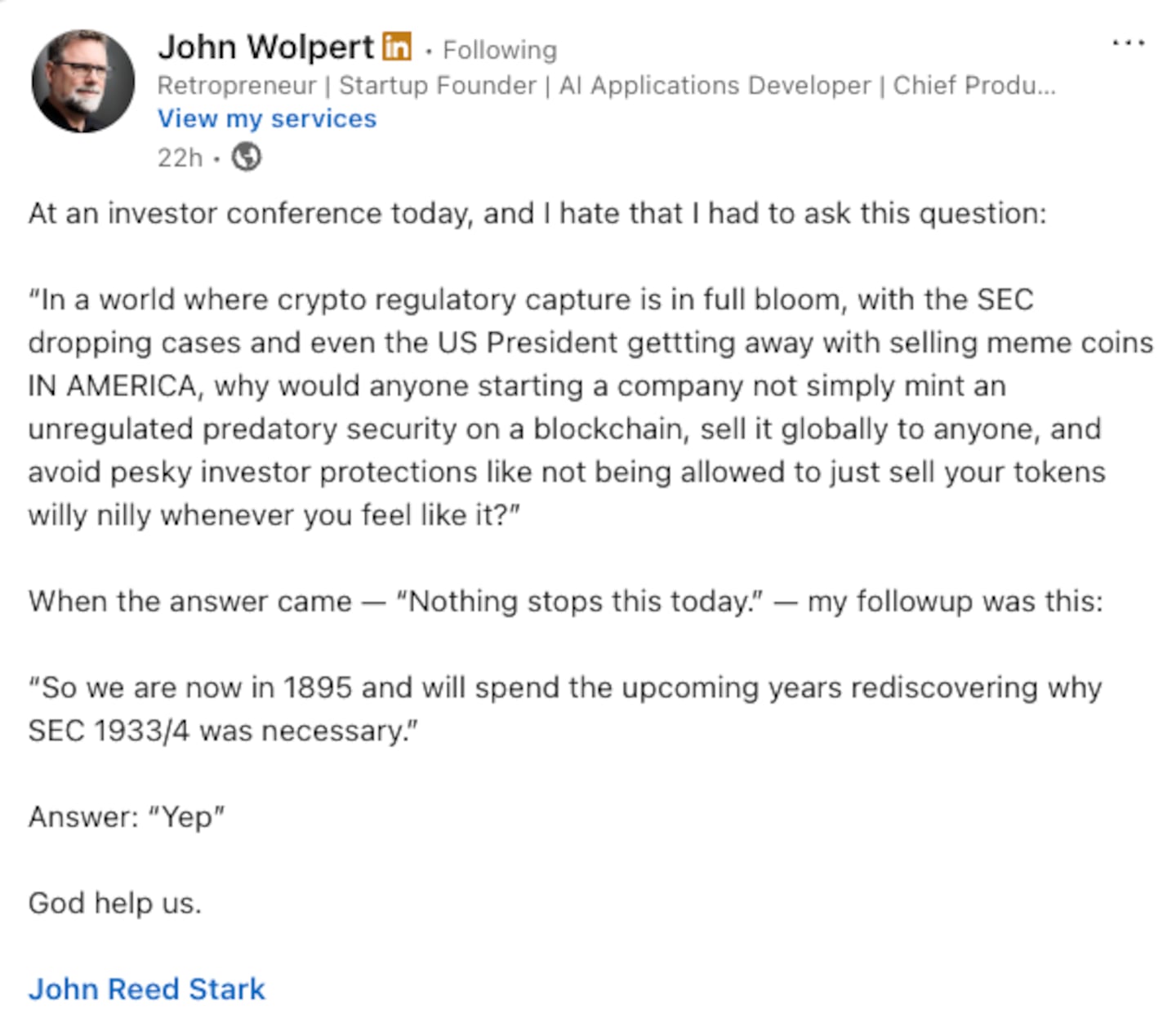

Post of the week

Crypto Backer Atkins’s nomination As Sec Chair is the latest sign that Trump aims to facilitate the regulatory pressure on the crypto. However, not everyone doesn’t think that stopping Cripto Crackdown Baden Era is a good idea.

(TagstotRanslate) Revolution (T) Robinhood (T) Fintech

https://www.dlnews.com/resizer/v2/UXDSCVJ75JGAJOHSTRA7RCIU6E.jpg?smart=true&auth=cbc1df85b271e8c847f5bb965b4c74819f924e7930ccc7b29723a05bb80b2de6&width=1200&height=630

2025-03-28 19:26:00