Gold Bull CEO Annual Address

VANCOUVER, British Columbia, Dec. 19, 2024 (GLOBE NEWSWIRE) — 2024 is proving to be a transformative year for us. Golden bull. Although the price of gold remains strong, sentiment among the small resources sector remains weak, which in turn weakens access to capital. For this reason, during the year Gold Bull focused on conducting due diligence on several companies regarding potential mergers or acquisitions. Gold Bull focused on evaluating companies capable of generating cash flow. Cash intended to fund development of Gold Bull’s Sandman assets, located in Nevada, into production in the near term.

At 10y In December we announced this Borealis Mining Company (TSXV:BOGO) (“Borealis“) Gold Bull has entered into a definitive agreement (“practical“) where Borealis will acquire all of Gold Bull’s shares. A Gold Bull shareholder meeting will be held to approve this transaction in February 2025. Gold Bull’s Board of Directors unanimously supports the approval of this transaction.

This transaction provides Gold Bull shareholders with a significant premium with an acquisition price of approximately $0.60 per Gold Bull share or a ratio of 0.93 Borealis shares per Gold Bull share, based on a 20-day volume weighted average price (VWAP).

The Borealis Mine and Sandman projects are synergistic as the Borealis ADR (carbon adsorption recovery plant) facility could be used to process carbon carried from the Sandman project as proposed in the Sandman 2023 PEA by an external facility. Other benefits that Gold Bull shareholders benefit from include:

- Immediate and significant upside for Gold Bull shareholders with an acquisition price of approximately $0.60 per Gold Bull share representing a significant premium to Gold Bull’s recent VWAP.

- Meaningful ownership in the strategically combined entities providing continued exposure to the Sandman and Big Balds projects as well as Borealis’ fully licensed Borealis mine including its ADR plant, also located in Northern Nevada.

- The cost of replacing the Borealis Mine infrastructure is higher than Borealis’ current market value.

- Increased trading liquidity, capital market presence, and enhanced pooled value proposition.

- Near-term revenue generation from the Borealis mine may limit shareholder dilution in the future.

- The combined entity creates increased financing options to push Sandman near-term into production organically.

We are convinced that combining forces with Borealis will unlock significant value for all stakeholders, as Borealis has committed to developing the Sandman project through a feasibility study with the aim of bringing Sandman into production as soon as possible to feed its ADR facility. The intended outcome is to build the combined entity into a mid-tier gold producer with a focus on Nevada.

Sandman Project, Nevada

The 2023 Sandman Preliminary Economic Evaluation (“PEA” or “scoping study”) investigated the feasibility of a small-scale start-up operation (the proposed mine) at Sandman, with an emphasis on existing gold resources.

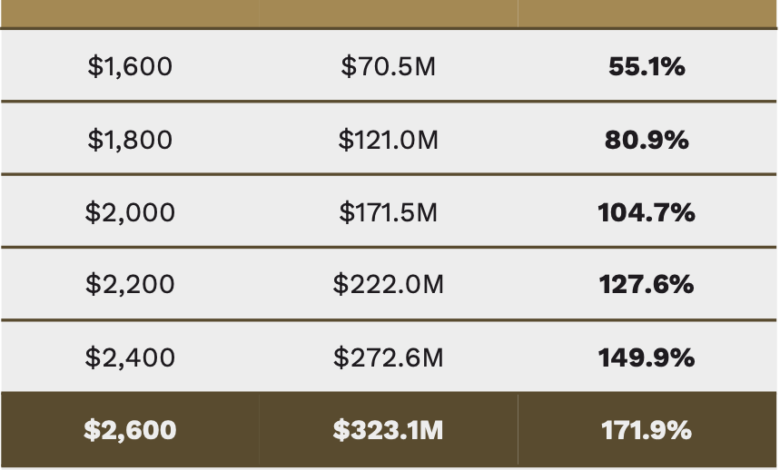

PEA looked at a conventional heap leach mining operation targeting the production of 38,000 ounces of gold per year over a 9-year operation. Due to the nature of the Sandman (outcrop) deposit, a production rate of 2.2 million tonnes per annum and a very low strip ratio of 2.2:1 extracts an average gold grade of 0.73 g/t gold (majority oxide). The economy using a gold price of $1,800 per ounce for this scenario is considered strong, with a 81% internal rate of return (after tax) and Net present value of US$121 millionwith only A Payback period 1.3 years (After tax). The capital required to build the above mine is modest with an initial pre-production capital of US$31.5 million and a second phase capital of US$19.7 million, paid from Phase 1 mining revenues (undiluted). LOM’s total capital is US$51.3 million, for an all-in sustaining cost of $1,337 USD Per ounce of gold (after tax).

Sandman economics are most sensitive to the price of gold. In our PEA, we used a gold price of $1,800. If we use today’s gold price of about $2,600, the net present value jumps from $121 million to $323 million with an IRR of 171.9% after tax: Gold Bull’s Sandman project revised for PEA Phase 2.

We should not forget that huge exploration potential exists in Sandman and in the surrounding area Additional exploration is warranted Since not all deposits are sealed and require further drilling as well as step drilling for sterilization.

Borealis has indicated its intention to begin a feasibility study for Sandman in 2025 following the deal.

the pictures: Gold Bull & Borealis management teams on site inspect the Borealis mine and supporting infrastructure at the Borealis mine, near Hawthorne in Nevada, USA.

I would like to take this opportunity to thank everyone who has supported Gold Bull this year: our communities and stakeholders, the Board of Directors, the Accounts and Management team, advisors and consultants, and the supportive stockbrokers, and I would like to acknowledge the dedication of our technical team in Nevada. The team is led by Regina Molloy. Most of all, thank you, our shareholders, for your continued support. I encourage you to learn more about the Borealis team and its origins via their website: Borealis Mining Company Limited | High quality exploration potential On behalf of Gold Bull, we wish you a Merry Christmas and a happy, safe and healthy New Year.

Sherry Leyden – President and CEO of Gold Bull Resources Corp.

About Sandman

In December 2020, Gold Bull purchased the Sandman project from Newmont. Gold mineralization was first discovered at Sandman in 1987 by Kennicott and the project has been explored intermittently since then. There are four known, limited drilling gold resources located within the Sandman Project, consisting of… 21.8 million tons @ 0.7 g/t gold for 494,000 ounces of gold; It comprises an indicated resource of 18,550 carats at 0.73 g/t gold for 433 koz gold as well as an inferred resource of 3,246 carats at 0.58 g/t gold for 61 koz gold. Many resources remain open in multiple directions, and the bulk of historical drilling has been conducted to depths of less than 100 metres. Sandman is conveniently located about 30 km northwest of the mining town of Winnemucca, Nevada.

Gold Bull is based on its core values and goals that include a commitment to safety, communication, transparency, environmental responsibility, community and integrity.

Qualified person

Sherry Leyden, BS Applied Geology (Summa Cum Laude), MAIG, a “Qualified Person” as defined in National Instrument 43-101, has read and approved all technical and scientific information contained in this press release. Ms. Leyden is the company’s CEO. Cherie Leeden has relied on resource information contained in the Technical Report on the Sandman Gold Project, filed on SEDAR on October 27, 2022 and prepared by Steven Olsen and Jerrod Eastman, who are qualified persons as defined in National Instrument NI 43-101. Both Mr. Olsen and Mr. Eastman are independent advisors and have no affiliations with Gold Bull other than an independent advisor/client relationship.

Cautionary note regarding forward-looking statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains certain statements that may be deemed “forward-looking statements” with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “anticipates,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” and “projects.” . , “likely”, “indicates”, “opportunity”, “possible” and similar expressions, or that events or conditions “will”, “will”, “may”, “could” or “should” occur. Although Gold Bull believes that the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and are subject to risks and uncertainties, and actual results or facts may differ materially from those in the forward-looking statements. Data. These material risks and uncertainties include, but are not limited to, the Company’s ability to raise sufficient capital to fund its obligations under its royalty agreements going forward, to maintain its mineral holdings and concessions in good standing, to explore and develop its projects, to repay its debt and for general working capital purposes. ; changes in economic conditions or financial markets; The inherent risks associated with mineral exploration and mining operations, future prices of gold and other minerals, changes in general economic conditions, the accuracy of estimates of mineral resources and reserves, the possibility of new discoveries, and the Company’s ability to obtain the necessary permits and approvals required for exploration, drilling and development of projects, and if they are obtained These permits and approvals must be obtained in a timely manner that is consistent with the company’s plans and commercial objectives for the projects; the Company’s overall ability to monetize its mineral resources or conduct merger and acquisition transactions; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, reliance on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates, opinions or other factors change.

https://www.juniorminingnetwork.com/images/jmn_feeder/globe/2024/GBRC7921a5e7-6821-4432-8293-5b6c98e64185-859px.png