Franklin Templeton supports BTC Defi Push, noting a “new benefit” for investors

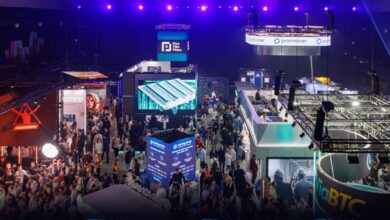

As the Dubai Token2049 Dubai Conference concludes, one of the main meals is that the narration about Bitcoin (BTC) quickly expands beyond its traditional role as a value store for a possible Defi asset that competes with Ethereum and Solana.

Players of industry such as Franklin Templeton view this development as a positive step, confident that it will enhance Bitcoin’s benefit without alleviating its basic attractiveness as a store of value as the owners of Al -Aqsa fear.

“I don’t think focus on Defi Bitcoin will reduce or complicate Bitcoin’s basic narration,” explained Kevin Farllly, director of Blockchain Venture Capital in Franklin Templeton and Digital Asset, during his main speech at the Bitlayer side event this week. “Instead, it expands the Bitcoin benefit for a specific type of investors – one with sufficient technical development to improve the needs of the wallet, safety or designated portfolio.”

“These users do not replace the” value store “thesis, they are building it.” “It is not a narrative dilution, it is a developed in infrastructure.”

Franklin Templeton is an investor in Bitlayer, which is Bitvm, which works as a bitcoin calculation while maintaining Mainnet safety. It provides features such as faster processing processing, low fees, new functions such as smart contracts or advanced Defi integration, which are not supported by Bitcoin Bitcoin alone.

ETF from Franklin Timbalon (EZBC) has recorded net flows of $ 260 million since it first appeared on January 11 last year. As of May 1, the Fund’s contract is 5,213 BTC, which is more than $ 500 million of management assets at the current Bitcoin price of more than $ 97,000.

Expansion beyond the value of the value of the value

The original vision of the Satoshi Nakamoto of Bitcoin Blockchain was driven by creating a centrally decentralized financial system that enhances financial sovereignty and privacy, eliminating the need for transactions brokers. Over the course of a decade, however, the original encoded currency in Blockchain, Bitcoin, has quickly got a reputation with digital gold – a reliable store of value – this novel has served it well.

The maximum Bitcoin market today exceeds $ 1.9 trillion, which represents approximately 60 % of the total market value of digital assets of $ 3.12 trillion, per Coindesk data. It is the most liquid encrypted currency, with an average of one billion dollars in daily trading volumes around the world, and many companies listed to the public have adopted as a backup asset.

Moreover, many organized alternative investment vehicles associated with BTC have appeared over the years, allowing traditional participants in the market to be exposed to encrypted currency.

For example, according to the Farside Investors data source, the SPOT 11th Investment Funds listed in the United States raised nearly $ 40 billion in investor money since they appeared for the first time in January last year. Meanwhile, Eter ETFS has seen a little clear flows from 3 billion dollars.

The strong institutional absorption of BTC is widely attributed to its simple and convincing narration as digital gold – one of the origins that are easy to understand in relation to complex platforms such as Ethereum or Solana. These platforms support a wide range of decentralized financing applications (Defi) and use cases, helping the original code owners to gain additional returns at the top of the immediate market holdings.

“In essence, he is seen as a value -made digital store,” Farily told Coindesk. “Unlike the most complex encoding projects, Bitcoin does not require a deep technical interpretation – it has a clear and focused purpose. Clarity may be part of which makes it easy to understand, easy to model, and with ETF, easier to customize it.” In a natural scene full of complexity and speculative novels, Bitcoin offers a kind of sign – and it seems increasingly increasing, “it has continued.”

As a result, many fundamentalists resist the idea of providing similar features to Defi directly on Bitcoin Blockchain, for fear of eliminating its basic attractiveness.

The Bitcoin Davi was around at the Bitlayer event and the main Takeen2049 conference, highlighting the increasing demand between BTC holders for additional production opportunities.

“Bitcoin Defi with a confidence bridge to a minimum, the products of sustainable return for ONSAIN Bitcoin holders are very important for Bitcoin asset holders and network governorates.”

“In Bitlayer, we build important infrastructure that can enable Defi Bitcoin through our Bitvm technologies,” he added. “It can make a lot of Bitcoin Defi use of Bitcoin’s interesting assets more valuable, giving users more reasons for retention and use in the future.”

BTC Defi can also benefit mining workers, who are rewarded for mining blocks. While the reward for each block decreases every four years, increasing the activity on the series driven by Defi applications can help compensate for this reduction through the higher transaction fees, support and sustain the network safety.

“More importantly, Bitcoin Defi also offers new transactions fees-a decisive component of sustainability and security in the long term of the network with the continued decrease in mass bonuses.”

HU expressed a similar opinion, saying that the hibbed networks mean that miners need more activities, such as Bitcoin Defi, to remain profitable.

“We will need to build a good bitcoin rolls with the ability to verify safety, which can contribute to returning to Bitcoin,” he pointed out.

https://cdn.sanity.io/images/s3y3vcno/production/8f765f79e7fe7fff68a4a79ac875a5954b9079c6-8660×5773.jpg?auto=format