Ethereum Cena could collapse 25% as metrics in the chain disappointed

The Etherum price collapsed over 52% from its highest level in December, and techniques and metrics on the chain indicate more shortcomings in the close term.

Ethereum (El) He jumped to $ 4.105 in December and traded $ 1,970. March 1. March. This collision 52% makes it one of the worst blue-chip coins in the market.

Ether crashed as a concern about her future. Only this week, Standard authorized analysts have reduced Their assessment for 60% of 10,000 to $ 4,000, stating growing competition from layers-1 and layer-2-2-2-effected layer.

Layers-2 networks on Ethereum, such as a database, the database, arbitrums and optimism, have driven more users on their ecosystems on their lower fees. For example, Deficiency data data This Decade Ethereum protocols managed a volume of $ 9.8 billion in the last seven days.

Arbitrum processed $ 2.87 billion, while the base had $ 2.8 billion. In the past, this volume would be processed online Etherum’s Mainnet.

Etherum also sees intensified competition from layer-1-like networks like Solana (Salt) and BNB chain. The BNB smart chain protocols have ruined DEX volume worth 13 billion dollars in the last seven days.

Etherum is also not expected to be the main user in emerging technologies like the actual world tokenization due to larger fees and more slowly. Instead, developers can opt for use of other scalable and cheaper networks like mantra (OMA) and BNB chain.

Etherum has weak metrics on chain

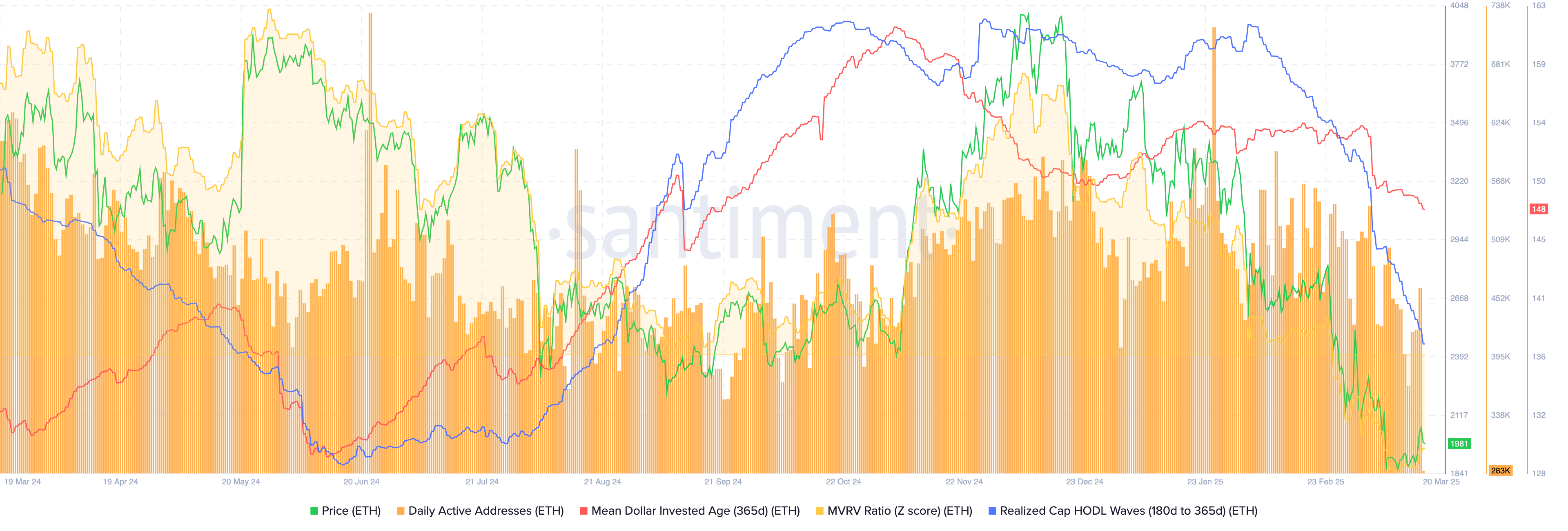

More data shows that the number of active addresses at Ethereum has reduced in the last few months. The chart below the santiment shows that Etherem had 461,000 active addresses on Wednesday, with 717,000 earlier this year.

Another significant data point is Etherum realized drop Hodl wave, which is shown in blue. He collapsed at the lowest point since August last year, a sign that long-term holders began selling.

The 365-day middle dollar invested age or MDIA, which calculates the duration that every coin remained at the address and all the money used to buy, fell to his September Pades.

Technical analysis of Etherum

The daily shows that in the last few months in the last few months. This drop started after forming a triple sample to $ 4,000, with a cleaver at $ 2,120.

Then he founded a death sample as a 50-day and 200-day average crossings crossed each other. This cross often leads to more intact for a moment. Also, popular oscillators such as relative power indices and percentage oscillator declined.

Therefore, the coin will probably continue to fall until the sellers target a psychological point at $ 1,500, which is about 25% below the current level.

https://crypto.news/app/uploads/2024/11/crypto-news-is-Ethereum-dying-option03.webp

2025-03-20 20:56:00