DXI, American bonds of yield demolished, m2 cash supply rises

The price of Bitcoin remained under pressure in the last few months, because she crossed the technical bear market after she fell by 20% from her highest level this year.

Bitcoin (Btc) And other Altcoyins have important catalysts that can push it in the next few months. He traded $ 90,000, more than about 15% from the lowest level this month.

First, American bonds returns this year from its highest level. The reference yield for ten years fell from 4.8% in January to 4.24%. 30-year and five-year yields also slipped in the last few weeks.

It makes a bond falling is a sign that the market predicts that the Federal Reserve this year will deliver more interest rate reductions. Economists prices in three cuts after the United States has published a series of weak economic data. Consumer and Business Trust Palo After Donald Trump added Tariffs on key US trading partners.

The labor market also softened, and the unemployment rate increases 4.1% in February and Nefarm of payment lists that increase by 151,000, which is lower than expected 159,000.

The US dollar index and bond returns crashed

Second, US dollar index or DXI moved to free fall. She fell in the last five consecutive days, crossing lower than $ 103.78, the lowest level from November. This year is down for almost 7% of its highest level. The price of bitcoin is often well for the rise of American dollar and bond, because it sets the chances of reducing interest rates.

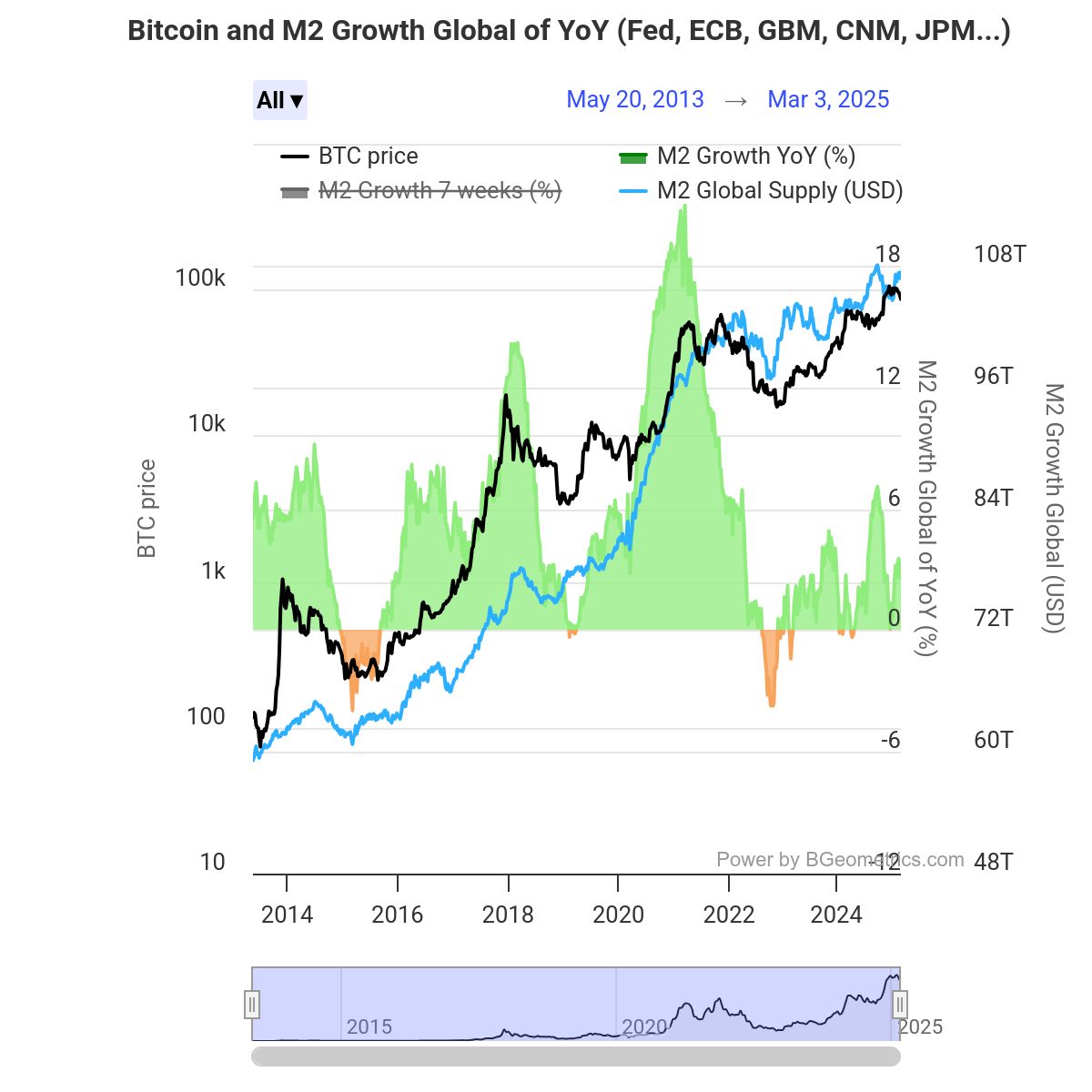

Furthermore, global money supply is expected to continue to increase how the government increase their consumption. Germany aims to spend billions of dollars on their defense, while China announced plans to strengthen spending. The graph below shows that Bitcoin has close correlation with global m2 cash supplies.

Technical price analysis for Bitcoin

The daily shows that the price of BTC held stable in the last few days, increased $ 78,000 last week at $ 90,000.

Bitcoin stayed above the upward trendline, which connected the lowest anger since August last year. He also crossed over 50-day moving average and weak, stopping and reverse point Murrey Math line.

Therefore, Bitcoin should rise above a strong, swivel and reverse level to $ 93,750 to confirm the Bulletle interruption. This price coincides with the highest level this week. The movement above that level will point to more profits, potentially at $ 100,000.

https://crypto.news/app/uploads/2025/03/crypto-news-Mount-Rushmore-Bitcoin-option03.webp

2025-03-07 17:08:00