Curve gave token eyes more low as a key zone

The worm shows a strong potential to continue the trend after finding support in the Great Zone of Construction. With a strongness that starts in the price structure that formed a potential higher low living room, all the eyes are, whether the bulls can defend this area and push the chart in the next leg.

The curve gave token (Worm) It begins to show signs of potential structural shift at the daytime. After sustainable hazard, the recent price of prices began consolidation above the zone packaged with technicality. These zones usually attract a strong interest of customers and, when defending successfully, they often mark the main points of turning. This analysis investigates key levels and signal traders should follow to confirm the formation of greater low and probability of continuing.

Key technical points

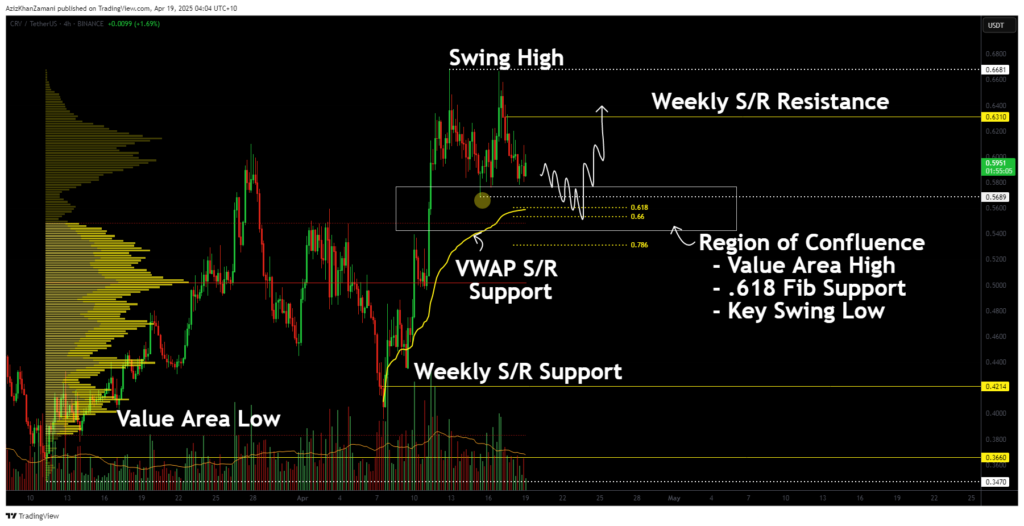

- Support zones in the conflicts: The price is above the value area low, a grid of 0.618 Fibonacci, and local swing is low, proposes that customers actively defend this level.

- Senior low adjustment: The coarse moves in the key low, and then regain the extended holding above it, it would confirm the strength and continuation of the trend.

- Strength and VVAP alignment: Spread amount of purchase, with the VVAP compliant in this zone would add a judgment on the potential Bullish interruption.

The CRV’s structure Graph chart builds classic larger low formation, which is often seen in the early stages of bikala trend. What makes this laying especially persuasive is the great estuary of key technical levels celebrated in one zone. The area of the value is low, obtained from the analysis of the scope profile, aligns closely with a coating of 0.618 fibination from the dictated leg. This overlap was further reinforced by local swing low, giving bulve solid defense foundations.

It zooms lightly, this sitting plant only above weekly support / resistance, proposes that the market has a memory at this level. The consolidation held immediately above this zone shows that customers enter the entry, but they have not yet made a decisive gurma. This type of slow, grinding of action often precedes with explosive moves, especially if it swing low briefly (capture liquidity), and then quickly approaches.

The key trigger to confirm would see the area of value high in the same zone acts as support. This would indicate that market participants not only defend the base, but also a comfortable transhipment to indentations. In order to play this effectively, the volume should constantly start constantly increasing as the price returns and holds above this range. VVAP, also aligned near the level of FIB, adds further weight to the bakery case.

What should I expect the following

If customers continue to defend the current region and pressing above the value area highly with the growing jacket, the worm could target significantly higher levels in the short term. The structure suggests that accumulation, and any regain local pipors can cause the trend to move. For now, the focus remains at higher is locked, and if it is held, the break could be around the corner.

https://crypto.news/app/uploads/2022/04/Curve_Finance.jpg

2025-04-18 22:02:00