(Bloomberg) – months, Cripto-Loving investors have sanels billions in use strategies with hope that Donald Trump will eliminate regulations on their support and server in the new world of digital prosperity.

Most reading from Bloomberg

Now, day traders who are betting on cryptocurners carry the burden of purifying Wall Street Selloff – one guided by fears due to the Trump, an agenda that causes a policy that encourages the trumpet. Digital funds are especially weak, partly due to disappointment that Trump Industrial Policy does not live in expectations.

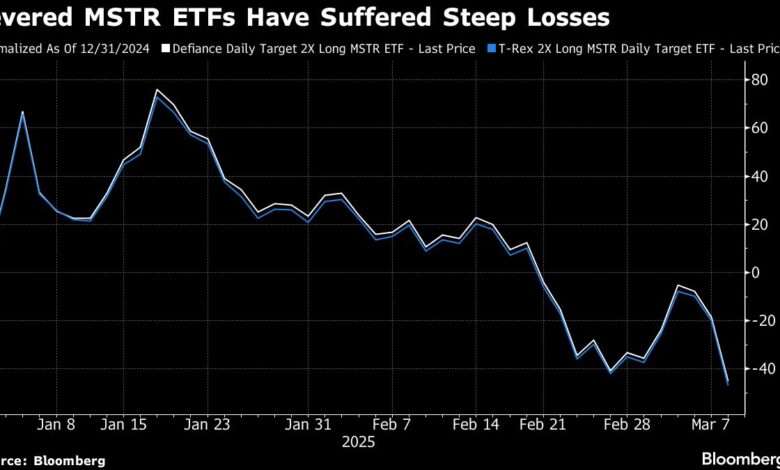

Just look at the trading exchange cohort that wants to offer the return of Sokovina to various virtual currencies or crypts themes. Among the largest losers are two ETFS that offer roles on the strategy – Bitcoin household company, which was previously known as a microstrate – both of them were more than 30% during the day.

Another fund that doubles the Daily Return of the Inc. Department of Departments. – Favorite mediation of cryptian retailers – fell 40%. Bitcoin policies lost approximately 20%, and those who focused on ether declined 26% due to a wider village in the digital token market.

Property and companies that are supported by means of supported can be viewed as the formation of the crypto-commercial complex who was turbocharging in the awakening of Trump return to the White House. The President accepted the digital property industry, promising strategic reserve filled with tokens and flammable speculations with the launch of his own Memecoin. Bitcoin and other crypturarzers rose after the election.

However, among trump industrial insiders for which the actions of Trump’s administration so far are at cryptocurrencies so far. Recent news about strategic cryptorervera are composed of garbage after the president said less famous Tokens KSRP, Sol and Ada will be involved. Then the top of the Cripto Summit in the White House last Friday “showed that Exercise Textbook PR – is great on optics, the light on the substance,” Donovan Choi and Macaulea Peterson in blocks wrote. “We are still in the waiting and seeing mode.”

ETFS also suffers steep loss as investors – amazed Trump trading threats, and Elon’s musk is a harmonization of federal workforce – they tend to make a growing list of reception signals. The S & P 500 shed all winnings from the elections and speculatory names that were part of the “Trump Trump” go and faster.

The growing number of economists are ringing alarm bells about potential recession. At the beginning of the month, the JPMORGAN CHASE & CO. Model. He has shown that the market probability of economic falls based on 31% climbed at 31%, while a similar model Goldman Sachs Group Inc. He also suggested that the risk of edge recession. In such an environment, “You will not want too much exposure to high betas, such as these” construction of ETFS, Todd Sohn said, older ETF strategic strategy.

The president also suggested that current market turbulence could be part of the necessary period of “transition”, because his new policies work through the economy. In this context, it is understandable that speculative names are “aggressively impossible,” said Michael O’Rourke, the main strategist market to Jonestreding.

“These are ordained bets, literally gambling in the most valuable aspects of the capital market,” he said. “The way they rose sharply to indicate that they can crash just as fast, if not faster.”

Two funds for taking on a company previously known as the microstrateus so far so far so far so far so far so far so far so far so far is about 45% so far. GraniteShares 2K Daily Long Long Coin Cons (Ticker ConL), which seeks to offer 200% Daily Coinbase Global Inc., Cripto Exchange is from the end of 2024. Years refused more than 2024. Years. And the double long-lasting Fondo Bitcoin, which was 35% lost at the Battle.

Bitcoin sank at four-meterly low from $ 76,606 on Tuesday morning in Singapore before the loss was palged.

Trust of $ 50 billion ETF (IBIT) Video is your biggest weekly inflow at the beginning of December, when more than $ 2.6 billion entered, according to the data composed by Bloomberg. February, on the other hand, marked the first and the largest month of the casting fund with almost $ 800 million. So far, another $ 130 million in March.

Also forcing: high octane technician and means associated with musk – once observed as a retail attack, among the retail audience gave proximity to the technology of billionaire proximity to the White House. The TSL Bull 2X Deadlifers (TSLL), which performs Tesla known volatility this year, this year is more than 70%, in the middle of overturning for EV manufacturer’s actions. And funds that want to give a double return Palantir technology Inc. Sports losses of about 20% on Monday.

Perhaps no other fund includes the idea of crypto-and musk complexes, as well as Ark Innovation Cathie Wood ETF (ARKK), given its declared affection innovative technologies. The fund has lost 16% per year to date. And investors withdrew about 240 million dollars, which comes after two possession of the year outflow of almost $ 4 billion. Arkkov Gornji farm include men’s Tesla, as well as actions of a tavern, wobeth and palant.

“There are many long-term growth drivers for the CRIPTO, especially the pro-crypto administration. But the CRIPTO is still highly risky, and not rationally,” Rokanna Islam, head of the industry head and research in TMKS Vettafi. “And it’s hard to have faith in crypt when there are so much concerns throughout the wider market.”

– With the help of Isabelle Lee.

(Updates to add Bitcoin price in the twelfth paragraph)

Most read from Bloomberg Businessweek

© 2025 Bloomberg LP