Collections for wrought-up to US Cripto Reserve News: Is the overestimate coin?

Stock Exchange should benefit from the swing criptocurrency

- The possibility of US strategic reserves in Cripto brought renewed attention to the cryptocurrency.

- Coinbase is likely to benefit from increased CRIPTO legitimacy, as it did in K4 when the trading volume increased after the November elections.

- Although the assessment of a tavern is elevated, Cript’s swing should drive gets for the company.

Coinbase recently was in a reflector light, not only for its business performance, but also for its role on the regulatory scene. On Monday, President Donald Trump elaborate In the plans for the United States to create a “CRIPTO strategic reserve”, a national existing gold and nation oil reserves. The news caused a short increase in the cryptic price, used platforms such as coinbase, which are very related to the health of the wider crypto market. On the announcement day, the actions of the waiter pointed as much as $ 235 per share, but quickly withdrew at about $ 205 to the end of the session, deleting most today’s gains.

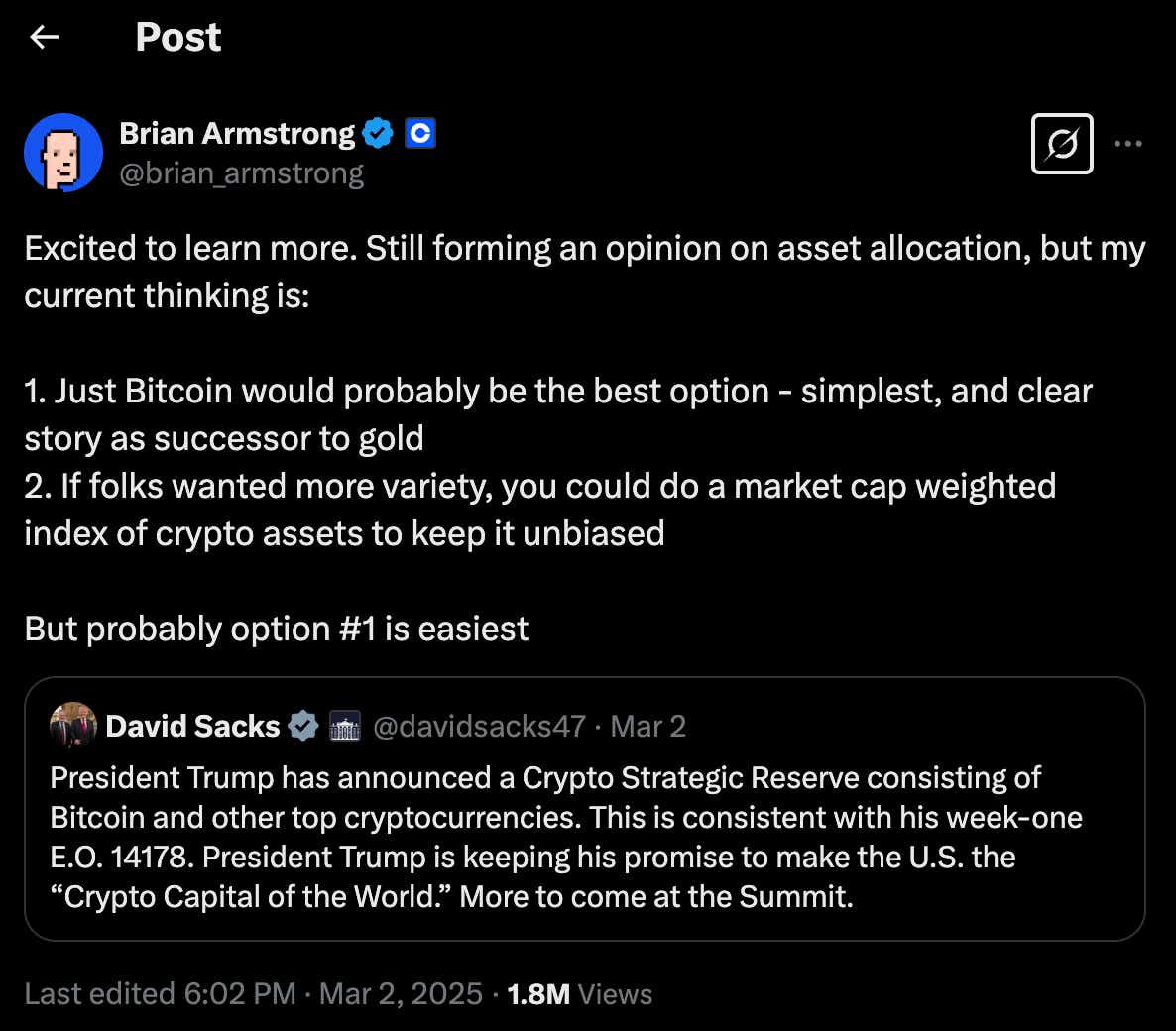

Although the plan attracted attention to the cryptocurrency and helped legitimizing industry, especially with the potential pavement of stablecoins and other digital assets, it also caused that witty discussion. Critics argue that the plan could be left to ethical and legal issues, especially if it includes risky cryptocurries, “altCOINS” supported private entities. Brian Armstrong, General Manager of Coins, expressed concern on social media, advocacy A more conservative approach is focused on Bitcoin, which was shown as the most stable assets for the National Reserve.

Trump’s Proposal CRIPTO reset is a mixed conversation around the role of digital assets in the global economy. However, for coinbases, news also brings opportunities and challenges. On the one hand, the establishment of a crypto strategic reservation will further legitimate digital assets, potentially launch demand for platforms such as coinbase. On the other hand, it could intensify competition in the sector as well as other exchanges and platforms located for its share in the growing market. The addition of this complexity is the potential of increased instability, which could also create risks and rewards for coinbass due to relying on the daily scope of trading.

Given this dynamic, the question remains: does the coin represent a convincing opportunity for investments? To explore this, to dive into company operations, recent earnings performance and its assessment.

A new era for coin and crypto

Coins operates at the crossroads of technicians and finance. As one of the largest and most basic cripptocurrent exchanges, it is the basis in the field of digital property, providing users with the possibility of buying, selling and storing cryptocurries such as Bitcoin, Ethereum and all larger lists of Altcoin. In addition to its basic trading platform, coins offer services in stalemate, detention and even stablecoins. Services Company not only in finance, but also in technology, where it uses advanced systems to power its business.

While coinbase still receives most of the income from transaction fees, his efforts to diversify them began to submit fruits. In addition to services such as a tavern of one and downtime, the company works to reduce its reliance on a often volatile trading model. These initiatives have proved successful, as they reflected the latest earning report, where a coin that noticed significant growth in her subscription and revenues from services. This company signals began to spin towards a more stable and repetitive income basis.

Robust earnings, but income relies on the transaction volume

In mid-February, coinbase reported impressive earnings for K4 2024, Setting Income Of $ 2.27 billion – 130% increase from the same quarter of the previous year. The company’s net income rose to $ 1.3 billion, considerably in more than 273 million dollars, earned a year ago in K4. This revenue growth was launched by crypto gathering support in activities after the election 2024. Years. Therefore, angry volume of trading has significantly increased in K4, and coinbase is reporting 185% of transition processors to 439 billion dollars. And as you would expect, the transaction based income and based on 1.56 billion dollars), beating analyst assessment to a wide margin. The company also saw strong growth in its subscription and revenues from services.

Despite these robust numbers, post-earning rally was short-lived, and sharing a taverns move lower during the second half of February. With rivals who acquire the traction and fear erosion, the stock of the waiter could not keep their gains, illustrates poor trust among investors in the middle of intensifying competition. For example, platforms like Slave (Hood) Reposes most of the market, drawing users with lower fees and experiencing in sleeves. Revenue revenue regarding Robbhood exploded By 700% last quarter, suggesting that the company is a serious threat to Coinbase domination.

Another factor that puts pressure on the stock of the Coinbase is an uncertainty that surrounds its almost concept. Despite the optimism of the company on switching towards several various income flows, its alleged guidelines hints on the potential growth in growth. This led to a doubt that the company’s path will be as simple as its previous success can propose. As the crypt world develops and competition ramp, coinbass could find its next chapter more complex than expected. This perspective emphasized the performance of post-earnings – since mid-February until the beginning of March, the actions of the Tavern fell are approximately 30%. As a result of that withdrawal, the market capitalization of the waitress fell from almost $ 80 billion up to $ 56 billion.

Swing could win the day

The valuation of the coin is not an easy task – especially in quickly moving the market such as digital property, where the possibilities and volatility are driven. Traditional metrics paint a picture of a costly stock. Coinbase’s P / E ratio Of the 22, it is significantly above the median sector of 13, signals that investors are betting on a larger, they grow faster. Similarly, the relationship between the company and sales (EV / S) and the ratio of prices and sales (P / S), both floating about 8 are well above the average of the Sector 3.

While the sublime coinbass valuation may seem in the first term, there are excessive reasons. The company firmly incorporated as a leader in Kriptou, strengthened by its market dominance and a reliable security reputation. Yes, competition is heating the crossover, it must be moving – but the waite still gives solid growth, especially in K4, thanks to its premium offer. The company switch according to the diversification of its income, especially with production services such as stems and USDC stablecoins, is starting to be paid, providing more stable footers in rapidly moving the market in rapidly movement.

Analysts allows an important lens to overview the valuation of Coinbase. 27 analysts covers Stock, only 10 feet is “Buy” or “overweight”, while you assign “hold” or “sales / less weight”, reflecting a generally cautious view. However, the average price of a price of $ 335 per share in accordance with its current price of $ 220 per share, sets an intriguing issue. This exclusion between analysts and goals of the price suggests that, despite a cautious attitude, the market can underestimate the potential of Coinbase, leaving space for considerable upside.

This paradox can probably be attributed to Crypt’s swing from the election of 2024. Years. Using the support of President Trump for the industry and his recent announcement of his plan to create crypto strategic reserves, digital assets have acquired legitimacy. These events should benefit from coinbase by expanding the adoption of digital assets and expanding the market reach of the sector – providing further justification for an elevated target goal. Simply put, it can be swinging in the wide crypto sector, instead of the basics of the waiter, which drives the stock price.

Investment water

Announcing a plan for the American strategic reserve created by a lot of buzzings, but was played as typical “Sales News”. The initial excitement caused a short increase, quickly followed by pulling, underline the inherent instability of digital property. Although this short-term DIP has created some uncertainty, long-term momentum in cryptocurlenition is still undeniable. Digital funds may have lost some soil, but they also solved at more attractive levels, potentially setting the stage for another round of purchase.

And when the next wave of growth arrives, the coins are likely to be one of the main users. However, with an elevated estimate, the stock cannot be for everything. If you are a solid believer in the future of digital property, the waite could still be solid investments despite its premium price pipe. On the other hand, if the CRIPTO Sale continues, a more favorable entry point could appear, expand the inventory appealing to the wider range of investors.

At the end of the day, exceptional resistance to the sector makes it firm to bet against, and it extends to coinbase-one of the most famous names in the industry.

Andrew Prochnov, A box for happiness Analysts-large, has more than 15 years of experience in trading global financial markets, including 10 years as professional options traders.

https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt631a9d6899508927/67c9b29824e52c0835e72797/mountain_bitcoin_andy.png?width=1200&height=628&disable=upscale&fit=bounds#time=1741273627

2025-03-06 17:34:00