Coding has become the latest favorite cryptocurrency buzzword on Wall Street

(Bloomberg) — Bitcoin’s record rise has revived hope that the digital ledger technology underpinning cryptocurrencies will revolutionize everything from home ownership registration to bonds.

Most read from Bloomberg

Tokenization, or the process of creating digital representations of real-world assets on a blockchain, has become one of the buzzwords this year in both traditional and crypto finance circles. This excitement is reminiscent of the hype a few years ago about using blockchain for everything from tracking lettuce at Walmart Inc. To digitize stocks that proved premature.

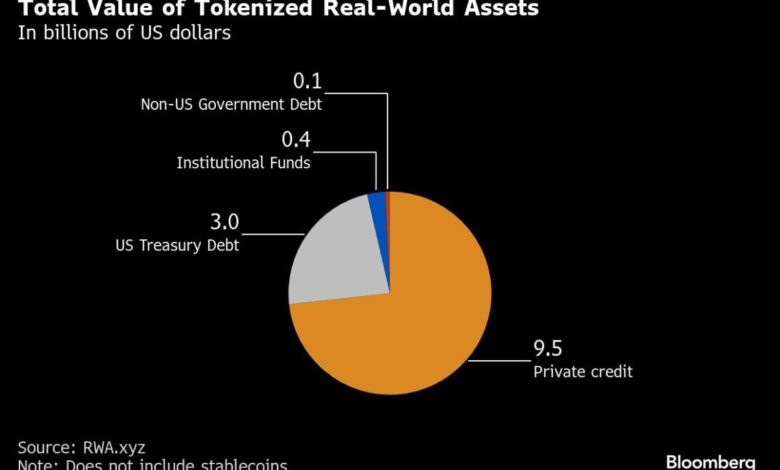

For years now, asset tokenization has been tagged outside of stablecoins that serve as an alternative to actual currencies in cryptocurrency trading. Only about 67,530 parties — mostly institutions — own token assets that are not stablecoins, according to data tracking website rwa.xyz. Researcher Opimas says that only 0.003% of the total value of global assets has been converted into tokens, and many of the companies behind these projects are on the verge of going out of business.

The unfavorable regulatory system in the United States was largely to blame. For years, regulators have encouraged banks to avoid cryptocurrencies and related risks. While tokenized securities run on the blockchain and adhere to the same rules as traditional securities, regulators often lump them in with cryptocurrencies as worthy of heightened scrutiny. Many financial services providers have chosen to stay away, investing instead in areas such as artificial intelligence.

This is starting to change, as President-elect Donald Trump plans to establish a more favorable regulatory regime for cryptocurrencies, and with the world’s largest asset manager, BlackRock, launching a money market token fund this year. This prompts others to follow him.

“They now feel like they can do something and speed up their schedule a lot, whereas before they were just watching,” said Charlie Yu, co-founder of rwa.xyz. “They make things happen.”

Bracing for more traction, card network Visa Inc., in October, rolled out a platform that allows banks to issue tokens based on fiat currencies. In November, stablecoin issuer Tether launched a tokenization platform. In the same month, Mastercard announced that it had connected its token network with JPMorgan Chase to settle cross-border business-to-business transactions on the bank’s blockchain-based platform, Keenexis, and sees an opportunity to offer these payment plans to more financial institutions.

“This is a clear trend that will continue to evolve and open up a lot of new business models. This trend is here to stay,” said Raj Damodharan, executive vice president of blockchain and digital assets at Mastercard. Kinexys already supports about $2 billion in transactions daily, according to JPMorgan.

https://s.yimg.com/ny/api/res/1.2/bH9fZZ5TtopBj4QB5.intw–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MTk-/https://media.zenfs.com/en/bloomberg_markets_842/fc0c7f13f1a70d15caf7be4e7d651390