Citigroup see StableCoin publishers among top American treasury holders until 2030. Years

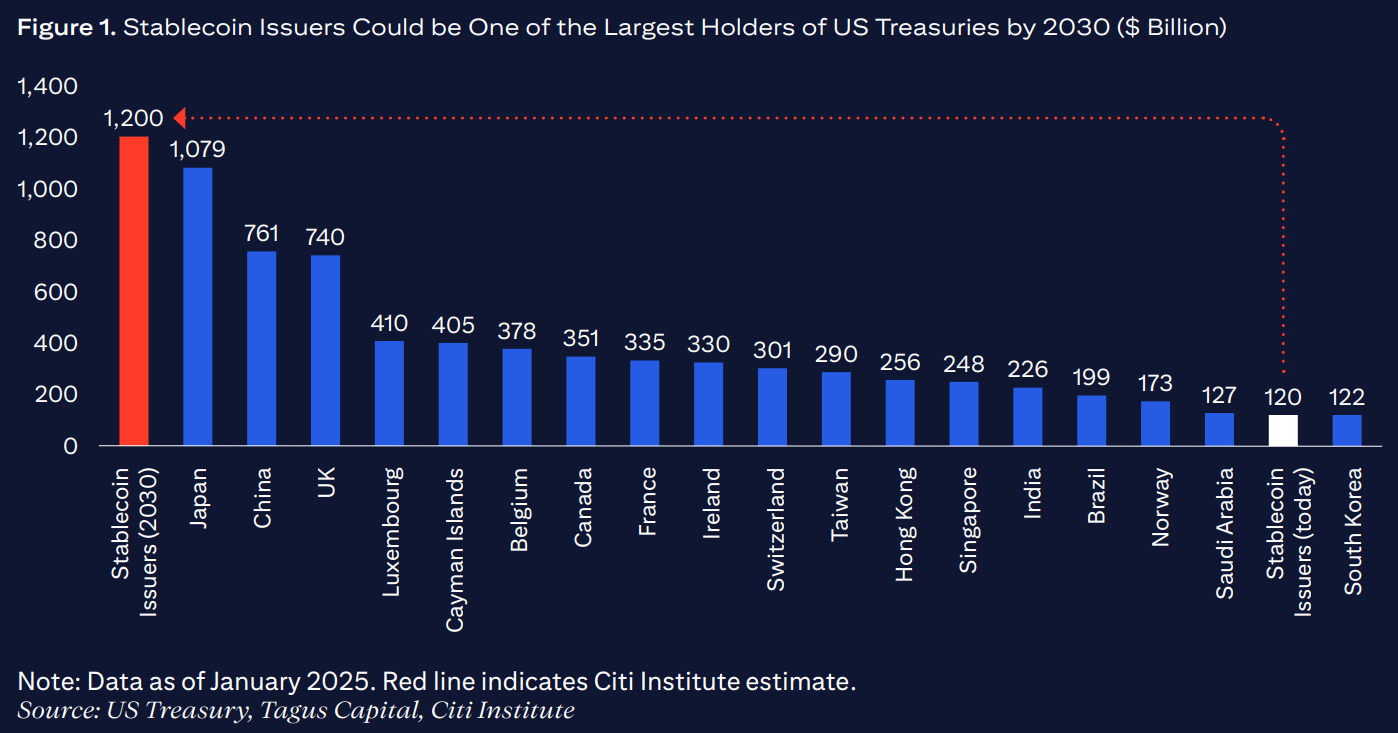

The Stablecoin Regulation could add over $ 1 treasurement in demand of vault and publishers among the biggest owners of the US government debt, Citigroup says.

Stablecoin Publishers could become some of the largest seeders of the American cash register until 2030. If the US adopts the regulatory framework, Citigroup said in a New reportadding that more than $ 1 trillion for extra demand for the cashier could come from stablecoese growth.

According to New York Bank, a supporting American regulatory framework could lead to Stablecoine to launch demand for “dollar and means without risk inside and outside the United States”

“Creating a US regulatory framework for Stablecoin would support Dollar’s demand and outside the United States, StableCoins will need to buy American cash registers, or comparable low stempercon, against each stablecon, against each Stablecon, against each Stablecon, against each Stablecon, against each Stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon, against each stablecon.”

Citigroup

Citigroup’s basic case assumes that Stablecoin issuers “could retain more than one unique competence today,” adding that if the basic case has a truth “can become one of the largest arrangements of American cash registers in relation to any other jurisdiction today.”

However, the bank analysts also highlighted risks and challenges. Since Stablecoins “carry the risk of” Failure of a Great Issuer “can cause the infection effect,” reads in the report. Citigroup also noticed that Stablecoins De-Pegged “about 1,900 times in 2023. years, with about 600 of them, it is big stablcoins.”

Geopolitical risks can also slow the global adoption of stablecoin as stableCoins “cannot see the instrument of hegemony in dollar,” Citigroup warned, adding that “creator policy in China and Europe will be main to promote digital currencies or stablecoins.”

https://crypto.news/app/uploads/2025/03/crypto-news-Stablecoins-are-inevitable-option03.webp

2025-04-25 09:23:00