Check check-a bitcoin for a corrupt system

If you watched the markets and feel like they lost the plot, you are not alone. Bitcoin jumped over 6% within 24 hours, breaking over $ 94,000 23. April, the highest level of March, before easier to easier to easily. He broke out of his month of long trading as much as Macro uncertainty reached the peak.

Signals clashed. Logic folded. Common correlations began to help themselves. Bitcoin, the digital jam was once written off as pure speculation, rose. Stock Rose, then fell, reacts more to tweets and titles than to earnings or data. The dollar slid, with the US dollar index (DXI) that floats close to 99, down over 105 at the end of March. And Fed found himself back in the center of attention, lasting a verbal barrage from the president, who branded the chairman “Major Loser”.

It is tempting to read the growth of insulation crypto. But what happens is higher. It is a symptom of a market system where risk, safety and strategy are no longer playing rules.

When the risk becomes a risk

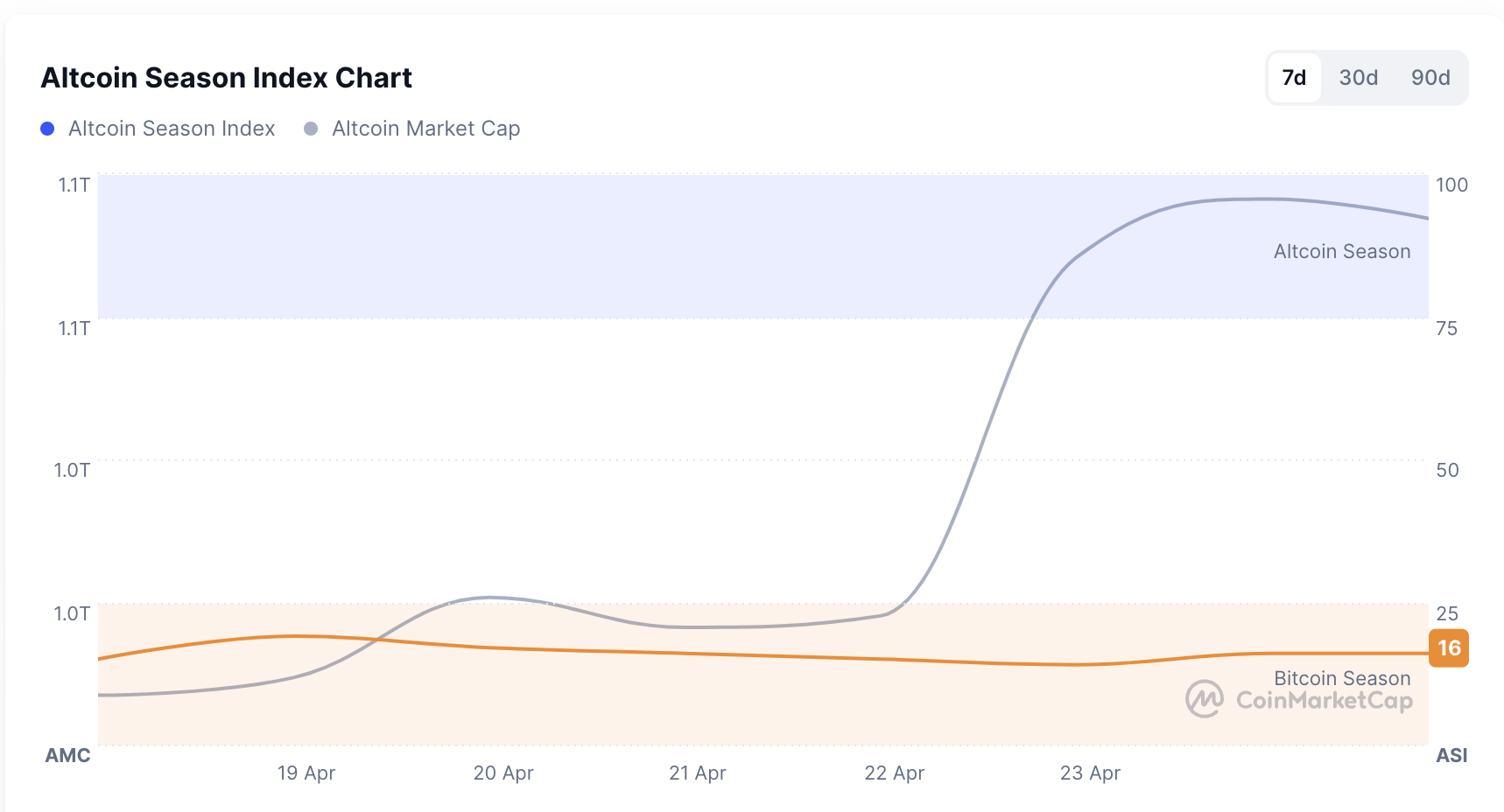

Usually, when you fall and geopolitical tensions, investors occur in safe refuge, cash, treasuries, gold. No bitcoin. And we are here again: BTC is in one day, and the broader AllCoin market followed, overall AllCoin Market Cap rose of 997.56 billion dollars from 22. to $ 1.04 million. April.

The Altcoin Season Index is sitting in 12, evidence that this is a guy who led Bitcoin. Investors do not turn into crypt for fun. It will be protected against policies, confusion and dollars that lost a grip. And against the feeling that no one, even Powell or Trump, knows what’s next happening next.

Bitcoin finally goes up his way?

A month ago, a 30-day Bitcoina correlation with S & P 500 floating about 0.9, almost was not different from the main indices of shares. But until 22. April, that image was sharply declined. The correlation with the S & P 500 fell to 0.35, with Nasband composite up to 0.34, while the correlation with gold climbed 0.39.

But here is where it becomes interesting: gold spiked for a record $ 15,500, 22. April, and then fell sharp as if the dollar was stiff and supplies rose. Bitcoin didn’t blink. He held his ground, resonating equality more than violence. Takeaway is that Bitcoin does not copy gold or technique. Interpret the noise in real time, with its kind of logic.

This makes the Bitcoin Divergency all the shock in a macro landscape shaped by protectionism, tariff threats and mixed messages on trade. After Trump imposed erasing 145% tariff on Chinese goods, Beijing rested and accused the US unilateral, demanding all tariffs. SCOTT BESSENT SECRETARY rejected Any plan for unilateral cuts, inviting the current setting of “EMBARG equivalent” and “unsustainable”.

Meanwhile, Trump accumulating to tariff de-escalation, calling 145% “too high” and promising that it will be “very beautiful” in China, only that China rejected all mitigations as “unfounded”. The result? Market confusion and diplomatic gratings. Investors saw Gold Spike before they retreated while the combined comments were amplified by the dollar and supplies.

In the midst of Chaos, Bitcoin remained stable. Like a growing generator, it kept the company while sovereign assets were distorted with every title. Improper from politics position, shows what it means to cross outside the old scenario. So, Bitcoin finally went his way? It may definitely say it too soon, but the signs suggest that it begins.

Powell, Politics and Fragility of Fed

The political targeting of central banks is a new terrain. The Fed Chair Jerome Powell is under the direct attack of Trump, which accuses him of political sabotage and hints on his replacement.

However, in the middle of Backlash, Trump also tried to reassure the market, guidance He “No intention” Sheeting chairs Fed – at least for now. Mixed messages only increase the atmosphere of insecurity – forcing investors to think about where monetary policy can go when the judge is derived from the field.

Meanwhile, Bitcoin, hold on for incima more. It is not for investors to suddenly believe crypto more – they can only trust more than the title.

Bitcoin greed returns

In addition to the breakup of Bitcoin, the investor feeling was harshly overturned. In just one week, the crypto market feeling has jumped with fear to greed. From 24. April 2025. years, Bitcoin Fear & Storel Index sites at 63, firmly in the territory of “Greed”, while CNN’s fear and greed meter for US acts remains in the territory of “fear” at 28.

But this is not a classic euphoria of bull, it is optimism for survival. Investors don’t buy Bitcoin because the future looks great. They buy it because everything else looks up.

This makes shift in correlation with gold even deeper: it signals that greed does not encourage momentum, it is encouraged by macro anxiety.

End of market logic?

This could be the right delay: the cycle may be dead. We used to expect the gathering of a postwarva, Altcoin season and hippered. But this rhythm seems to be there, and investors don’t play an old game.

Instead, they are prepared for a different, one where the dollar weakens, trade frequent, central banks become politically bojan, and the only rational bet is something that is located outside the system.

Final thoughts

Markets usually move on patterns. But what if the sample is now a dislocation itself? What if the power of Bitcoin is not a sign of investor confidence, but due to the disappointment of investors?

That is what makes this moment so important. It’s not just a rally. It’s a referendum.

And for now, Bitcoin, that old symbol of rebellion, could be the closest thing we had to rationality in the world in which everything remained crazy.

https://crypto.news/app/uploads/2025/03/crypto-news-US-Bitcoin-reserves-option03-1380×820-1.webp

2025-04-24 22:48:00