Cardano, Ripple Slide AS Bitcoin Traders Waiting for “Coin-Flip” meeting

Cardanova Ada and KSRP led Tuesday, because traders await the outcome of the appointment Federal Federal Reserve (FOMC), where the rates remain unchanged, but the Jerome Powell can provide further positioning at further positioning on the further market

Bitcoin Prices (BTC) were held above $ 94,000 after a short relief below that level on Sunday, continuing her behavior related to a recent range.

The Ada price dropped almost 4% while the XRP was similarly followed. Ether (ETH) fell by almost 1%, the BNB BNB chain rose by 1.3% and Memecoin DogeKoin decreased 2% in the last 24 hours.

Wide-based COINDESK 20 (CD20), a liquid index that monitors the largest market capitalization tokens, has fallen slightly over 1.8%.

By the way, some definitive tokens like AAVE, Curveine WRV and Hyperlikuid Hyperi have seen at the request in the trademark of interest in projects with mechanisms of communal and yields, some say.

“How Memecoins fall from favorites, traders turn to projects with stronger basis and token economy,” Kai Lu, CEO, Hashkei Eco Laboratory, said COINDESK in the telegram.

“Defi Ecosystems are bombylating to this composition, especially as Bitcoin shows a decrease in volatility and macro-sided that the trend will maintain reduced volatility and crypto seems like a living fence for economic uncertainty.

The HIPE LED profits is among point 100 tokens with 72% increase in the past week, and AAVE and the worm is in as much as 40%.

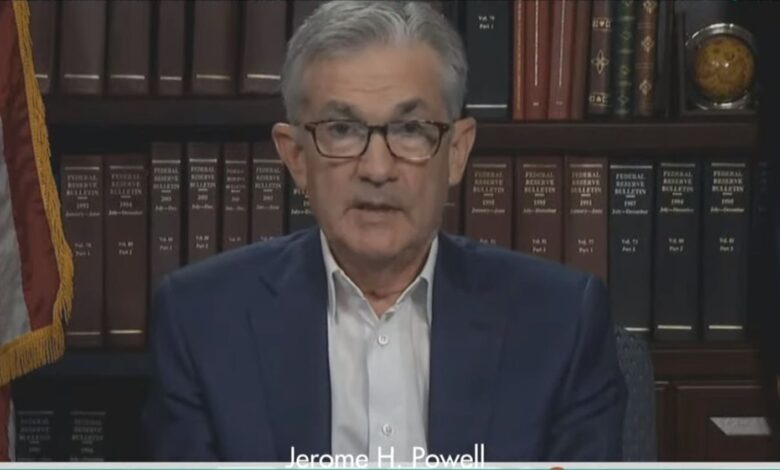

Power Comment in focus

Dealers via the cripto and traditional financial markets are viewing the decision of the FOMC interest rate, with consensus expectations that show at the foot break.

However, uncertainty around inflation, tariff and wider American trade tensions left many participants cautious.

“We don’t expect Fomc to start a big move in markets,” said Augustin fan, the chief of insight on the signal file, in the telegram message. “It’s a dressing dressing in a direction. The cropto will probably take signs from the wider earnings and how the economy digests the influence of recent trade policies.”

The recent power on the stock exchange suggests that investors price prices in just a slight recession risk, about 8%, according to historical retreat models. This contrasts with carriers with bearers from the bond market and macroeconomic forecasts, a fan was added.

Last week, President Trump did not confirm immediate plans for talks with China, damping hopes for a breakthrough in American trade negotiations. However, the possibility of special trading agreements helped feel the risk intact Reported Monday.

(Tagstotranslate) Cardano (T) XRP (T) Bitcoin (T) Fomc (T) Top-Talking

https://cdn.sanity.io/images/s3y3vcno/production/7f55c16d77f8f454a753e2a34792aa715fcd69c9-1685×849.jpg?auto=format

2025-05-06 10:08:00