Can Pepe Price rose 200% and hit the new all the time?

The price of Pepe Coin was bounced back from this month as investors bought DIP and futures open interest.

Pepe (Pepe), A viral coin, jumped to High 0.000008960 dollars, the highest point of 24. February and 73% of the lowest point this year.

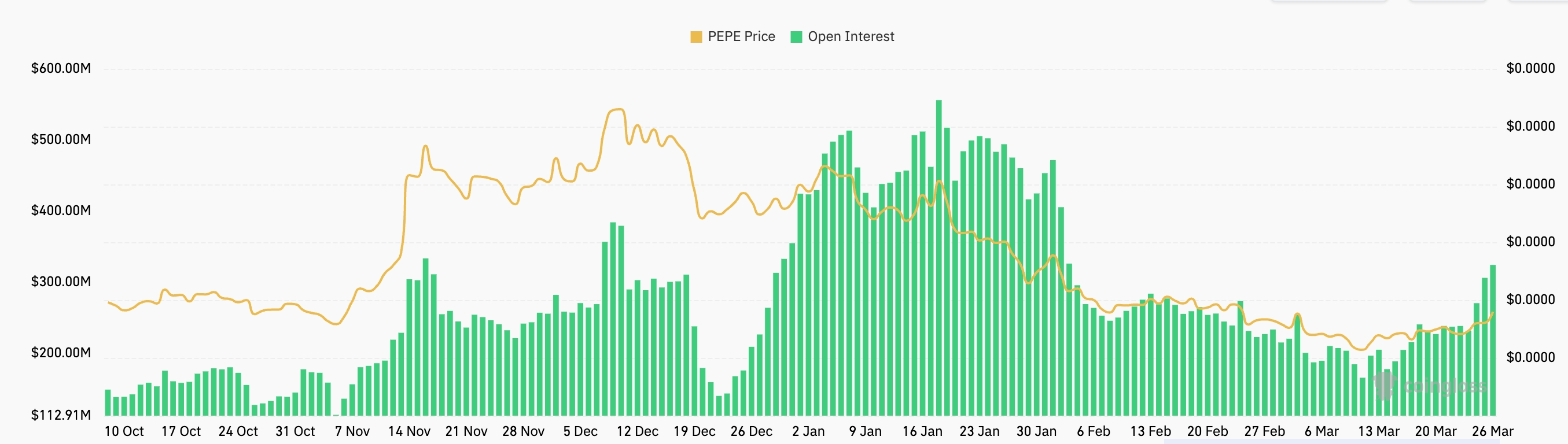

The permanent jump came as futures open interest increased to his highest level of 2. February. Metric rose to over $ 324 million, above this month low from $ 166 million.

The highly open interest is a crucial indicator in crypto markets, measuring all extraordinary futures agreements that have not yet been resolved. The overall open interest is often seen as a bikar signal.

Pepe also gathered in the middle of the signs of investor accumulation. According to Nansen, exchanges, exchanges, are 0.73% in the last seven days to 240.7 trillion tokens. The reduction of foreign currency reserves often indicate that owners move their tokens excluded exchanges, usually a sign that intends to hold, not selling.

Additional data show that the most profitable owners of Pepe during the past week still keep most of their positions. The most profitable trader earned $ 607,000 and still have 91% of his tokens. The next three above traders each have almost 100% of their positions.

The Pepe’s jump coincided with the compensation in the total crypton feeling. The Cripto Fear & Pastred Index has exited the “Extreme Fear” zone, from 18 earlier this month. The improvement followed a wide market miting that pushed the overall cry for the crypto market nearby 3 trillion dollars.

Pepper price analysis

Pepea price list is underway in accordance with recent envisages of CRIPTO.NEVS, as you can read here and here.

The daily ticket shows the token recovering after the bottom to 0.000005895 March 10. Marta. That level is significant, because it coincides with the lowest points reached in August 2023. years. Since then, the coin has tested, but it has failed to break money several times.

The latest bouncing was followed forming the formation of a drop-down meal of the wedge, a common division to cancel the bakery. This form is formed when assets are traded between two silences, converting trendy trends that are approaching the breakpoint.

The relative power index and MACD indicators pointed out. The RSI moved to 60, while two MACD lines approach their zero line.

Pepe prices moved something above the 50-day exponential moving average, the Bikarska sign. The next point of resistance to the viewing key will be 0.00001717 USD, 50% of the level of need for fibointments, which is about 95% above current level. The movement above that level will point to more upside down, potentially until all the time.

https://crypto.news/app/uploads/2024/07/crypto-news-pepeunchained-option02.webp

2025-03-26 17:26:00