BTC price collapse increases with positive

Written by omkar GodBole (at all times ET unless it is indicated otherwise)

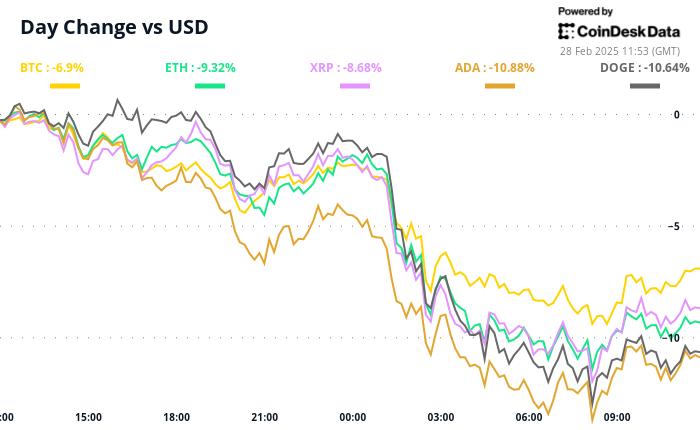

It is dipping that keeps dipping. Bitcoin made another blow early on Friday, as it decreased to less than 80,000 dollars, and February fell to more than 20 %. This motivated a bloodbath in the broader encryption market, with the ether sliding to less than 2100 dollars, a level that has been able to keep it since August.

It is not just an encryption. Increased volatility in cryptocurrencies reflect trends in traditional markets. Compare a 10 % jump in Volmex Bviv, which tracks 30 -day implicit fluctuations in Bitcoin, with an equal increase in the movement index, measure the implicit fluctuations of US Treasury notes. VIX, the so -called fear scale in Wall Street, increased by 14 %.

These movements, in addition to selling in the currencies of goods sensitive to grow Renewed concerns about the possible Trump tariffWhich leads to rotation towards less volatile assets.

“US local policies have become unstable, and the White House seems happy to take advantage of this instability,” said Griffin Erder, head of the Crypto Financial Platform options. “Given the challenges that investors face in obtaining accurate aspiration guidelines, many tend to maintain low -sized assets … Traders need to liquidate parking to reduce their exposure to specific assets before moving to other markets, which explains the decline across almost all asset categories, including cryptocurrencies.”

The fluctuations seem to remain increasing, with President Donald Trump According to what was reported to be speaking later on Friday. Meanwhile, those who hope for a great recovery in risk assets based on personal consumption data You may disappoint you Since it can be overwhelmed by the expected soft readings due to the concerns of the winding tariff and the high standards of aspirational inflation.

While the look may seem dark, more positive developments may occur once the total dust stabilizes. It is worth noting, this week there was progress on the organizational front, with SEC dropping charges against UNISWAPOne of the leading decentralized stock exchanges, and think about the same regarding its issues with consysys.

As Evgeny Gaevoy, CEO of Market Maker Wintermute, He referred to Hong Kong consensus Last week, many overlook the SEC’s advanced position, and this is a factor that the market has not completely caused.

In addition, the decrease in CME Bitcoin and Ether Futures, a sign of poor demand, has stopped from the technical analysis perspective, fast bitcoin Closing A possible request area. So, stay on alert!

What do you see?

- Checks:

- Macro

- February 28, 8:30 am: The US Economic Analysis Office launches consumption and personal expenses in January.

- Basic Prices PCE Mami Pets Index. 0.3 % against the previous. 0.2 %

- The basic PCE price index. 2.6 % against the previous. 2.8 %

- PCE Price Index Mom Est. 0.3 % against the previous. 0.3 %

- Pce Price Index Yoy Est. 2.5 % against the previous. 2.6 %

- Personal income is 0.3 % against the previous. 0.4 %

- Personal spending is 0.1 % against the previous. 0.7 %

- March 2, 8:45 pm: Caixin and S& P February China.

- PMI Prev manufacturing. 50.1

- February 28, 8:30 am: The US Economic Analysis Office launches consumption and personal expenses in January.

- Profits

Symbolic events

- Voting of referee and calls

- Sky Dao discusses Reducing the activity of the smart burning engineAnd, which would effectively reduce the rate of re -purchase of the sky icon from about one million dollars to $ 400,000 a day.

- Lido Dao discusses a suggestion on the SSV Lido (SSVLM) unit, which is an interest unit without permission, STAKING Bonuses Distribution For knot operators, Lido and stereotypes.

- Feb 28, 12 pm: vechain (vet) to host A. Vicein Builders Ama.

- to open

- March 1: DYDX to open 1.14 % of the $ 5.58 million trading offer.

- March 1: Zetachain (Zeta) to open 6.48 % of the trading offer of $ 12.45 million.

- March 1: SUI (sui) to open 0.74 % of the trading offer of $ 60.40 million.

- March 2: ENA to open 1.3 % of the trading offer of $ 15.91 million.

- March 7: KASPA (KAS) to open 0.63 % of the $ 12.35 million trading offer.

- March 8: Berrachain (BERA) to open 9.28 % of $ 73.80 million.

- March 9: Movement (move) to open 2.08 % of its trading supplies of $ 21.4 million.

- Distinguished symbol lists

- February 28: WorldCOIN (WLD) to be included on Kraken.

- February 28: Zcash (ZEC) and Dash (Dash) from Bybit are crossed out.

- February 28: SVM (Sonic) to be included on Ascendex.

- February 28: Redstone (Red) to be included on Binance and Mexc.

Conferences

Distinguished symbol speech

Written by Shuria Malwa

- The Lazarus Group, the North Korean Hacker Group collection, wash more than $ 240 million in the ether through Thorchain, a non -central swap protocol, by converting it mainly into Bitcoin.

- Thorchain allows the cross -chain bodies without wrapped assets, keep user custody and provide money on Blockchain.

Warning: Lazaros washing via Thorsin – at least $ 240 million so far

More than $ 240 million from ETH was sent through Thorchain by the Lazarus wallets that you watch on Arkham.

This money has been mainly replaced for the original BTC. pic.twitter.com/c1eytj6AFW

Archham (Rechham) February 27, 2025

Locate the location of the derivatives

- TRX and Tron see negative permanent financing rates, or the dominance of short situations, while deepening the sale of encryption. Most other major metal currencies still have positive financing rates.

- In ExchandE DERIVE.XYZ, ETH options have decreased for each options for 7 days and 30 days sharply to -15 % and -6 %, respectively, which represents a strong bias for prevention.

- Bitcoin on Derive at the time of the press showed a 44 % chance of BTC less than $ 80,000 by the end of June. And only 3.5 % is an opportunity for prices that rise to 150 thousand dollars, talking about fear in the market.

- On Deribit, BTC and ETH options showed a bias to clarify them until the end of April.

Market movements:

- BTC decreased by 3.3 % from 4 pm on Thursday at 80,552.45 dollars (24 hours: -7.09 %)

- Eth 4.62 % decreased at 2,135.58 dollars (24 hours: -9.3 %)

- Coindesk 20 4.63 % decreased at 2,821.02 (24 hours: -8.31 %)

- Stokeing compound rate Ether Cesr 4 amputation per hour at 3.06 %

- BTC financing is 0.0069 % (7.55 % annual) on Binance

- DXY did not change 107.32

- Gold decreased by 0.77 % at $ 2,863.13

- Silver decreased 1.09 % at $ 31.15/ounces

- Nikkei 225 closed -2.88 % in 37155.50

- Hang Seng -3.28 % closed at 22,941.32

- FTSE increased by 0.25 % in 8,778.39

- Euro Stoxx 50 decreased by 0.49 % at 5,445.93

- Djia closed on Thursday -0.45 % in 43,239.50

- S & P 500 closed -1.59 % in 5,861.57

- Nasdak closed -2.78 % at 18,544.42

- Closed S&P F/TSX Complex -0.79 % in 25128.24

- S & P 40 Latin America closed -1.36 % in 2,347.52

- The ministry of the Ministry of Treasury in the United States decreased for 10 years by 2.26 %

- E-MINI S & P 500 is 0.34 % in 5896.50

- E-MINI NASDAQ-100 futures increased by 0.3 % at 20667.25

- The E-MINI Dow JONES Industrial Vilese index increases by 0.33 % to 43,438.00

Bitcoin Statistics:

- BTC dominance: 60.51 (-0.41 %)

- ETHEREUM ratio to Bitcoin: 0.02681 (-1.58 %)

- Hashrate (Seven Day Average): 844 EH/S

- Hashprice (spot): $ 48.1

- Total fees: 8.38 BTC / 715,412 dollars

- Cme Futures Open benefit: 155,245 BTC

- BTC at gold price: 27.5 ounces

- BTC market roof for gold: 7.80 %

Technical analysis

- Ether at the level of manufacture or separation of 2100 dollars, which has witnessed the seller has been exhausted several times since August last year.

- If support allows the field, this may lead to additional sale by long -term holders, which leads to an extended chip.

Encryption

- Microstrategy (MSTR): closed on Thursday at $ 240.05 (-8.82 %), a decrease of 1.99 % to $ 235.28 on the market before the market

- Coinbase Global (COIN): Closed at $ 208.37 (-2.16 %), a decrease of 3.64 % to $ 200.78

- Galaxy Digital Holdings (GLXY): Closed at 20.28 Canadian dollars (+0.6 %)

- Mara Holdings (MARA): Closed at $ 13.13 (+5.46 %), a decrease of 3.43 % to $ 12.68

- Riot platforms: closed at $ 8.66 (-3.13 %), a decrease of 3.35 % at $ 8.37

- Core Scientific (Corz): Closed at $ 10.71 (+6.89 %), a decrease of 2.24 % to $ 10.47

- Cleanspark (CLSK): Closed at $ 7.51 (-4.7 %), a decrease of 2.4 % to $ 7.33

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): Closed at $ 16.89 (-1.92 %)

- Semler Scientific (SMLR): Closed at $ 40.63 (-7.47 %), a decrease of 3.03 % to $ 39.40

- Exit (exit): closed at $ 42.20 (-5.13 %), an increase of 0.52 % at $ 42.42

Etf flows

BTC Etfs Stain:

- Daily net flow: -275.9 million dollars

- Cutting net flow: 36.85 billion dollars

- Total BTC Holdings ~ 1,132 million.

ETH ETFS spot

- Daily net flow: -71.2 million dollars

- Cutting net flow: $ 2.86 billion

- Total Eth Holdings ~ 3.702 million.

source: Farside investors

It flows overnight

Today’s scheme

- The daily trading volume on Exchange Uniswap has seen a small rise to $ 3.5 billion on Tuesday, as SEC fell against the protocol.

- Since then, however, the volumes have erupted, perhaps due to the wider decline in the market.

While you sleep

- Bitcoin decreases to 80,000 dollars, XRP loses the main support as it regains the Central Trump tariffs and the rise in the dollar index (Coinsk): President Donald Trump said 25 % of the customs tariffs on imports from Canada and Mexico and will be 10 % in effect on Chinese imports on March 4.

- The sale of Bitcoin can be a “Breakout and Retest” school book: Godobile (CoINDESK): Bitcoin’s decrease by 15 % less than $ 80,000 is the typical market behavior, as traders test a previous resistance level before they taste another mass.

- Trump’s tariff in the attack comes faster than his team can do (The Wall Street Journal): The Trump’s mutual tariff plan, which aims to align American trade duties with other countries duties, face delays, with a report on April 2, but it is possible that full implementation will be months away.

- China is on “all necessary measures” against the new US definitions (Bloomberg): China threatened revenge after President Trump announced that the tariffs of 10 % on Chinese imports will enter into force on March 4.

- The British pound outperforms their competitors with stronger economic data (Financial Times): The pound benefits the stronger UK’s economic data, demanding government bonds, which provide higher returns than US Treasury bonds, and less risks than American customs tariffs.

- Mexico sends the nightmare of the major drug to us with the threat of Trump’s tariff (Reuters): On Thursday, Mexico carried out its largest delivery for years, as it sent 29 Cartel figures to the United States amid pressure on the smuggling of fentanel.

In the ether

https://cdn.sanity.io/images/s3y3vcno/production/508fd86dcb2271ae12c163b594f60d8493400885-700×430.png?auto=format